Tax Day is an important time for Kentuckians to consider the role of government in our state and nation. Taxes are a critical tool for doing things together that we cannot do alone. With them, we invest in good schools and higher education, well-kept roads and bridges, social services for vulnerable children and adults, safe and beautiful communities and other public structures essential for shared prosperity in the Commonwealth.

Our tax dollars pay for investments we can agree on.

Unfortunately, those seeking to shrink or eliminate many of the functions of government argue for tax cuts that would starve our public systems and structures of resources—often in a way that shifts responsibility for public investments away from wealthy individuals and businesses onto the middle class and poor Kentuckians. We also know from research and experience that individual and corporate income tax cuts aren’t the way to a stronger economy and more jobs.

Investing in our people and our communities, on the other hand, makes us competitive. Taxes support a wide variety of functions, including the following:

- Education: Early childhood education and child care; K-12 education; higher education; adult education; worker training; vocational education; libraries; public television.

- Health Care: Health insurance for people with disabilities, pregnant women, low-income children and parents, and the elderly in nursing homes through Medicaid; public health; mental health services; disability services; substance abuse services.

- Human Services & Supports: Child and domestic violence protection; foster care and adoption; housing; nutrition assistance; support for low-income families; support for veterans; support for the elderly.

- Infrastructure: Roads; water and sewer systems; public transit.

- Environmental Protection: Land conservation; enforcement of laws protecting land, air and water; state parks; forest protection and management.

- Public Safety & Justice: Court system; public defenders and prosecutors; state police; jails and prisons; disaster relief; consumer and worker safety protection.

- Economic & Community Development: Small business development; tourism; job development; agricultural development; arts and culture.

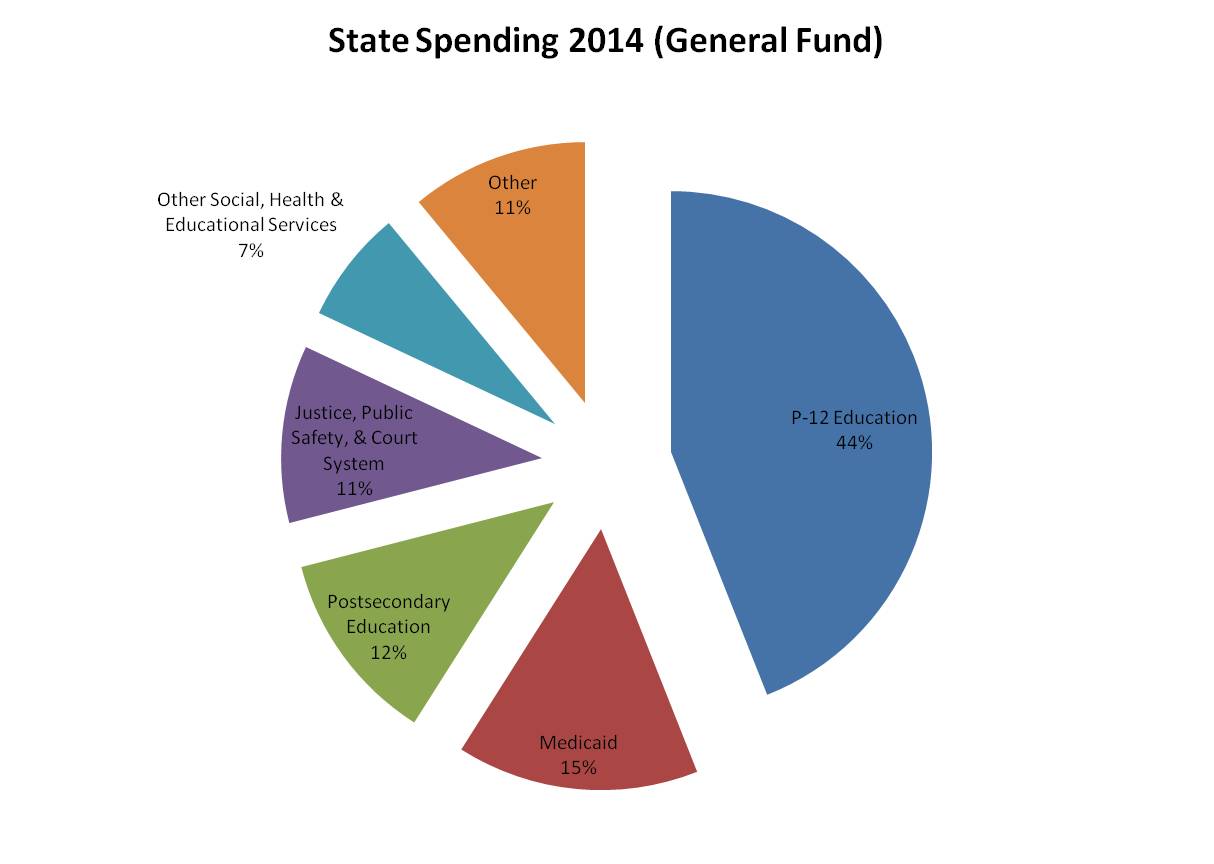

Kentucky is projected to collect about $9.5 billion in its General Fund in 2014. 40 percent of the General Fund is expected to come from the individual income tax; 32 percent from the sales tax; six percent from the property tax; five percent from corporate taxes and the remaining from the coal severance tax, cigarette tax, lottery and other sources.

Those dollars are allocated as follows:

Source: Budget of the Commonwealth 2012-2014, HB 265 2012

For a closer look at how our state tax dollars get appropriated to different budget areas, click here. And to see where federal tax dollars go, click here.

The new Budget of the Commonwealth for 2014-2016 is apportioned similarly to the budget depicted above (with education receiving the lion’s share of funding, for instance). Like previous budgets, it also reflects consecutive rounds of budget cuts and deep underfunding in many areas. Kentucky’s eroding tax base needs comprehensive reform if the next budget is to be any better. On Tax Day, Kentuckians should remember the importance of the public structures that taxes pay for, and consider what’s at stake when they are allowed to erode.