New Report: Farmer’s High-Risk Overhaul Creates Imbalance in Kentucky’s Tax System

Shift to Consumption-Based Tax System Would Result in Narrow, Upside-Down Tax Structure

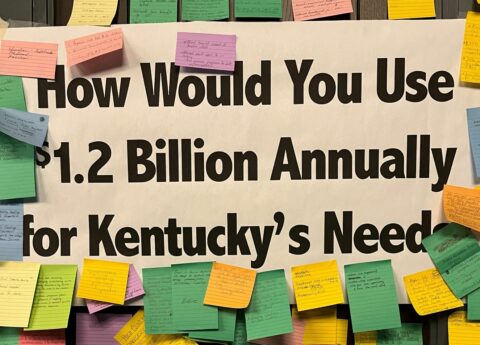

A new report analyzes Rep. Bill Farmer’s tax reform proposal and shows that a shift to a consumption-based tax system in Kentucky would harmfully narrow the tax base and turn responsibility for paying taxes upside-down.

Among the report’s findings are that the poorest 20 percent of Kentuckians would pay an average of $382 more in taxes under Farmer’s House Bill 196, while the wealthiest one percent of earners would receive an average tax cut of $27,851. The report’s distributional analysis was conducted by the Institute on Taxation and Economic Policy, a non-partisan research organization based in Washington, DC.

“We need comprehensive tax reform in order to raise the revenues Kentucky needs to move forward, assure those revenues grow in line with our needs in the future , and do so in a way that maintains balance in who pays,” said Jason Bailey, Director of the Kentucky Center for Economic Policy (KCEP). “But plans like Farmer’s that eliminate Kentucky’s income taxes fail on all those counts.”

“Expanding an outdated and too-narrow sales tax base is an important part of needed tax reform, and the Farmer plan appropriately considers ways to do that,” said Melissa Fry Konty, Research and Policy Associate at KCEP. “But by also eliminating all of Kentucky’s individual and corporate income taxes, it shifts the state to narrow reliance on a single tax. That flies in the face of good tax reform.”

The report notes significant risk with House Bill 196 because of a questionable impact on revenue. Many items in the expanded sales tax base have not been taxed before, and exact revenue results are uncertain. Many newly-taxed items would also likely be subject to subsequent pressure to exempt them, which would lower needed revenue.

While supporters of eliminating income taxes sometimes claim economic development benefits, many studies conclude that all other things being equal taxes make little difference in economic development. States like North Carolina with greater reliance on progressive income taxes have seen substantial economic growth in recent years, and corporate income taxes make up a very small share of the cost of doing business.

“Economic development depends much more on the environment for growth including the strength of the education system, the condition of infrastructure and the quality of life in a state,” said Bailey. “That requires adequately-funded public systems and services.”

The report can be accessed here.

###

The Kentucky Center for Economic Policy (KCEP) was founded in 2011 with the purpose of conducting research, analysis and education on important state fiscal and economic policy issues. KCEP seeks to create economic opportunity and improve the quality of life for all Kentuckians. The Center is an initiative of the Mountain Association for Community Economic Development (MACED) and is supported by foundation grants and individual donors.