The Senate has proposed a budget that spends significant dollars out of the Budget Reserve Trust Fund (BRTF), primarily on infrastructure projects, much more than the House proposed. However, the budget remains largely austere when it comes to meeting other needs, containing still-inadequate monies for education, child care, housing, state and school employee raises and other areas despite additional ongoing funds being available.

The Senate budget doesn’t hold down spending as much as the House budget in an attempt to hit the triggers for an income tax reduction in 2025, though like in the House proposal the Senate plans for a reduction in the income tax rate in 2024. To make a tax cut in 2025 still possible, the Senate shields even more spending from counting toward the trigger and than the House had planned.

Senate budget includes much more spending out of the Budget Reserve Trust Fund and says trigger rules don’t apply, but doesn’t make certain a tax cut in first year of new budget

It is likely that the state will hit its income tax trigger for fiscal year 2024, which if the legislature approves a cut in the 2025 legislative session will result in a reduction of the income tax rate from 4% to 3.5% on Jan. 1, 2026. Language in the Senate and House budgets already anticipate a reduction in revenues of $359 million in 2026 as a result.

Based on the appropriations included in the Senate budget bills and suspension of the law described below, it is possible though not likely the triggers will be hit in fiscal year 2025. If the triggers are hit and the cut is approved by the legislature, the income tax rate would drop from 3.5% to 3% on Jan. 1, 2027.

The Senate budget makes triggered tax cuts possible by “notwithstanding” or suspending the trigger law to ignore $2.8 billion in new spending on infrastructure, a one-time retiree payment and other expenses, not counting this spending toward whether the trigger is met (the House had included $900 million of such spending).

More than $2.6 billion of that spending is contained in House Bill (HB) 1 while HB 6 contains $17.9 million for crime victim funding and $211 million to pay off a bond related to the former Kentucky Wired broadband project that are also designated not to count toward tax cut triggers. HB 1 in both the Senate and House versions also includes $950 million in extra pension contributions, though those already do not count toward income tax triggers.

The Senate version of HB 1 includes all of the appropriations in the House version plus the ones in bold below:

- State-supported highway construction: $890 million

- Teachers Retirement System unfunded liability: $500 million

- Matching grants for federal infrastructure monies: $450 million

- Local projects: $356 million

- Kentucky Employees Retirement System nonhazardous unfunded liability: $300 million

- University and higher education projects: $204 million

- Water and wastewater infrastructure: $150 million

- State Police Retirement System unfunded liability: $150 million

- Cabinet for Economic Development loan pool and projects: $125 million

- Cabinet for Economic Development mega-projects: $100 million

- Cabinet for Economic Development loans and expansion of Defense Industrial Base: $85 million

- One-time payment for state retirees: $75 million

- Western Kentucky law enforcement training academy: $50 million

- Airport improvements: $45 million

- Department of Community-Based Services/community projects: $42 million

- Horse park improvements: $36 million

- Highways projects: $30 million

- Riverport improvements: $18.5 million

- Department of Aviation: $11.4 million

- Kentucky State Police lab equipment: $6.4 million

The result of this additional spending in HB 1 is that the ending balance in the Budget Reserve Trust Fund, or rainy day fund, is much lower in the Senate than the House. In the Senate budget, the BRTF declines from $3.7 billion today to approximately $2.8 billion by the end of the biennium. In contrast, in the House plan the fund’s balance would grow to an enormous $5.2 billion. While an amount equal to 15% of an annual budget is considered a strong rainy day fund, Kentucky’s balance would grow to an excessive 32% in the House budget. It will be a strong but much more reasonable 17% at the end of the biennium in the Senate budget.

The Senate also includes more new debt than the House budget for various infrastructure needs. The Senate budget contains $3.1 billion in bonded debt compared to $2.7 billion in the House, while the governor’s budget included $1.7 billion. Borrowing can be used as a tool to help get around the tax cut triggers despite ample cash available in the BRTF, as described above.

Total spending in the Senate budget is more than $1 billion below projected revenues in 2025, but may be somewhat shy of the amount needed to trigger a tax cut that year unless the state experiences a significant revenue surplus. The House budget aims more directly to trigger a tax cut in 2025. Neither the House nor Senate budget is designed to trigger a tax cut under the formula in fiscal year 2026.

