Kentucky lawmakers are expected to vote early in the legislative session on another half-point cut to the individual income tax rate, a drop from 4% to 3.5%. This cut is expected to pass despite a projected decline in tax revenues due to the income tax reductions of the last couple of years. With this next drop, the state will get closer to the level of tax cuts Kansas put in place in 2013 and was forced to reverse just five years later because the state wasn’t bringing in enough money to meet its obligations.

Historically, the individual income tax was the largest and most productive revenue source used to fund Kentucky’s schools, health care, infrastructure and human services. Its continued diminishment will severely hamper the state’s ability to fund critical investments needed to make us healthier, safer, educated and prosperous. And it will do so while giving tax cuts that go overwhelmingly to those at the top.

An additional $718 million cut will take from what we need

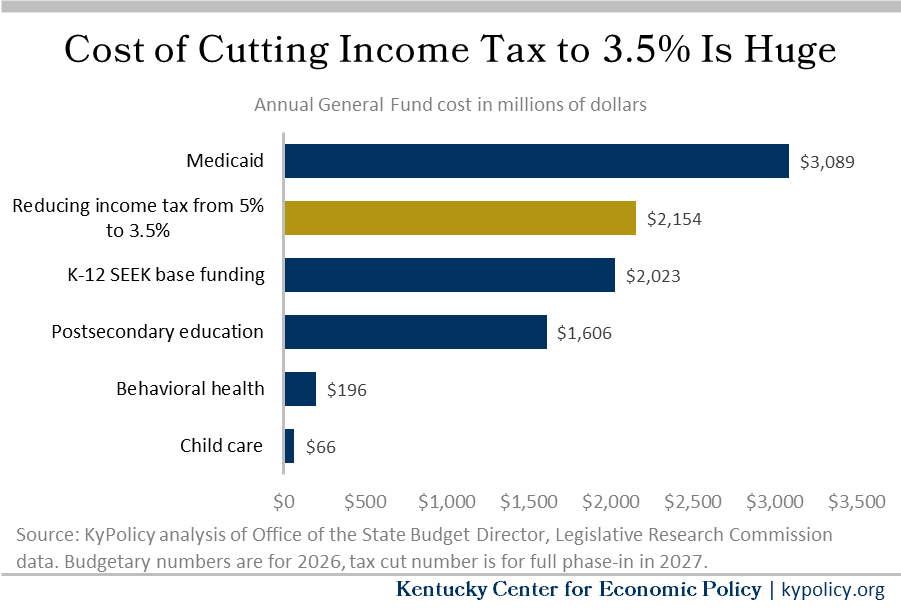

Each half-point cut in the individual income tax costs $718 million, meaning the recent reduction from a 5% rate in 2022 to a 3.5% rate starting Jan. 1, 2026 will cost $2.2 billion. That cost exceeds the base funding for K-12 schools, and is more than the state puts into universities and community colleges, behavioral health, and child care combined, as shown in the graph below.

For the same $718 million cost, Kentucky could do any or a combination of the following:

- Provide a 10% educator pay raise to make up some of the salary erosion of the last 15 years and address the teacher and staff shortage ($495 million)

- Reduce class sizes by 10% to improve student-teacher interaction ($358 million)

- Provide universal preschool for four-year-olds ($172 million)

- Improve schools further by fully funding student transportation for the first time since 2004 ($85 million), providing free school meals for all kids ($50 million), funding textbooks and teacher professional development for the first time since 2018 ($29 million), and creating a permanent teacher student loan forgiveness program to better attract people to the profession ($26 million)

- Pass SB 203 sponsored by Sen. Danny Carroll to further address the severe child care funding challenges ($100 million)

- Create a refundable child tax credit that would benefit 60% of kids and lift 30,000 children out of poverty ($712 million)

- Provide funding to the Kentucky Affordable Housing Trust Fund to begin tackling the severe shortfall of approximately 206,000 housing units ($200 million)

- Provide monies for a cost of living adjustment to state retirees for the first time in 14 years ($174 million for 1.5%) and an additional 6% raise to address pay erosion for state workers and correct wage compression ($179.5 million)

Budget likely headed for trouble

The General Assembly has been cutting the income tax at a unique time in state budget history. Nearly all states have experienced ample budget surpluses in recent years as pandemic-induced inflation and federal aid caused a temporary surge of state tax revenues. Now that the aid has ended and inflation is back down, serious problems are beginning to emerge in states that cut taxes during this period.

