The official body charged with predicting revenues for the state budget met yesterday and confirmed a weak revenue forecast for the next two years — meaning more budget cuts are on the way unless new revenues are put on the table.

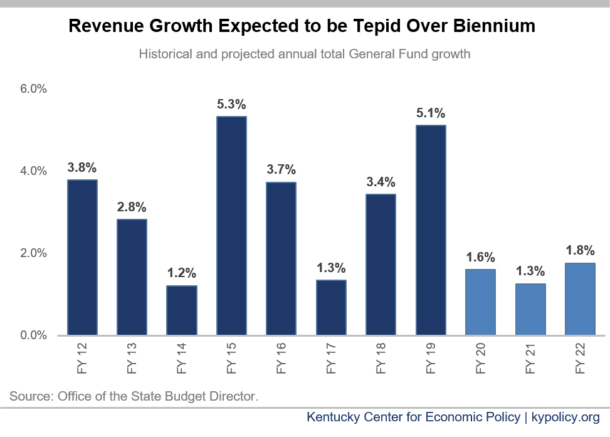

Estimates for the 2020-2022 biennium anticipate growth of just 1.3% in in 2021 and 1.8% in 2022, producing $146 million in new revenues in 2021 and $207 million in 2022. Compared to budget needs, as well as historical annual growth in the total General Fund, growth in the next biennium will not be adequate.

A major factor shaping the slow revenue forecast is the tax cuts for banks, corporations and wealthy individuals passed in the 2018 and 2019 legislative sessions. In addition, revenue growth is weakened by a possibility of recession or slowdown over the biennium. A shift in reliance on revenues generated by the individual income tax, which has been the state’s best performing tax historically, to slower-growing consumption taxes also contributes to the weak estimates. Cigarette tax receipts, for example, are expected to decline more than 2% in each year of the biennium as smoking rates fall. The forecast also anticipates a leveling off of growth resulting from the expansion of the sales tax base in 2018.

The modest new revenues will not be adequate to address expected cost growth in areas like corrections and pensions, much less pay for new needs or reinvest in things like education, human services and public protection that have been cut repeatedly over the last decade. Perhaps even more than the tough budgets of recent years, more revenue will be needed in order to make progress.