Kentucky’s new tax law is now being implemented, with income tax changes already applying to the 2018 tax year and sales tax changes and cigarette tax increases becoming effective on July 1. The state’s revenue department is busy answering questions about how the law works, and employers are making adjustments in employees’ withholding to comply with the new income tax provisions.

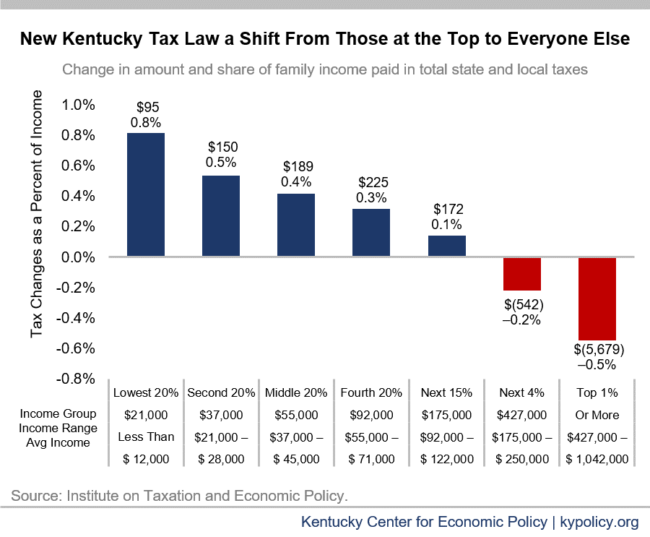

The overall impact of the changes is a shift in who pays, with the bottom 95 percent of Kentuckians paying more in total taxes on average and the richest 5 percent of Kentuckians getting a tax cut — especially the top 1 percent.

Here’s more on how that tax shift works, with a focus on the sales tax and personal income tax.

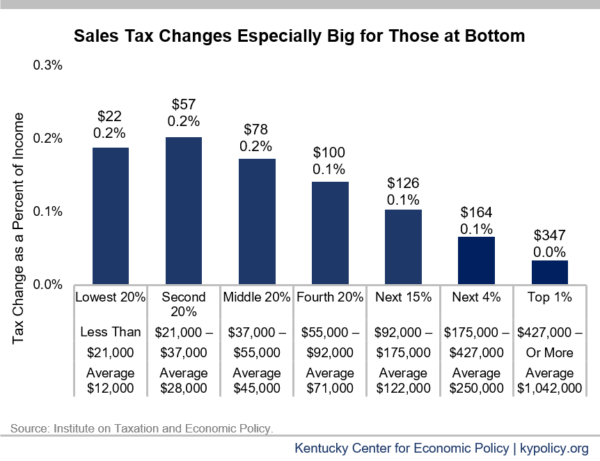

Sales tax changes matter more for those with less

The changes in Kentucky’s sales tax law are expected to raise an additional $238 million a year by applying the tax to a variety of new services, fees and admissions. Among them, the biggest revenue generator is a tax on the labor associated with installing, maintaining and repairing taxable personal property — like car repairs. The state will now also tax landscaping, small animal veterinary visits and grooming, dry cleaning, bowling, fitness centers and other services.

While all Kentuckians who use these services will pay more in sales taxes as a result, low- and middle-income Kentuckians will pay more as a share of their incomes than will wealthy Kentuckians, as shown in the graph below. That happens simply because low- and middle-income people spend most or all of their money, with little room for savings, making more of their income subject to sales taxes. In contrast, those at the top are able to save big portions of their income, making sales tax less significant to their family budgets.

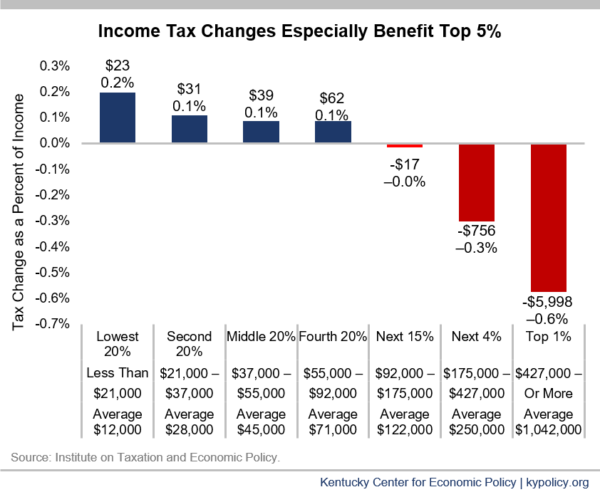

Income tax changes designed to benefit the very wealthy

Proponents of the 2018 tax changes have claimed that while sales and cigarette taxes are higher, everyone is getting a cut in their income taxes. But that is simply not true. The income tax changes are also a tax shift, with the bottom 80 percent of Kentuckians on average paying a little more in income taxes, the next 15 percent getting a small tax cut and the top 5 percent getting a large tax cut. This shift is shown in the graph below.

If Kentucky moved from a top rate of 6 percent to a flat 5 percent income tax, why will so many people pay more in income taxes? There are a few reasons.

First, the new tax law raises income tax rates on everybody’s first $5,000 in income. Whereas the first $5,000 was taxed at a rate between 2 percent and 4 percent before, it is taxed at a rate of 5 percent now. For a person of modest income, say $20,000 a year, that $5,000 taxed at a higher rate can result in a higher overall tax bill (It should be noted that people whose incomes are below the federal poverty line based on family size do not pay income taxes in Kentucky, and those with incomes up to 33 percent above the poverty line pay at reduced levels, but these exclusions only apply to some low-income people.) Those benefiting the most from the new flat tax rate are the very wealthy, whose incomes were mostly taxed at 6 percent before the rate reduction (the 6 percent rate applied to income above $75,000, and a 5.8 percent rate between $8,000 and $75,000) but are now taxed at 5 percent.

Second, for some moderate- and middle-income people, the additional income subject to tax because of the new limit on itemized deductions in the law outweighs the small reduction in taxes due to flattening of the rates. Especially important is that, for state tax purposes, people can no longer deduct the property taxes and occupational taxes they pay from their income. That will result in some modest-income workers and homeowners no longer being able to claim a few thousand dollars in deductions, increasing tax liability more than the new flat 5 percent rate reduces it. For the wealthy, the cut in income tax rates far outweighs the ability to deduct less.

The third group who pay more are those retirees who previously benefitted from the exemption of their first $41,110 in retirement income, a maximum that has been lowered to $31,110 under the new law.

All of the base broadening mentioned above — expanding the sales tax to services and reducing income tax deductions and the retirement income exclusion — is good tax policy if considered independently. However, the new tax law spends much of the revenue generated on income tax cuts for the wealthy and corporations. Kentucky needs additional significant investments in our schools, infrastructure and in other building blocks of thriving communities. What we got instead was a tax law that prioritizes yet another giveaway to those who need it least.