To view in PDF format, click here.

The Senate budget maintains the governor’s dramatic proposed cuts of nine percent to postsecondary education, parts of P-12 education and a wide range of services affecting health, quality of life and vulnerable Kentuckians. Its primary difference from the governor’s plan is to leave less money in the rainy day fund and a proposed permanent fund while increasing direct funding for pensions.

The Senate budget is similar to the House plan when it comes to total pension funding. The main difference between the two is the Senate still leaves $336 million more in the rainy day fund and permanent fund combined at the end of the biennium than the House, which uses those monies to reduce budget cuts in education and other areas.

Maintains the Governor’s Deep Budget Cuts to Higher Education and Many Other Areas

The Senate budget includes the governor’s budget cuts of 9 percent (4.5 percent this year) to many parts of state government with few modifications.

It includes 9 percent cuts to higher education institutions, which would mean funding for universities and community colleges will have been reduced by 35 percent between 2008 and 2018 once inflation is taken into account. In 2018 it puts 25 percent of higher education funding into a new performance-based system in which institutions must compete against each other for their portion of those funds (Kentucky State University is excluded).

The Senate budget does not include $57 million the House had proposed for need-based lottery-funded scholarship programs — the College Access Program and the Kentucky Tuition Grant program — which have had dollars diverted from them in recent budgets 1. The Senate also doesn’t fund the Work Ready scholarship proposed by the House that fills the gap in providing free tuition to traditional age students at the state’s community colleges. Instead, the Senate plan puts $58.9 million over the biennium into Kentucky Educational Excellence Scholarships (KEES), which are based on grades, for high school students who are dually enrolled in college credit or technical programs.

The Senate goes along with the governor’s budget in including nine percent cuts to the non-SEEK portions of P-12 education, which the House budget had not cut. Within Learning and Results Services, that means cuts of nine percent to areas like preschool, extended school services, teacher professional development and instructional resources. Family resource and youth services centers are cut by 6.3 percent, paid for by defunding a few programs including dropout prevention and the visually impaired preschool services program.

The Senate budget does not expand eligibility for preschool from 160 percent to 200 percent of the poverty level, as in the House plan. Like the House, the Senate would essentially freeze funding for SEEK, the core funding formula for schools.

The Senate cuts other areas as the governor proposed that the House had exempted from cuts, including constitutional offices (Attorney General, Secretary of State, Auditor, Treasurer, Agriculture), Kentucky Educational Television, Office for the Blind, Libraries and Archives, Board of Elections, Registry of Election Finance, Kentucky Center for the Arts, Commission on Human Rights, Commission on Women and the Executive Branch Ethics Commission.

Like the House and the governor, the Senate includes approximately nine percent cuts to other areas including behavioral health, community-based services, environmental protection, public health, aging and independent living, Kentucky Arts Council, Educational Professional Standards Board, natural resources, energy development and independence and the Kentucky Nature Preserves Commission 2.

The Senate budget deletes the House’s proposed additional $10.6 million each year to expand eligibility for child care assistance from 150 percent to 160 percent of the poverty level. The Senate also deletes an authorization included in the House budget of up to $10.5 million over the biennium for the fund that provides care for the uninsured at University of Louisville Hospital, as well as monies for colon, breast and cervical cancer screening 3.

The Senate budget eliminates funding for 44 new public defender positions both the House and governor had included to help with caseloads. As in the House budget and the governor’s proposal, there are again no raises for employees in the budget other than selected raises for a few occupations such as social workers and state police.

