Higher education funding issues in Kentucky have been in the news a lot recently — for ranking among the worst in the country for per-student cuts in a new report; with the public universities and community colleges beginning to implement layoffs, unpaid furloughs and hiring freezes; and as the process of raising tuition for the 2016-2017 school year is nearly finalized. While many of these conversations focus on the impact of cuts on the institutions themselves, we should not lose sight of how these budget cuts hurt all Kentuckians seeking higher education — especially low-income and minority Kentuckians. Budget cuts can mean that these students are:

Less likely to enroll and graduate.

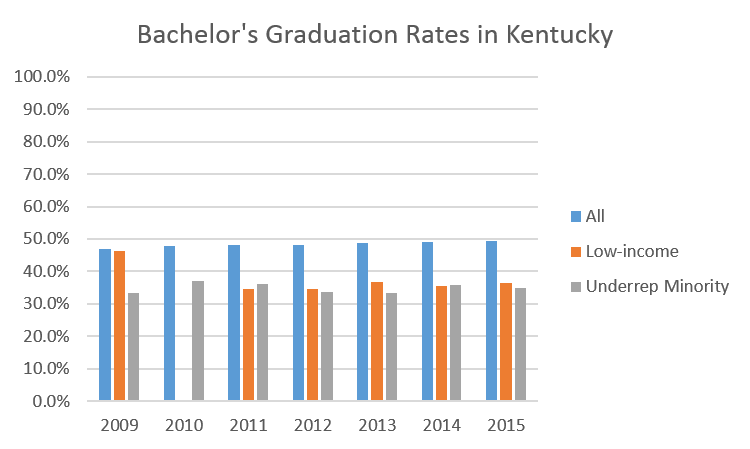

Research shows that students with low-incomes and students of color are less likely to enroll when tuition goes up; due in large part to a lack of resources they are more likely to be dissuaded from attending because of increased cost. Kentucky is already falling short in degree attainment for these students. There are significant gaps in the graduation rates of low-income and underrepresented minority students compared to other students, and little to no progress has been made in recent years. Continued higher education funding cuts will likely worsen the problem.

According to data from the Council on Postsecondary Education the bachelor’s graduation rate for the state was 49.4 percent in 2015, up from 47 percent in 2009. Meanwhile, the bachelor’s graduation rate for low-income students was 36.3 percent — down from 46.2 percent in 2009, and for underrepresented minority students it was 34.8 percent, up just a little from 2009’s 33.2 percent.

Source: Council on Postsecondary Education Dashboard. Data for low-income student graduation rates in 2010 were not available.

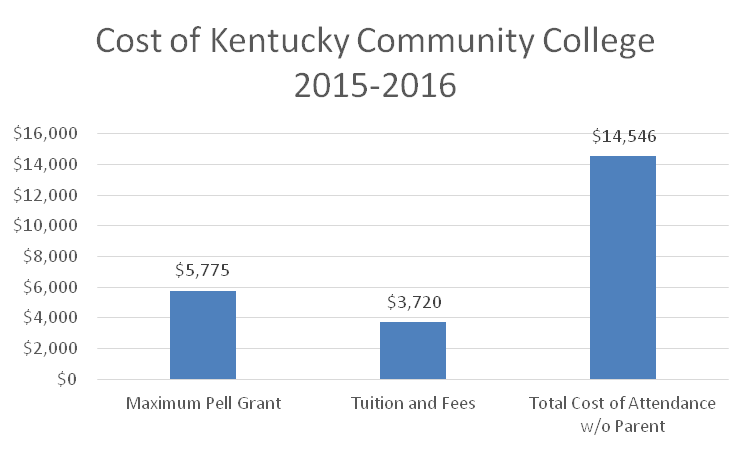

Facing more financial difficulties even when they attend community college and receive Pell grants.

Low-income students receiving Pell may be able to use the federal scholarship to cover tuition and fees at a Kentucky community college, but these grants are not large enough to cover the full costs of college (housing, books and supplies, transportation, etc.) — especially for the many adult students at community colleges who often have families to support rather than parents supporting them. In addition, not all students receive the maximum Pell amount.

Source: Elizabethtown Community and Technical College and U.S. Department of Education. Amounts in graph are for enrolling in 12 credit hours for 2 semesters.

More likely to take out additional loans to pay for college.

In 2012, 79 percent of students from families whose incomes are in the lowest 25 percent graduating with a bachelor’s degree had student loans and more than 4 out of every 5 African American students borrowed at public institutions. Students who receive Pell are actually more than twice as likely to borrow and have higher amounts of student loan debt.

In Kentucky we’ve seen the average student loan amount increase 63 percent between 2008 and 2014, with many unable to repay these loans; our state ranks third highest in the rate of student loan default.

Continuing to face affordability problems even with the increase in funding for state need-based aid.

It was an important step in the right direction for the state to fund an additional 8,000 need-based scholarships in the 2016-2018 budget. However, the unmet need is still much greater than this, with more than 62,000 qualified students being denied need-based scholarships due to a lack of funds in 2015 alone. In addition, scholarship amounts are small ($1,900 a year for a full-time student receiving a College Access Program grant) and the purchasing power of these scholarships continues to decline as tuition increases and scholarship amounts do not.

Likely to see reduction in support services available.

Public university and community college presidents gave testimony during the legislative session that budget cuts could lead to the reduction of support services for students who have difficulty navigating aspects of the higher education pipeline and earning a degree; these students are often low-income, minority and first generation college students. Students who are academically underprepared or are the first in their families to attend college often face barriers to completing college. Among the services that can increase the likelihood of successfully earning a degree are intensive academic advising and education/career counseling.