An interim forecast now predicts that revenues will fall by $213 million compared to last year and that the state will face a revenue shortfall this fiscal year of $214.5 million. That would mark only the fourth time in the last 50 years that revenues have declined year-over-year (having previously happened twice during the Great Recession and once during the dot-com bust of the early 2000s).

Another half-point cut to the income tax that will go into effect on Jan. 1, 2026 will reduce revenues by $359 million in 2026 and $718 million in 2027. At best that will likely keep revenues from growing during the years 2024-2027 despite inflation, and may mean an absolute drop in receipts and forced drawing down of the Budget Reserve Trust Fund, depending on the unpredictable condition of the overall national economy. Inevitably, at some point a recession will occur, causing revenues to contract and the cost of services like Medicaid to go up as more Kentuckians become eligible due to job loss.

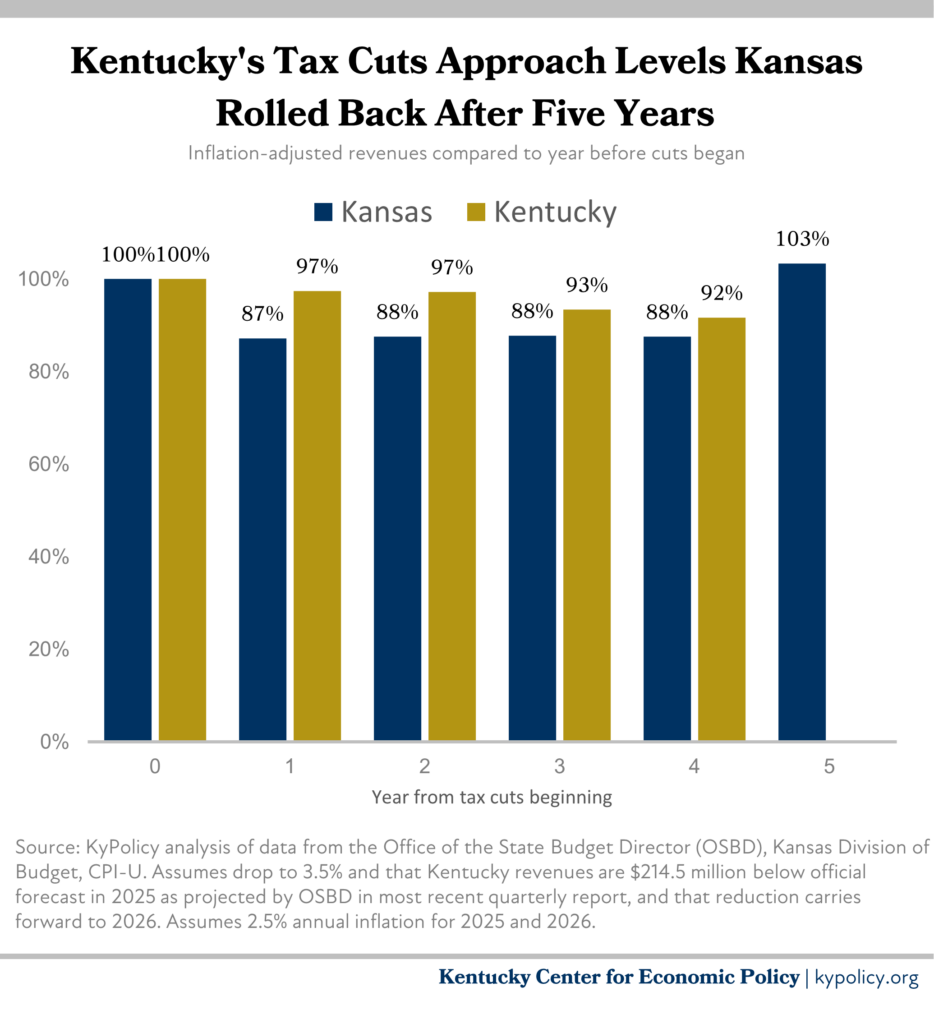

Kansas created a budget debacle in the early 2010s when it cut taxes and promised that the resulting economic growth would make up the difference in revenue. Five years later, it had to roll those cuts back. Kansas’ tax cuts were immediate while Kentucky is phasing in its cuts over a period of several years. But the reduction in the Kentucky rate to 3.5% gets us closer to what that state had to reverse, as shown in the graph below. Another reduction to 3% will meet or surpass the cuts Kansas made.

