Previous posts have described how a state Earned Income Tax Credit (EITC) would help working low-income Kentuckians make ends meet and reach every corner of the state. A state EITC would also make the tax system fairer, as shown in a new report by the Institute on Taxation and Economic Policy (ITEP).

Kentucky’s tax system has a lot of room for improvement in the area of fairness. Low- and middle-income Kentuckians pay a greater share of their incomes in state and local taxes than those at the top. For instance, Kentuckians with the lowest incomes—under $15,000—pay 9.1 percent of their incomes in taxes while the top 1 percent of earners in the state—with an average income of $759,000—pay just 5.7 percent.

That’s largely because the sales tax is a very regressive tax. The lowest-earning 20 percent of Kentuckians pay 5.6 percent of their income in sales and excise taxes, while the top 1 percent pay only 0.8 percent.

There have been recent proposals to enact a state EITC in Kentucky but little movement on the issue in the legislature. As part of his tax reform plan in the 2014 General Assembly, the governor proposed a state EITC of 7.5 percent of the federal credit, half of what the governor’s tax reform commission had previously recommended as part of a package of recommendations to make the tax system fairer and more adequate, among other guiding principles. In the 2014 session, Representative Wayne introduced a bill with a state EITC at 15 percent of the federal credit, while a bill sponsored by Senator McGarvey proposed a 10 percent EITC. The average state EITC across the country is 16 percent.

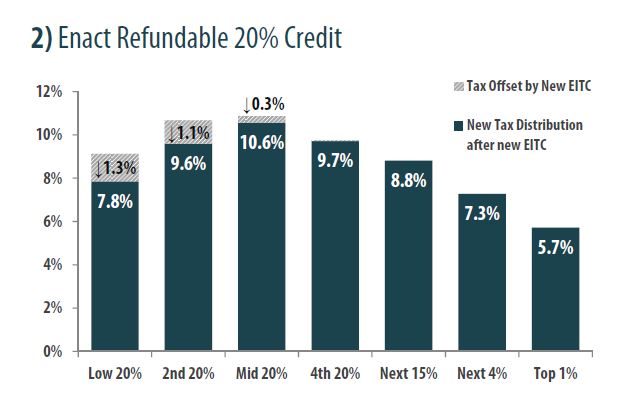

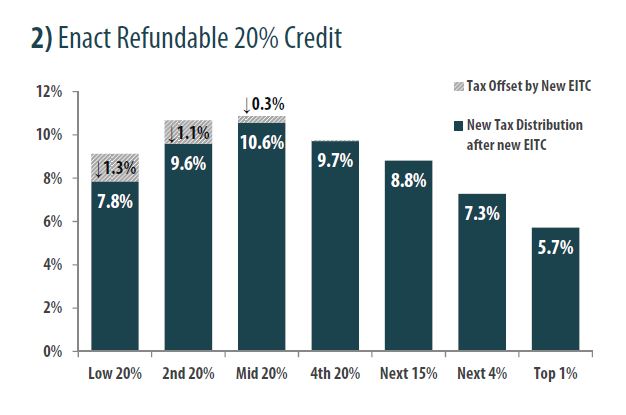

The new ITEP report shows how states would fare in five different EITC scenarios—for those without a state EITC: a refundable state credit of 16 percent, 20 percent, 30 percent, 40 percent and 50 percent. As seen below, a refundable state EITC at 20 percent of the federal credit would help working Kentuckians with incomes under $15,000 by returning 1.3 percent of their income they now pay in taxes.

However, as the graph makes clear, a state EITC alone cannot make Kentucky’s tax system progressive. Even a refundable state EITC that is 50 percent of the federal credit would not reduce taxes for the lowest income group to a share equivalent or below that of the highest income group. That’s why we also need progressive tax reforms that ask a little more of those at the top, who are most able to pay taxes and whose incomes have grown dramatically in recent years while many Kentuckians’ wages have been stagnant.