The lack of revenue with which legislators are creating the next biennial budget is an urgent reminder of the need to clean up the tax breaks that limit the amount that is available. Legislators from both parties have filed four bills this session that seek to provide more transparency, greater oversight and better information about the impact of proposed and enacted legislation on state revenues. Each takes a different approach to addressing weaknesses in our current system, under which fiscal notes are not required prior to the passage of legislation, and no coherent or regular process exists to review of the cost and efficacy of existing tax expenditures.

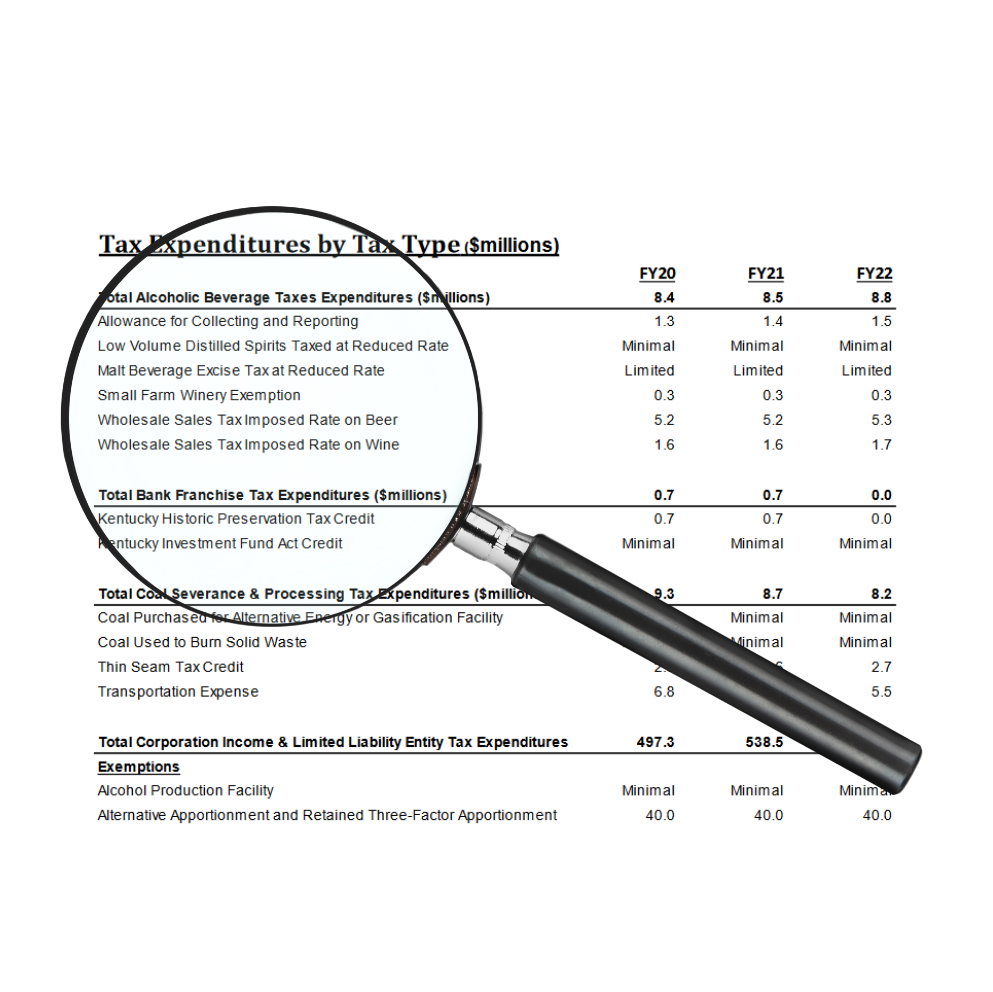

Kentucky loses more than $8 billion a year through tax expenditures – special exemptions, exceptions and deductions. Because tax breaks reduce the revenue available to invest through appropriations, the latter of which receive intense scrutiny every two years during the biennial budget process, equal attention should be paid to the fiscal impact of tax expenditures.

To improve transparency as well as legislators’ ability to evaluate and prioritize how Kentucky spends public resources through the tax side of the budget HB 63, HB 413, HB 422 and HB 533 contain a number of commonsense measures.

- Oversight board and review process for tax expenditures – HB 413 sponsored by Rep. James Tipton establishes a 17-member Tax Expenditure Oversight Board to review, analyze, provide oversight and report to the General Assembly on tax expenditures. It also requires the assignment of a unique identifier to each taxpayer (individual and corporate) to allow the tracking of tax expenditures across agencies and programs. HB 533 sponsored by Rep. Angie Hatton requires the Interim Joint Committee on Appropriations and Revenue to set aside time during interim meetings to evaluate tax expenditures and to make recommendations.

- Sunset of newly enacted tax expenditures – HB 413 requires a 5-year sunset for all new tax expenditures, and HB 533 requires a 4-year sunset for all new tax expenditures. This means that for a tax break to continue, it must be re-authorized after its sunset.

- Required reduction or elimination of an existing tax expenditure if a new one is enacted – HB 422 sponsored by Rep. Jason Petrie requires that any bill that creates a tax expenditure must include the reduction or elimination of an existing tax expenditure in an amount equal to or greater than the estimated revenue loss from the new expenditure.

- Required fiscal notes – Petrie’s HB 422 and HB 63 sponsored by Rep. Rod Wiederstein require that fiscal notes be prepared for each introduced bill or amendment that creates a tax expenditure. They also require that the note be updated as the proposal is amended throughout the legislative process unless waived by a committee chair or a vote of the majority of the members of a chamber. Both bills require that fiscal notes be made available to the public on the LRC website. Under the current system, fiscal notes are prepared only upon request, and may remain private, which means bills are often passed without crucial information being available to the public about the fiscal impact of the proposal.

- Required publication of a tax expenditure analysis – Currently the tax expenditure analysis, prepared every other year in the year preceding a budget session, is required by language in the budget bill. HB 413 and HB 422 make the publication of the tax expenditure a statutory requirement.

- Additional required reporting and publication of information – HB 533 requires enhanced reporting by and to the Cabinet for Economic Development on incentives under the New Markets Tax Credit, and by the Kentucky Horse Racing Commission about the collection of taxes from betting on horse racing and instant racing machines and on the distribution of those funds. (This reporting already occurs, but is not required by statute). HB 413 provides broad discretion for the Tax Expenditure Oversight Board to gather the information needed to review and evaluate tax expenditures.

- Required refund as opposed to front-end exemption under sales and use tax new and expanded industry exemptions – HB 533 establishes a process for manufacturers to apply for a refund of sales and use taxes paid to purchase machinery and equipment used in the manufacturing process (referred to as the “new and expanded industry exemption”) rather than allowing the exemption at the time of purchase, as is the case under current law.

In order to fulfill their responsibility to create a balanced budget, Kentucky legislators need better information and opportunities to evaluate tax breaks. And the state needs automatic processes that provide a backstop to the loss of revenue through tax breaks and the resulting impact on our ability to invest in P-12 schools, college affordability, public health and other critical investments in communities. The growing, bipartisan interest in such accountability measures may not be enough to improve the 2020-2022 Budget of the Commonwealth, but should be acted on now as a key part of making better decisions about Kentucky’s budget in the future.