Half of Kentucky adults say they or someone in their household have lost employment income since the COVID-19 crisis began, according to new Census data. The sources they’re relying on to make ends meet, including enhanced unemployment insurance, stimulus payments and more personal debt, are either running out or limited.

These numbers spell trouble for Kentucky’s economy and families unless federal policy action is taken. As long as the pandemic persists — and especially since prematurely reopening the economy without controlling the disease first is proving to be a growing disaster across the nation — the responsibility lies with the U. S. Senate to agree with the House and provide much more in federal aid.

Employment-related income loss is widespread, and threatens to worsen existing inequities

In a Census survey of Kentucky adults for the week ending June 30, 50% said their household had experienced a loss of employment income since March.

The data also shows these losses are hurting certain Kentuckians to a greater degree. The loss of employment income is more prevalent among people with kids in the household (55%), Kentuckians with poor health (64%) and people with lower incomes — 63% of those with incomes from $25,000-$34,999 have lost household employment income, compared to just 18% of those with incomes of $200,000 and above. A total of 59% of Kentuckians in Black households and 88% in Hispanic households have lost employment income, compared to 49% in white households.

Strategies to make ends meet are limited without more federal aid

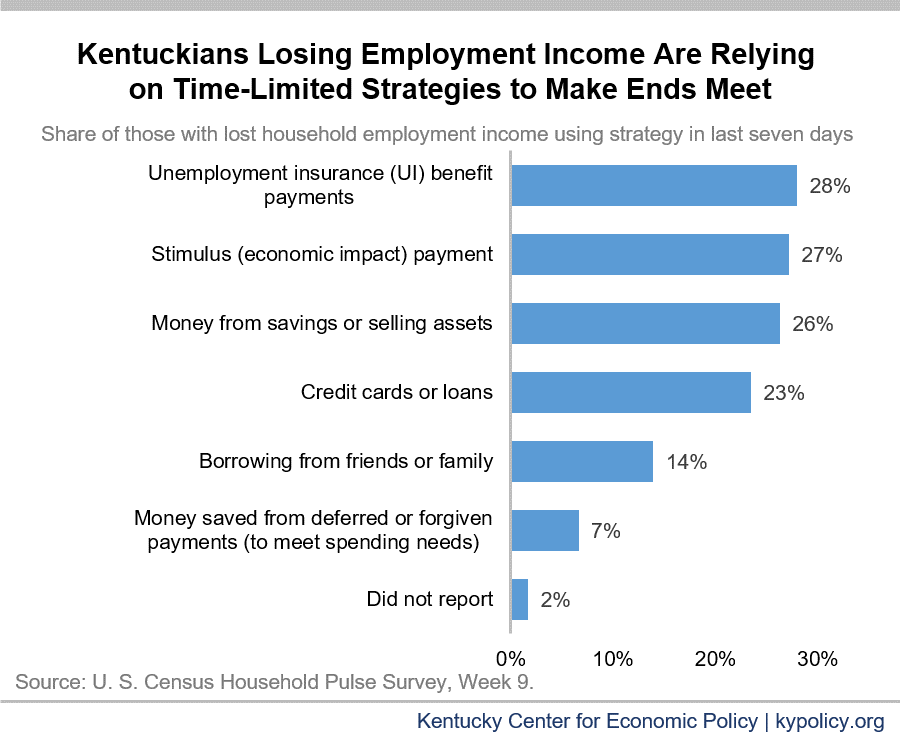

Kentuckians report using a variety of strategies to make ends meet in the survey. Federal and state aid are at the top of the list: 28% are relying on unemployment insurance (UI) benefits, and 27% on the stimulus payments provided in the CARES Act. Many are also drawing down savings or selling assets (27%); relying on credit cards or loans (23%), and borrowing from friends or family (14%).

All of those strategies face limitations. The state and federal government have opened up unemployment insurance to more people, but recipients will lose a devastating 64% of their weekly benefits on average if the U. S. Senate allows the supplemental $600 a week provided under the CARES Act to expire as scheduled on July 25. That will leave unemployed workers with an average of just $332 a week in UI benefits. The stimulus checks of $1,200 per adult and $500 per child were a one-time payment, and the Senate has not agreed to additional rounds of payments. Families only have so many assets to sell and savings to draw down, and doing so can make economic prospects more difficult in the future. And additional personal debt can be hard to get and can worsen financial well-being.

The continuing weak economy means much more in aid must be provided

Far from a quick recovery some suggested would happen if we just let businesses begin reopening, the rise in COVID-19 cases across the country is creating deep trouble for the economy and for unemployed workers. The economic gulf won’t go away until the disease is under control, and the economic disruption it has caused means some challenges will persist even after the pandemic is behind us. Until it is no longer necessary, the federal government must provide ongoing aid to help families make ends meet and protect the economy from further harm.

The U. S. House has passed the HEROES Act, which continues the supplemental $600 in unemployment benefits, provides another round of stimulus payments and includes other forms of aid many people need (including help with housing and food). Now the Senate must agree to a robust aid package, or a Kentucky already rocked by the economic crisis will face new and deeper problems.