SEEK funding doesn’t keep up with inflation, no dedicated teacher raise, does not fully fund student transportation

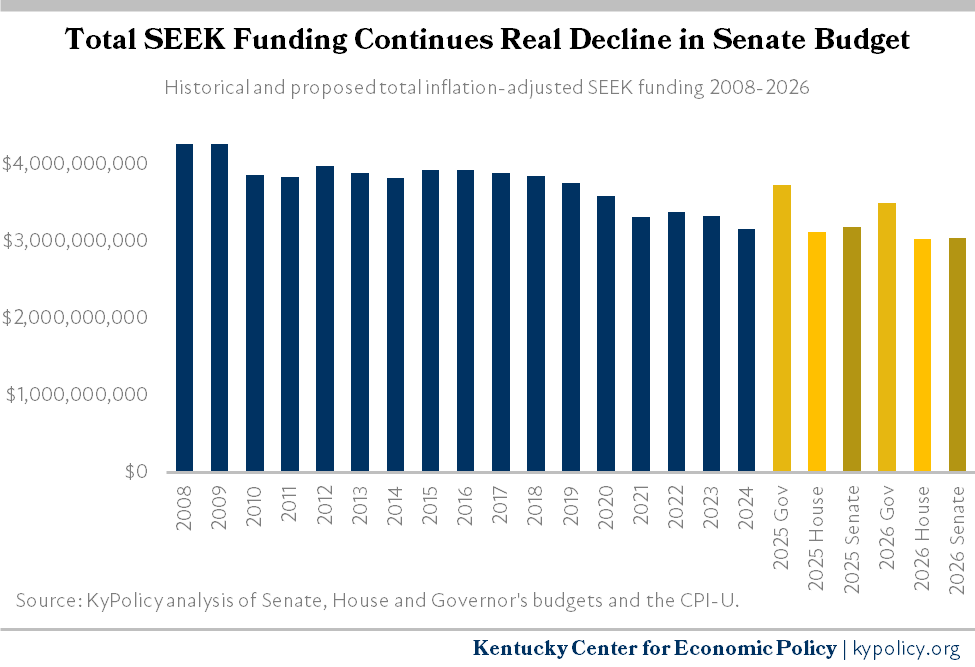

By not including dedicated teacher and school employee raises as with the governor’s proposed 11% increase, and by increasing core K-12 school per-pupil funding (SEEK) by only modest amounts, SEEK again does not keep up with inflation in the Senate budget. Real total SEEK funding falls from 26% below 2008 levels in 2024 to 28% below by 2026 (compared to 29% below in the House). The base per-pupil guarantee increases by 4% in the first year of the budget and 2% in the second year, just as the House had proposed. But that’s a state plus local number, and strong state-wide property assessment growth means a significant portion of that increase is being paid at the local level. The Senate budget also increases the amount of Tier 1 funding that it equalizes from 15% of base funding to 20%, which provides extra state dollars to most districts while providing little or no funds for those with higher property assessments, like Jefferson and Fayette counties.

The Senate budget funds school transportation at 66% of the statutorily required amount in 2025 and 74% in 2026. It was reported that the Senate funded transportation at 80% the first year and 90% the second, but those numbers are calculated based on 2023 estimates. The annual SEEK transportation estimate is released each March 1, and the new estimate is $85 million higher than last year due to the recent increase in bus driver and other costs. Therefore, the Senate’s budget level is significantly below what the law requires over the next two years.

The Senate budget does not include additional funds for preschool, which is still funded at its 2019 level ($84.5 million). Extended school services (afterschool programs) are also at the same level as in 2019. The Senate budget includes $29.5 million for the Center for School Safety in 2025, and $31 million in 2026, which is slightly more than the funding level in the House of $29.5 million both years (and above the $13 million in the Governor’s budget). And the Senate and House budgets propose adding $4 million each fiscal year to support the operations of additional Family Resource and Youth Services Centers (FRYSCs), though that is half the amount added in the governor’s proposal for additional FRYSCs.

There are no funds for teacher professional development, which has not been specifically funded since 2018, or for textbooks. The budget does not include $150 million contained in the governor’s proposal to address inflation in existing school facility construction projects. The Senate budget also does not include funding for a pilot program of teacher student loan forgiveness, which the House budget funded at $4.8 million in 2025 and $10 million in 2026 and the governor proposed to appropriate $26.3 million a year. As in the House proposal, the Senate budget includes $750,000 for an audit of Jefferson County Public Schools.

The Senate budget also suspends the state law to allow local school boards to exceed a 4% increase in local property tax revenue without triggering a potential voter recall, though the rate could not exceed 75% of lost state SEEK funding due to an increase in property valuation. The additional revenue resulting is equalized by up to two-thirds of state equalization funding in 2025 and one-third in 2026.

Budget includes increase for higher education, full funding of need-based college aid

The Senate budget increases base funding for public higher education institutions by 6% the first year (compared to 2024) and 4% the second (compared to 2025) and puts $200 million each year in the performance funding pool, which the House had funded at $101 million per year.