Contributes Similar Overall Amount to Pensions as House

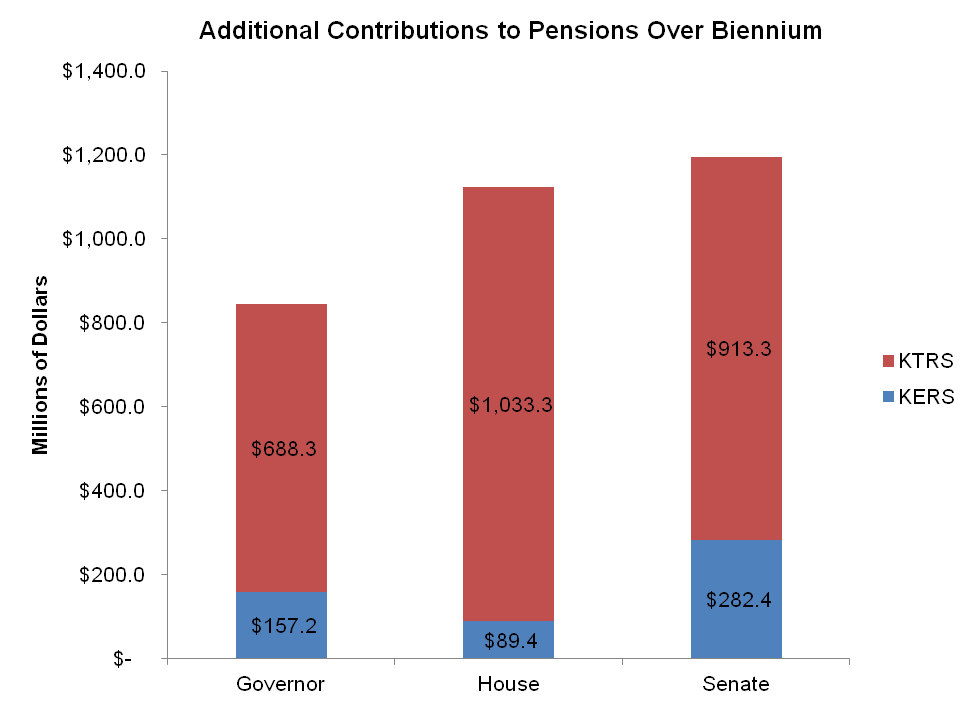

The Senate agreed with the House in making significantly larger contributions to employee pensions than the governor proposed, with a contribution of $1.195 billion over the biennium compared to $1.123 billion in the House plan. That compares to $845.5 million in what the governor proposed.

The Senate somewhat changed the mix of funding to the pension plans compared to the House. The House included the full actuarially required contribution (ARC) to the Kentucky Teachers’ Retirement System (KTRS) over the biennium, while the Senate plan includes 88 percent of the KTRS ARC. The Senate plan puts over three times the amount the House does in additional dollars above the ARC to the Kentucky Employees’ Retirement System (KERS) (see graph below, which does not include base funding for the systems).

Source: KCEP analysis of HB 303 SCS.

