Last week, leaders in the House released their proposed bill to extend and expand tax breaks that overwhelmingly benefit the wealthiest Americans. These tax breaks are paired with budget cuts that harm communities across the U.S., especially in Kentucky, by making record cuts to SNAP and Medicaid that will leave millions without health care and vital food assistance.

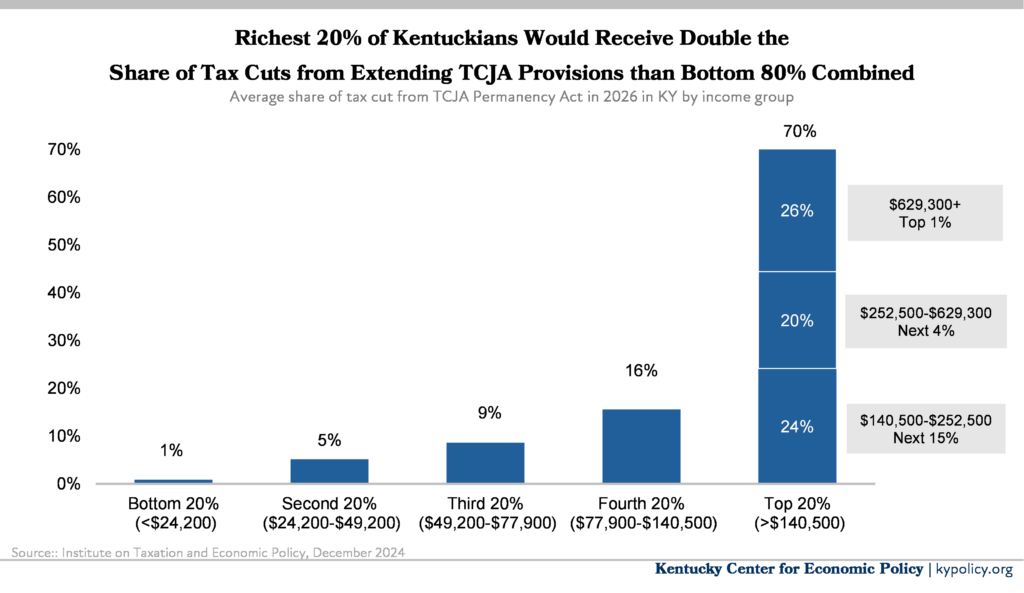

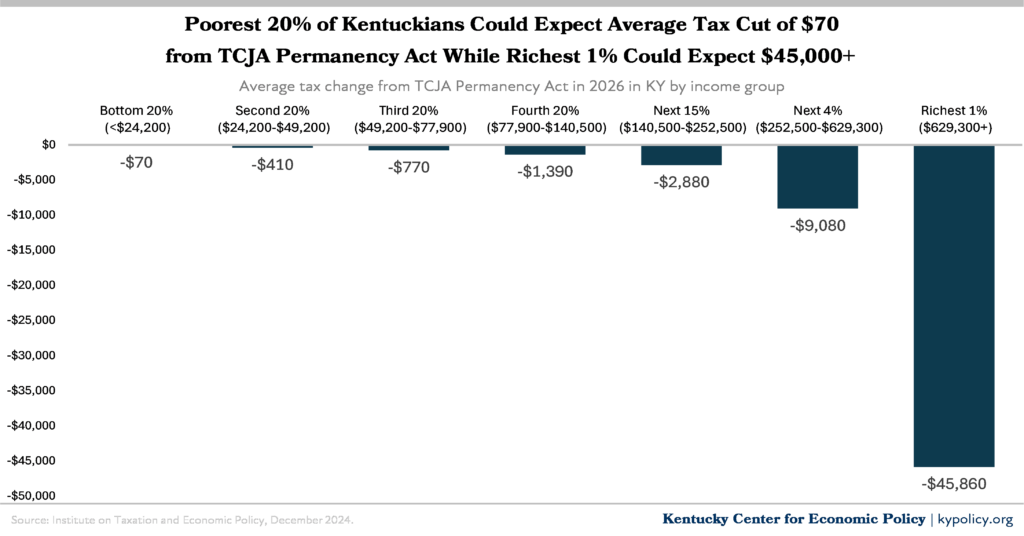

The bill would, among other provisions, permanently extend individual tax cuts from the 2017 federal Tax Cuts and Jobs Act (TCJA), disproportionately benefiting the wealthiest in our state, as shown in the graphs below.

The proposed tax plan would make several provisions of the TJCA permanent that primarily benefit corporations and wealthy individuals, while provisions that reduce taxes for most families are minimal in comparison and temporary, as they would expire in 2029.

The House plan would:

- Make permanent the TCJA income tax cuts and bracket changes that largely benefit the richest fifth of taxpayers, with those benefits especially concentrated in the top 1%.

- Make permanent the pass-through deduction, which is heavily skewed toward super-wealthy investors and business owners, and increase it from 20% to 23%.

- Increase the estate tax exemption for estates to over $30 million per couple, despite the tax already applying to a historically small group of the ultra-wealthy.

- Reinstate corporate tax subsidies and make permanent a tax break for the foreign profits of American corporations.

- Triple the deduction for State and Local Taxes (SALT) that disproportionately benefits the wealthy and is of declining use in Kentucky due to the state’s legislature’s deep cuts in the individual income tax.

The bill has some new or expanded provisions that would expire in 2029 include an increase in the Child Tax Credit from $2,000 to $2,500 and a dollar-for-dollar deduction for income tax paid on tips and overtime for people earning under $160,000. Notably, the deduction of tips and overtime from income taxes does not apply to Social Security and Medicare payroll taxes. These temporary provisions that, at first glance, would provide relief to many people actually exclude large groups of the most vulnerable Kentuckians or simply would not provide the benefit promised.

For instance, allowing the deduction of tips from income taxes could cause more harm than good by further encouraging employers to use tipping, an inherently volatile source of income, as compensation. The deduction of overtime would also aid very few, as less than 8% of workers claimed FSLA-qualified overtime in 2023, and would put downward pressure on base wages. In addition, the temporary expansion of the child tax credit, while helpful for many, would prevent 308,000 low-income Kentucky children from receiving the full credit because their families’ incomes are too low. It would also entirely exclude 15,800 Kentucky children from the credit due to its requirement for one or both filing parents to have Social Security numbers.

Additionally, the House’s proposed bill would create a new tax shelter by allowing wealthy individuals to avoid paying capital gains taxes by funneling money into private school vouchers. Our state’s constitution prohibits the use of public funds for private education. Kentuckians overwhelmingly affirmed that they want to maintain this prohibition by soundly defeating Amendment 2 during our most recent election. Through this bill, protection of public dollars for public schools would once again be jeopardized, this time at the federal level.

The total impact of the tax cuts combined with proposed budget cuts and price hikes due to tariffs could result in net harm to many Kentuckians, some of whom could lose SNAP and Medicaid coverage or be harmed by job loss from less spending on health care and food. The damage of this plan will far outweigh its meager to non-existent benefits for Kentucky families.