New data shows Kentucky has the 4th highest student loan default rate in the nation. While the national rate of students missing payments on their loans for an extended period of time is 10.8 percent, Kentucky’s default rate is 14.3 percent (last year it was 14 percent and we ranked 9th worst). The only states with higher student loan default rates this year are West Virginia (17.7 percent), New Mexico (16.2 percent) and Nevada (15.3 percent).

What is the student loan default rate?

Each year in September the U.S. Department of Education publishes the official “three-year cohort default rates” (as defined below) for federal student loans by state, individual higher education institution and type of institution (i.e., for-profit, public four-year, etc.).

The default rate is calculated by determining – of the number of individuals whose student loans went into repayment in a given year (in the most recent data, in 2015) – the share that missed payments for at least nine consecutive months over the following three years (in this case in 2015, 2016 and 2017). So in 2015, 73,691 Kentuckians were scheduled to begin making payments on their student loans, and 10,570 (14.3 percent) missed payments for at least 9 consecutive months over the following three years.

The student loan default rate gives insight into the financial difficulties college students are facing after they leave school, some before earning a degree. College costs have skyrocketed while wages have not — and having a student loan in default can harm credit scores, making it difficult to get housing and transportation because a credit check is often involved.

Who is most likely to default?

Individuals with lower incomes and people of color often face the greatest barriers to student loan repayment. Those who borrow relatively small amounts are actually more likely to default rather than those with very high levels of debt. For Americans with loans entering repayment in 2011, for instance, 43 percent of those who defaulted owed less than $5,000; meanwhile, those with student debt greater than $20,000 made up just 6.2 percent of defaults.

Even small amounts of debt can become insurmountable when an individual is struggling to make ends meet, as so many Kentuckians are. It’s especially problematic that many of those unable to make payments on their student loans have had to leave college — often for financial reasons — before earning a degree which might have improved their economic opportunities. Data suggests whether a degree is completed (and the type of degree) is more predictive of whether or not a student will default on loans than how much is owed.

What does it mean that Kentucky is 4th worst?

Kentucky’s high student loan default rate reflects the state’s college affordability challenges including tuition increases largely driven by mounting state budget cuts, growing student debt, inadequate need-based financial aid and too-low rates of degree completion, especially for students with low incomes and students of color.

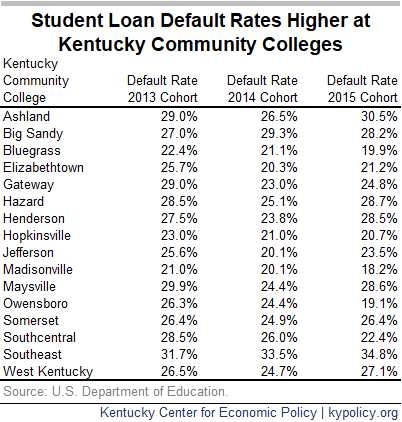

Southeast Kentucky Community and Technical College is 1 of 12 institutions in the nation with a student loan default rate of 30 percent or higher for three years in a row. This puts the institution at risk of losing at least some federal financial aid due to consistently high student loan default rates. Southeast KCTC was in the same situation last year but received a special waiver, which prevented the loss of federal aid, due to the severe economic challenges facing the students and communities it serves.

The new student loan default rate data does underscore the college affordability challenges — and economic challenges more generally — facing Kentuckians, but it does not tell the whole story. A separate, longitudinal set of student loan data analyzed at the national level earlier this year shows the student debt crisis is much worse than indicated by student loan default rates:

- Just half of students beginning college in 1995-96 had paid off all their federal student loans 20 years later, and the average borrower in this group still owed approximately $10,000 in principal and interest (about half of what was originally borrowed).

- While the official student loan default rate looks at the first three years after a loan enters repayment, many students end up defaulting after that — which means the student debt crisis is much worse than depicted by these numbers. More than half of students who defaulted within 20 years of beginning college were in repayment for more than 3 years before they defaulted (the average default was 4.9 years after entering repayment).

- Student loan default may be accelerating. While a quarter of students who started college in 1996 defaulted within 20 years, a quarter of students who began college in 2003-04 defaulted in just 12 years.

It is also notable that those who use repayment options known as deferments or forbearances are not included in the default rate. These options enable borrowers to stop payments without going into delinquency or defaulting, and some colleges are aggressively pushing borrowers to utilize them, which reduces institutional accountability by making the official default rate lower than it otherwise would be. Loans in forbearance and often in deferment (but not always) continue to accrue interest, so an individual may not be “defaulting” but their student loan balance is actually growing, making it even more difficult to pay down.

What are the default rates of individual schools in Kentucky?

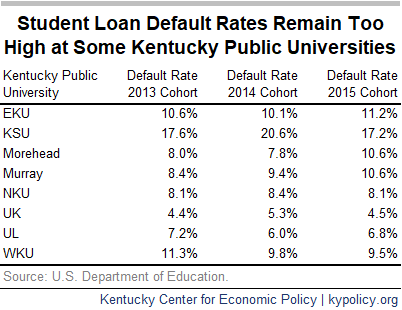

In keeping with national trends, the student loan default rates are higher at Kentucky’s community colleges than at the public universities, as seen in the tables below. Institutions serving a large share of students with low incomes and students of color typically have higher default rates.

Student loan default rates are also typically higher at for-profit institutions, but state-level data is only available for the for-profit institutions that are headquartered in a state — not for the state branch of a national chain.

Data on student loan defaults makes it clear the state needs to address the college affordability challenges facing Kentuckians. To put higher education within reach for all Kentuckians, we have proposed that the state provide the equivalent of two years of free community college to students attending public higher education institutions. Making college more affordable will help move our commonwealth forward.