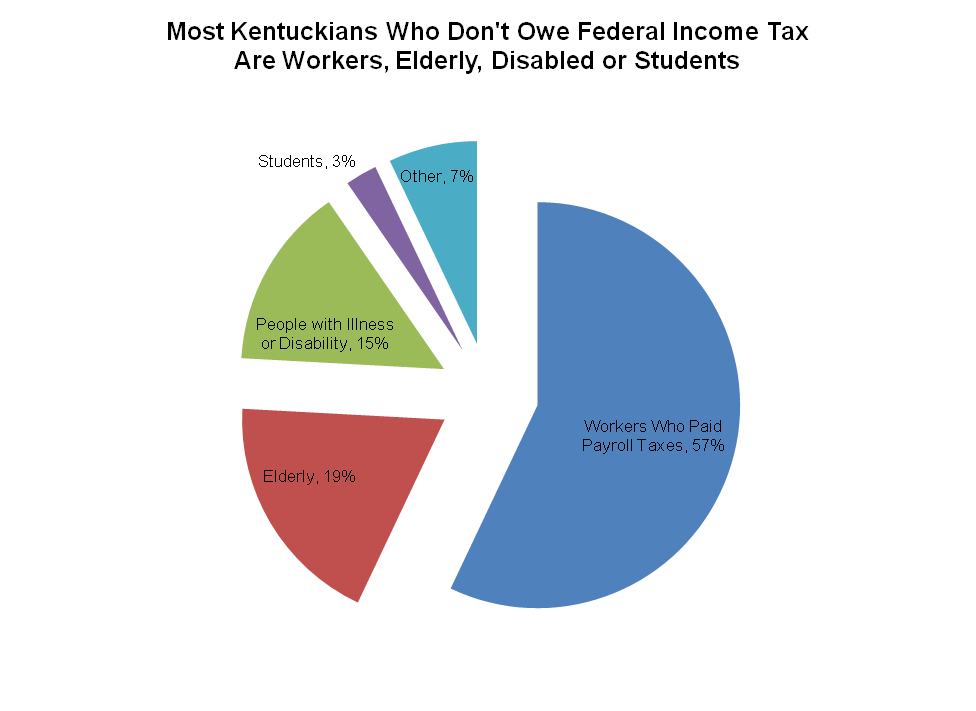

The vast majority of Kentuckians (and Americans) who don’t owe federal income taxes are either workers who pay payroll taxes, seniors, people with disabilities or students.

In 2009-2010, 49 percent of Kentuckians owed no federal income taxes. 76 percent were either workers who paid federal payroll taxes (57 percent) or the elderly (19 percent)—many of whom paid federal income taxes before they retired. These groups didn’t owe federal income taxes because their wages were too low; because they qualified for measures like the Earned Income Tax Credit, which helps lift millions of American families out of poverty; and/or because Social Security is only partially taxed.

Many of the remaining Kentuckians who owed no federal income tax either have an illness or disability (15 percent) or were students (3 percent)—and many students will pay federal income tax once they enter the workforce. A significant portion of the remaining group consisted of early retirees and those who couldn’t find work given the high unemployment rates of the past few years.

What’s more, the individual income tax is only one of many taxes that Americans pay. State and local taxes are regressive—meaning that lower income people pay more of their incomes in these taxes than high-income people. In Kentucky, lower and middle-income people pay between 9 and 11 percent of their incomes in state and local taxes, while the richest Kentuckians pay only between 6 and 8 percent.

Source: Center on Budget and Policy Priorities unpublished analysis of 2009 and 2010 Current Population Survey data.