February 10, 2021

Dear Kentucky House of Representatives:

As you consider legislation potentially legalizing “Historical Horse Racing” (HHR) slot machines, an important issue concerns the inadequacy of the tax on those machines. It has come to our attention that there is misinformation and confusion on this issue that this email is intended to clear up.

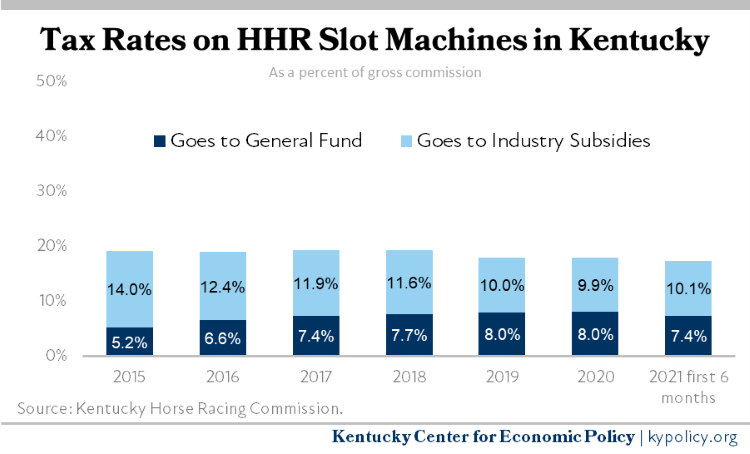

Kentucky’s current tax on HHR slot machines is 1.5% of the handle, which refers to the amount that is bet on these machines. That translates into approximately only 18% of the gross commission, which refers to the industry’s income after paying out winnings to bettors, and is the common way that states characterize their taxes on this form of gambling. That 18% is then split into two streams: about 10% goes back to the industry to support purses, breeding and equine-related programs, and only about 8% to Kentucky’s General Fund. That information is reported monthly by the Kentucky Horse Racing Commission and is available here.

The tax rates throughout time can be seen in the below graph.

The Tax Rate on HHR Is Not 31%

Some proponents are inaccurately claiming that the existing tax rate is actually 31% by referring to purse contributions. They are either misrepresenting the fact that the 10% that includes purse contributions is already part of the existing 18% tax, or they are counting monies that HHR facility owners have been voluntarily contributing to purses beyond what comes out of the 10% tax, or both. Any voluntary contribution is not a tax. An HHR facility owner can choose to use their gross commission beyond the 18% tax as they see fit, and there is no requirement in law that they make any additional contributions in the past nor that they continue to do so in the future.

Another piece of misinformation is that HHR slot machines are different from other slot machines because of the method of gambling, and therefore should not be subject to the same tax level as slot machines in other states. As you know, the Kentucky Supreme Court ruled unanimously that HHR does not constitute pari-mutuel wagering. Regardless, the bottom line in comparing slot machines is the “payout percentage,” or the share that goes back to the bettor. The payout percentage on HHR slot machines in Kentucky is currently 91.1%. As this inventory on payout percentages of slot machines across the country shows, that’s the same approximate payout percentage of any slot machine in any casino across the country. Thus the ability to pay taxes on HHR slot machines is on par with the ability to pay taxes on any slot machine.

Kentucky’s tax rate of 8% to the General Fund/18% total on these slots is far lower than other nearby states, as compiled annually in a report by the American Gaming Association. For example:

- Pennsylvania’s racinos have a tax of 55% on electronic gaming device (slot machine) revenue (equivalent to gross commission in Kentucky).

- West Virginia has a tax of 53.5% on electronic gaming device revenue.

- Ohio has a tax rate of 33.5% on electronic gaming device revenue and 33% on casino gaming revenue.

- Indiana has a graduated rate of up to 40% on casino revenue and 35% on racino revenue.

- Illinois has a graduated rate of up to 50%.

Also, Kentucky’s tax rate on HHR slot machines is significantly lower than the tax on live horse racing at a comparable level of handle, with HHR being taxed at just 1.5% of handle while tracks with an average daily live handle of over $1.2 million are taxed at a much higher rate of 3.5% — 133% higher.

Especially given the many needs Kentucky has in its state budget, the General Assembly should not act on legalizing HHR machines without also including an increase in their egregiously low tax rate. Raising the tax to 35% would be on par with other states, though still lower than in many states like Pennsylvania and West Virginia, and would raise approximately $100 million annually for our budget, and more as these machines continue to be deployed.

Thank you for your consideration of this important issue.

Sincerely,

Jason Bailey, Executive Director

Kentucky Center for Economic Policy