New economic data released today shows that economic loss and hardship from COVID-19, including variants currently ravaging the state, are far from over for Kentucky communities. Yet safety net programs have had a tremendous positive impact, and there is a great need to extend and expand these investments by passing the landmark Build Back Better plan now in front of Congress.

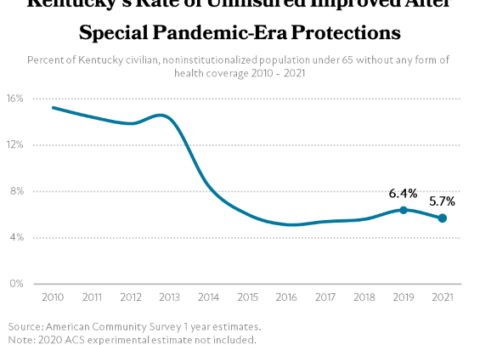

According to new national data from the U.S. Census Bureau’s Current Population Survey, the median household income fell by 2.9 % in 2020 as a result of the COVID-19 recession, which was one of the deepest and the most unequal in US history. Yet despite the unprecedented downturn, federal assistance kept more people from falling into poverty, and actually reduced the Supplemental Poverty Measure (SPM) rate to 9.1% in 2020, down 2.6 percentage points from 2019. Unlike the official poverty measure, which is based on cash resources, the SPM also accounts for cash and noncash economic assistance programs and necessary expenses like taxes and medical costs. According to the official poverty measure, the share of Americans living under the poverty line was 11.4% in 2020, up one percentage point from 2019. The share of Americans who were uninsured in 2020 was 8.6%, statistically no different from the rate in 2018 — an expected result of the federal government’s critical and historic relief efforts and the requisite rise in Medicaid enrollment.

Underlying the Census’s picture of poverty, income and health coverage in 2020 is the critical role that unemployment insurance, nutrition assistance, Medicaid coverage and paid sick leave played in mitigating some extreme harms of the health and economic crisis. All of this pandemic-related assistance was made possible by the Families First Coronavirus Response Act, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and other much-needed federal investments.

State-level poverty rates and income levels are not available this year due to COVID-related disruptions in American Community Survey data collection. However, other available data paints a compelling picture of the efficacy of federal relief efforts in Kentucky:

- A recent analysis from the Urban Institute found that 1 in 6 more Kentuckians would be in poverty this year without 11 anti-poverty programs.

- The most recent data from the Household Pulse Survey (HPS) show the enhanced Child Tax Credit payments that started in mid-July reduced food hardship levels by a third.

- Data released last week from the United States Department of Agriculture (USDA) shows that, despite increased hardship due to the pandemic, food insecurity did not worsen significantly in 2020.

“Federal relief has had a profound impact on Kentuckians’ ability to weather the COVID pandemic and economic crisis,” said Jessica Klein, Policy Associate at the Kentucky Center for Economic Policy. “By putting money in families’ pockets for groceries, rent, health care, utilities, school supplies and more, these programs have prevented even worse levels of hunger, homelessness and hardship, and they’ve also strengthened our economy for a faster recovery.”

But Kentuckians are not out of the dark yet. More than one in four Kentucky adults still report difficulty covering usual household expenses. And federal action is needed to tackle long-standing economic hardship and inequity that predate COVID-19. In Kentucky, systemic barriers have led to higher rates of poverty and food insecurity than in other states, a low median household income and economic disparities by race, gender, geography and more.

“The help that came from the ARPA and other relief packages was needed — the child tax credits, the unemployment insurance, the increases in EBT benefits for school children — but it didn’t go far enough. It’s not stopping me from losing my rental house to gentrification, and the PPP loans were not accessible to me,” said Cassia Herron, an independent contractor and mother of two in Jefferson County. “We are looking to Congress to make more investments so more Americans have what’s necessary to live quality lives. We cannot contribute if we are hungry and without homes.”

Lawmakers now have the opportunity to fundamentally improve Kentuckians’ lives and build a fairer, more equitable economy with the next round of recovery legislation currently under consideration in Congress. The final bill should strengthen the nation’s weak unemployment insurance system, invest in affordable housing, make the full Child Tax Credit permanent for families with low or no earnings, reduce food hardship and much more. It should be funded in part by closing loopholes that allow the wealthiest individuals and corporations to pay little or no federal income tax, and by strengthening IRS enforcement to ensure those at the top pay what they owe.