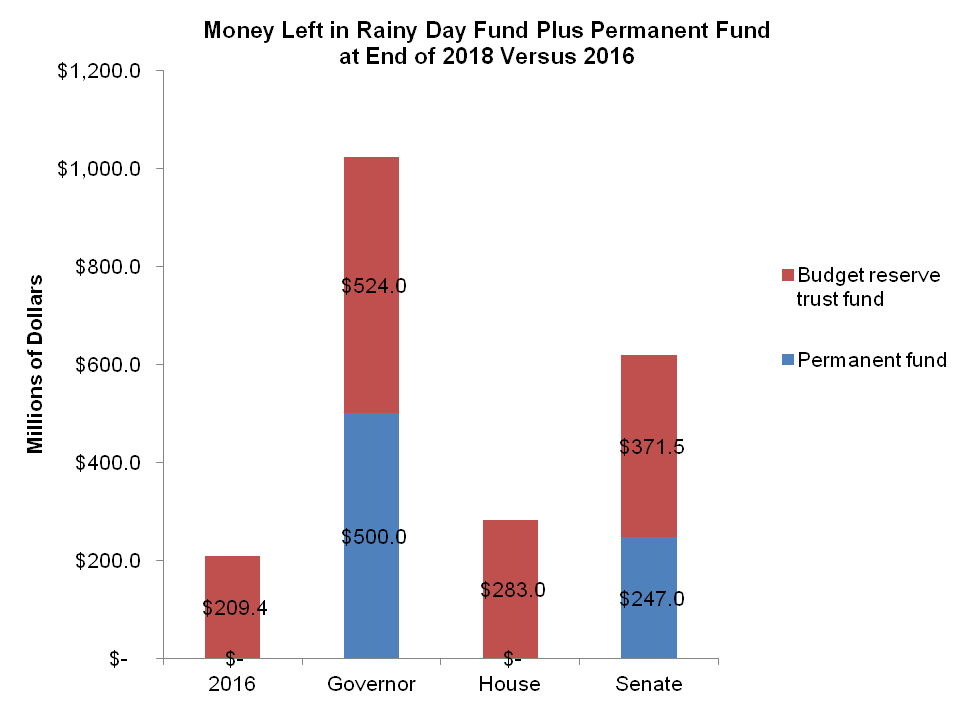

The Senate also leaves $250 million in a permanent fund compared to $500 million in the governor’s plan and $0 in the House budget 4. The Senate leaves a rainy day fund balance of $371.5 million at the end of the biennium compared to $283 million in the House plan and $524 million in the governor’s budget (see graph below) 5. In total, The Senate leaves $336 million more in idle funds at the end of the budget period than does the House.

Source: KCEP analysis of HB 303 SCS.

The Senate’s budget is built with $634 million in fund transfers over the biennium, compared to $638 million in the House budget and $611 million in transfers contained in the governor’s plan. The Senate budget includes $580 million in new debt for capital projects compared to $549 million in the House plan and $625 million in the governor’s budget. In the Senate, that includes $50 million for a workforce development construction pool, which the House had not included in its budget but for which the governor had proposed $100 million. The Senate budget does not allow postsecondary institutions to issue debt on unauthorized, self-funded capital projects over $600,000, as the House had allowed.

Other Important Differences

- The Senate maintains that approximately half of coal severance money will continue going to the General Fund, with half going back to counties through a variety of programs and local revenue sharing. It includes no specific local projects as the House included. The House budget begins to shift more coal severance tax dollars back to counties and local spending, with a plan to make that transition complete over four years. Some of the programs previously funded with coal severance dollars, like Operation Unite and the SOAR initiative, are funded through other parts of the House budget.

- The Senate budget repeals prevailing wage on public construction projects, while the House budget does not.

- While the House had required specific funding amounts for certain programs within some of Cabinets, the Senate restores the discretion to the Executive Branch the governor had proposed.

- Dustin Pugel, “Fact Sheet: Need-Based Financial Aid Dollars Being Diverted to General Fund,” Kentucky Center for Economic Policy, February 23, 2016, https://kypolicy.org/need-based-financial-aid-dollars-being-diverted-to-general-fund/. ↩

- Anna Baumann, “House Budget Does Not Restore Many Crucial Services for Vulnerable Kentuckians,” Kentucky Center for Economic Policy, March 18, 2016, https://kypolicy.org/house-budget-not-restore-many-crucial-services-vulnerable-kentuckians/. ↩

- Jason Bailey, “Uninsured Costs at U of L Hospital Have Dropped Dramatically Because of Medicaid Expansion and Kynect, But Could Go Up with Changes,” Kentucky Center for Economic Policy, March 22, 2016, https://kypolicy.org/uninsured-costs-u-l-hospital-dropped-dramatically-medicaid-expansion-kynect-go-changes/. ↩

- Jason Bailey, “Why the House Budget Approach Is Better than a Big Set Aside of Idle Funds,” Kentucky Center for Economic Policy, March 18, 2016, https://kypolicy.org/house-budget-approach-better-big-set-aside-idle-funds/. ↩

- The House budget also includes some items in its budget as necessary governmental expenses that will reduce the final amount in the rainy day fund. ↩