The Senate and House budgets provide some additional funding to Kentucky State University (KSU), which has long been inequitably underfunded as identified by the federal government in a recent letter to the state. The Senate budget also includes $37.5 million each year in bond funds for asset preservation at KSU; in the House budget that amount was $12.8 million per year. Yet the state’s higher education institutions are still funded at a level 24% below 2008, when inflation is taken into account, by the end of the biennium. As in the last budget, the Senate budget does include full funding of the lottery-supported need-based college scholarship programs.

Plan includes much smaller raises for state employees, a one-time payment for retirees, massive pension liability contributions

The Senate plan includes $74.8 million for a one-time payment for state retirees to help address the fact they haven’t received a cost of living adjustment in their pensions since 2012. The House budget did not include a payment, and the governor had proposed $100 million for that purpose.

The House budget includes a 2.6% raise the first year of the budget for state employees, and a 2.6% raise the second year, compared to a 4% and then 2% raise in the House budget. That’s smaller than the governor’s proposed 6% raise in 2025 and 4% in 2026. The Senate and House budget also do not include funds to address wage compression, a situation in which many long-term employees do not make much more than newer employees due to years without raises. The governor had proposed additional raises of 1% to 7% to deal with that issue. The Senate and House instead mandate another study of the issue (the third such report), this time by an independent consultant, to be completed by December 2024.

On top of the significant appropriations to unfunded liabilities in HB 1 mentioned above, HB 6 in both the Senate and House versions includes $500 million in additional funds to the Kentucky Employees Retirement System non-hazardous pension fund, for a total of $1.45 billion on top of the actuarially determined contribution to the state’s retirement systems. The governor’s plan had included $209 million above the actuarially determined contributions.

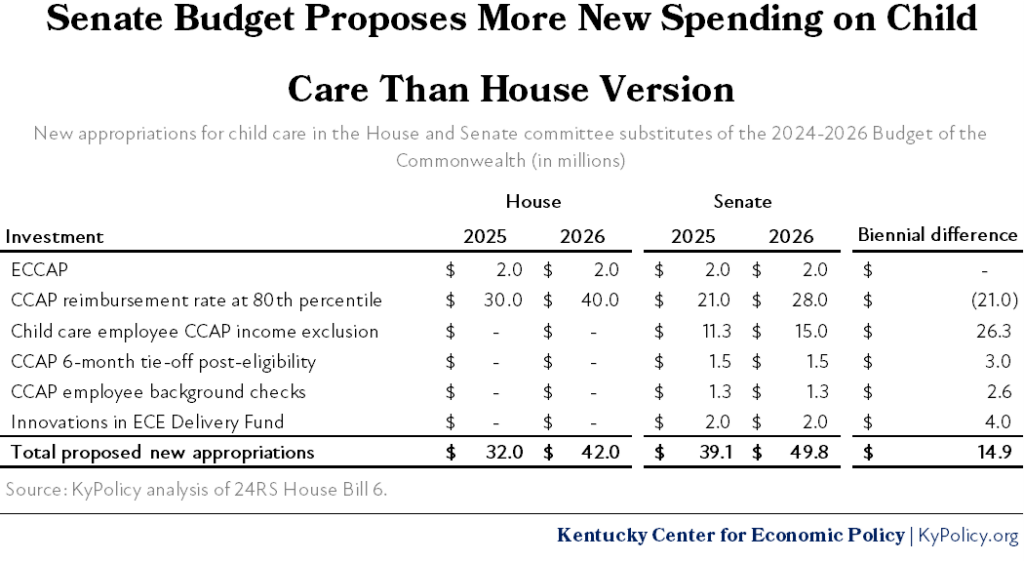

Plan includes too little child care funds, restores cuts to Medicaid

The Senate budget includes $39 million in new spending on child care in 2025 and $50 million in 2026. This amount is more new state spending for child care than the House-proposed version of the budget. These monies hold the child care provider reimbursement rate at the 80th percentile of market rate, support a successful program that allows child care workers to take advantage of subsidies, continues a six-month tie-off for parents no longer eligible for Child Care Assistance Program (CCAP), and provides for several other child care improvements. The Senate budget also includes $2.5 million a year in early childhood development scholarships that were not in the House budget. But the Senate budget does not include funds to maintain the stabilization payments or the higher income eligibility threshold for CCAP that were part of federal pandemic funding.

