Social Security helps nearly a million Kentuckians make ends meet, cuts senior poverty dramatically and supports local economies by ensuring more people have money in their pockets to spend, as outlined in a a new report by the Center on Budget and Policy Priorities.

The report shows a total of 936,497 Kentuckians received Social Security benefits last year, 263,000 of whom would have otherwise been in poverty. Social Security doesn’t just benefit seniors, but children dependents as well; in Kentucky 63,882 children benefited from Social Security.

| Age 65 and Older | Age 18-64 | Children Under Age 18 | Total |

| 610,903 | 288,712 | 63,882 | 963,497 |

Social Security provides modest cash benefits for retired workers, disabled workers, and aged widows and widowers. For the average American retired beneficiary, monthly income from Social Security is only $1,329; in Kentucky the average benefit is even less: $1,123 1. In fact, typically, Social Security replaces just under 40 percent of a retired worker’s previous earnings – far below other the average in other industrialized nations.

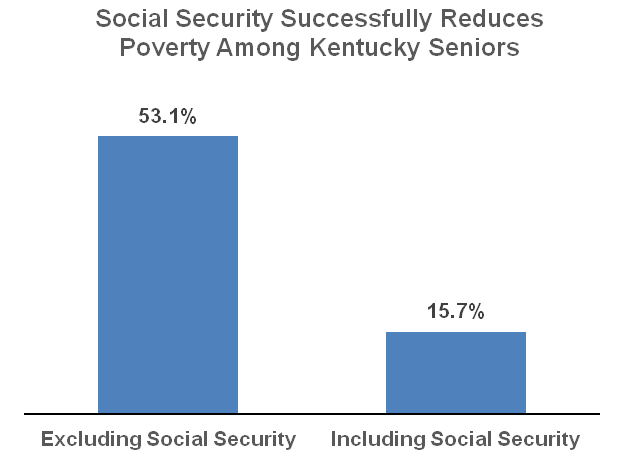

Still, if it weren’t for these benefits, 53.1 percent of Kentucky seniors would live under the poverty line, causing great hardship for them and economic stress in their communities (a 2013 AARP study found that every dollar spent through Social Security generates two dollars in the economy).

Source: Center on Budget and Policy Priorities

Social Security is a vital part of retirement security. Alarmists often claim Social Security won’t be around in the future, but the program can be protected with relatively modest revenue adjustments in the future. A trust fund was created to protect Social Security in 1983 as the baby boomers retire, and even when it is used up in 2034, incoming revenue will still be enough to cover three-fourths of the cost of benefits. Simple changes can be made to protect the program without reducing benefits or creating short-term disruptions, such as:

- Lift or eliminate the cap on taxable wages in the Social Security payroll tax (currently no tax is owed over $118,500 in income). By making sure those at the top don’t get a break, lifting the cap could close anywhere between 25-90 percent of the funding gap (depending on what amount you lift the cap to, or if you eliminate it altogether).

- Expand the kinds of compensation that can count as taxable payroll (like certain kinds of retirement contributions or health insurance contributions made by employers). This could close one third of the funding gap.

- Increase the Social Security payroll tax gradually by 0.6 percentage points over seven years (from 12.4 to 13 percent). This would close one fifth of the solvency gap. If it continued to rise to 14.8 percent, it would close two-thirds of the funding gap.

Social Security is not just a pension, it’s an anti-poverty tool that protects our most vulnerable – seniors, children and the disabled — and it’s an economic engine that boosts local economies when those dollars are spent. Decision makers in Washington should build on this program, and choose policies that ensure its long-term success.

- According to 2015 ACS microdata for US Citizens, in Kentucky, aged over 64. ↩