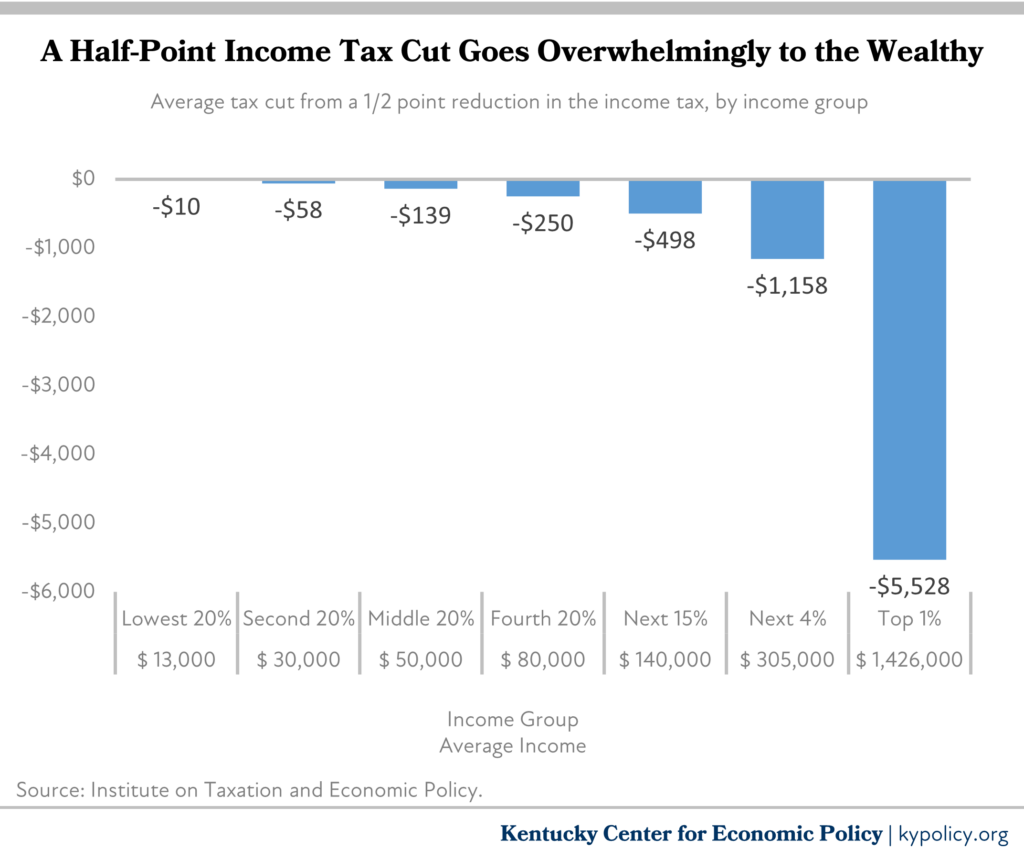

Most income tax cuts go to the wealthiest people

These expensive tax cuts also go overwhelmingly to those people who need them the least. Approximately two-thirds of income tax cuts in Kentucky flow to the wealthiest 20% of people. The richest 1% of Kentuckians will receive an average of $5,528 a year from a half point reduction in the income tax, while working class Kentuckians may receive enough for one oil change or a cable bill a year, as shown in the graph below. Meanwhile, they will be disproportionately harmed by poorer schools, reduced access to health care, outdated infrastructure, higher fees of various kinds to address future shortfalls, and more.

The legislature is determined to reduce the income tax this year and has even put in law the goal of getting the rate to 0%. But more people are beginning to publicly question the wisdom and feasibility of this path. The state budget is the most important policy tool Kentuckians have to help build a thriving commonwealth. We’ll soon see how well it withstands the most serious threat it has ever faced.

Updated January 8, 2025 to reflect data from the fiscal note to HB 1.