While all of the policies the Senate funded are necessary to support child care providers and the parents they serve, more is needed in light of the coming fiscal cliff, particularly with the loss of the quarterly stipends to child care providers. An estimated $330 million per year would be needed if the state were to fully replace those lost funds, and SB 203 proposes $150 million more annually for this purpose.

The House budget had shorted the funding for the Medicaid program for fiscal year 2025 by veering from the forecast the administration used for enrollment and costs. The administration would likely be forced to reduce services, provider payments and/or enrollment in 2025 if additional funds are not appropriated. The Senate budget corrects that issue. The Senate also included $9 million per fiscal year to increase dental service rates to help support the recent expansion of dental services to adults covered by Medicaid. The Senate and the House budget do not include $10 million in 2025 and $15 million in 2026 for Mobile Crisis Intervention Services that was to provide emergency mental health services in homes and communities and was in the governor’s proposal.

The Senate budget includes funds for 1,925 new Medicaid slots for people with disabilities, significant progress on a waiting list that includes more than 12,000 Kentuckians. The House had included 2,550 new slots. The Senate budget also includes $109 million in 2025 and $114 million in 2026 to improve reimbursement rates to waiver service providers and nursing homes. However, the Senate budget cuts $3.9 million in ’25 and $5.9 million in ’26 that the House had included for local health departments.

The Senate proposal, like the House, includes an increase in both the foster care and relative caregiver payment rates at amounts similar to what the governor had proposed, and $10 million each year for senior meals to prevent a waiting list (the same as the House and governor’s plan). The Senate and House include $1.5 million each year for the required administrative match to implement Kentucky’s federally-funded Summer EBT program, which provides food assistance to students in the summer who qualify for free and reduced meals during the school year. But the Senate and House do not include $2.5 million per year in state aid for local libraries that was included in the governor’s plan.

No additional monies for housing or disaster relief, less for clean water needs

The budget includes no funds specifically for affordable housing, except for $10 million in Lexington. Advocates have called for $200 million to spend on rural and state-wide affordable housing needs. The Senate, like the House, also doesn’t include the $75 million the governor had included for additional disaster relief in eastern Kentucky following the 2022 floods. The Senate, like the House in a separate bill (HB 262), caps what can be spent on necessary emergency disaster aid this year at $75 million, and at $50 million each of the next two years, rather than allowing the needed funds to be spent.

The Senate and House budgets include $150 million for water and wastewater infrastructure, significantly less than the governor’s proposed $500 million plus $30 million in assistance to local entities (though some of the $475 million in matching grant funds in HB 1 could be used for water and wastewater infrastructure). The Senate and House budgets also do not include $12 million earmarked for Martin County water projects included in the governor’s budget to help address that county’s severe clean drinking water problem.

Budget provides additional funds for prosecutors but not public defenders

The Senate does not include restrictions on use of funds for the successful Alternative Sentencing Worker Program (ASWP) in the Department of Public Advocacy (DPA), which the House prohibited. There is also additional money in the Senate budget allocated to fund conflict counsel services for DPA.

Like in the House budget, in the Senate plan prosecutors receive additional funding in both years of the biennium, including $5 million in each year for additional personnel and $6.5 million over the biennium for salary compensation standardization for Commonwealth’s Attorneys, along with $3.5 million in each year for additional personnel and $17 million over the biennium for salary compensation standardization for county attorneys. There are no new appropriations in the Senate plan for comparable increases for public defenders.

Senate budget supports governor’s recommendations for the Department of Juvenile Justice, more capital projects for corrections

The Senate provided $3.8 million in 2025 and $3.9 million in 2026 to the Department for Juvenile Justice for increased alternatives to detention programming, which is the amount requested by the governor. In comparison, the House provided more than was requested by the governor at $7.8 million a year. And $6.8 million is provided across the biennium in both proposals for other programs including social service specialists.

The Senate budget also approves bond funding to support the juvenile justice capital construction projects that the governor had proposed, including two new female facilities, retrofitting three existing detention centers and building a new high acuity psychiatric detention facility to be run by the Department of Juvenile Justice and the Cabinet of Health and Family Services. The House budget did not include this funding.

Neither the House nor Senate budget includes the over $5 million a year for improved re-entry services for those leaving prison and jail that was in the governor’s plan. The Senate and House budgets continue the $4 increase in the per-diem amount in the previous biennium for county jails for each person serving a felony sentence (up from $31.34 per day to $35.34 per day).

The Senate budget appropriates $20.2 million of COVID funds to the Department of Corrections in 2024-25 that was not included in the House budget and appropriates $20 million more in General Fund dollars in 2025-26 than the House budget, primarily to support additional capital projects not included in the House budget.

Updated March 27, 2024 to reflect updated SEEK transportation estimates.