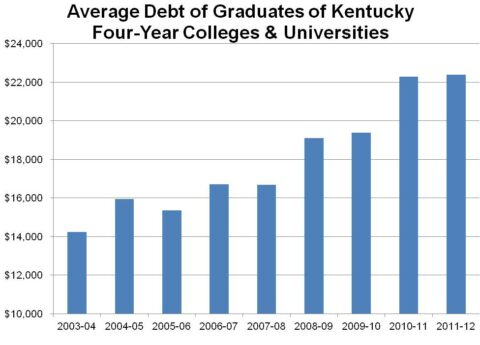

Lessening Burden of Student Loans One Step of Many Toward Greater College Affordability

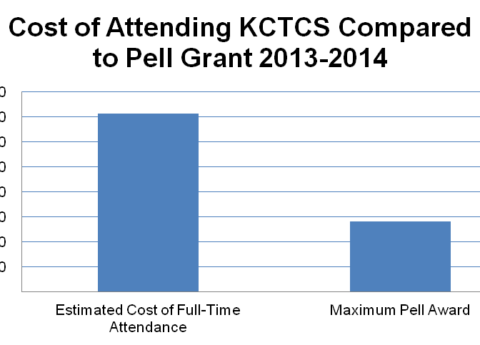

There is a lot of focus this week on what can be done to address the student loan debt crisis—with...

Research That Works for Kentucky

Copyright © 2025 KyPolicy Privacy Policy Terms & Conditions Sitemap