Senate Bill (SB) 6 in the 2025 Kentucky General Assembly makes the most significant change in the history of the core school funding formula created by the Kentucky Education Reform Act (KERA), known as Support Education Excellence in Kentucky (SEEK). But the change does not increase spending or inject any more money into classrooms. Instead, it simply changes how some existing expenditures are categorized, clouding the picture of how much the state is putting into public education.

Under SB 6, all state payments already being made outside of SEEK for fringe benefits like health insurance and retirement benefits will be counted as part of SEEK. Of particular concern, SB 6 inappropriately adds to SEEK all the enormous catch-up pension payments for old debts incurred due to past failures of the General Assembly to fully fund teacher pensions. These catch-up payments are not a contribution to the current operation of schools, as is the purpose of SEEK.

SB 6 will artificially and dramatically inflate SEEK spending — if it had been in effect in the current budget, SEEK funding would’ve been 59% higher — without any additional dollars going to schools. Some may use this change to continue claiming “record funding” for education without providing more resources to the kids attending public schools, which have received eroding state investment since 2008.

SEEK is designed to support current operations of schools in an equitable manner

The SEEK formula was one of the major outcomes of the 1989 state Supreme Court ruling, known as Rose v. Council for Better Education, Inc., that declared the state’s school system unconstitutional. SEEK plays a primary role in meeting the state’s constitutional obligation for an adequately and equitably funded school system.

SEEK guarantees a minimum amount of funding per student and establishes a formula that divides responsibility between school districts and the state, with the state providing more funds to districts with lower property wealth and thus less capacity to generate local tax revenue. The SEEK formula includes additional amounts based on the number of students in each district that cost more to educate, such as at-risk pupils, special education students and English language learners. SEEK also includes funding for student transportation.

Schools receive other funding from the state outside of SEEK, including for purposes ranging from preschool to career and technical education, and from the federal government, including Title 1 funds for low-income schools and grants for school meals. But SEEK represents the single largest source of funds to help Kentucky schools carry out their basic missions in an equitable manner.

SB 6 requires including all fringe benefit-related state payments in SEEK

SB 6 requires that the SEEK budget unit include the full state contribution for fringe benefits like medical, vision and dental insurance for current employees as well as retiree pension and health benefits. These contributions are sometimes called “on behalf” payments. SB 6 also requires that any reports produced by the Kentucky Department of Education on SEEK payments by school district include these fringe benefit payments.

A significant portion of retiree pension, medical and life insurance benefits are already included in SEEK and are based on contribution formulas prescribed in law. Those retirement contributions now in SEEK amount to $458 million this year and $468 million in 2026. The remainder of Teachers’ Retirement System (TRS) contributions are included in the budget category General Government in the TRS budget unit, an appropriation totaling $847 million in 2025 and $1.037 billion in 2026.

Additionally, health and life insurance for current employees is currently funded by the state through the Department of Education, but not as part of SEEK. That makes it like funding for preschool, career and technical education, technology, extended school services and other non-SEEK education expenditures. The state contribution for health and life insurance totals $944 million in 2025 and $1.078 billion in 2026.

If the state had counted all these state fringe benefit payments in SEEK in the current biennium, it would’ve increased SEEK spending by 59%, or $1.8 billion more in 2025 and $2.1 billion more in 2026. But including them in SEEK will not increase the amount of state funding overall, just shift the category in which they are represented.

A huge portion of added SEEK dollars under SB 6 are catch-up pension contributions that are overwhelmingly owed to teachers who are already retired

The problem with including all current pension contributions as part of “education funding,” much less as part of SEEK, is that a huge portion of those contributions now go to catch-up payments for past underfunding of pension benefits. During the years 2009 to 2016, the General Assembly did not make the full actuarially determined contributions to pension benefits (and those contributions were not made for retiree medical benefits until a “shared responsibility plan” passed in 2010 that increased teacher, school district and state contributions to that fund). The compounding effect of not putting in those funds for pensions caused the debt to balloon. Whereas the state TRS pension plan previously had been nearly fully funded, it fell to a low of 55% funded by 2016, and unfunded liabilities grew to $14 billion.

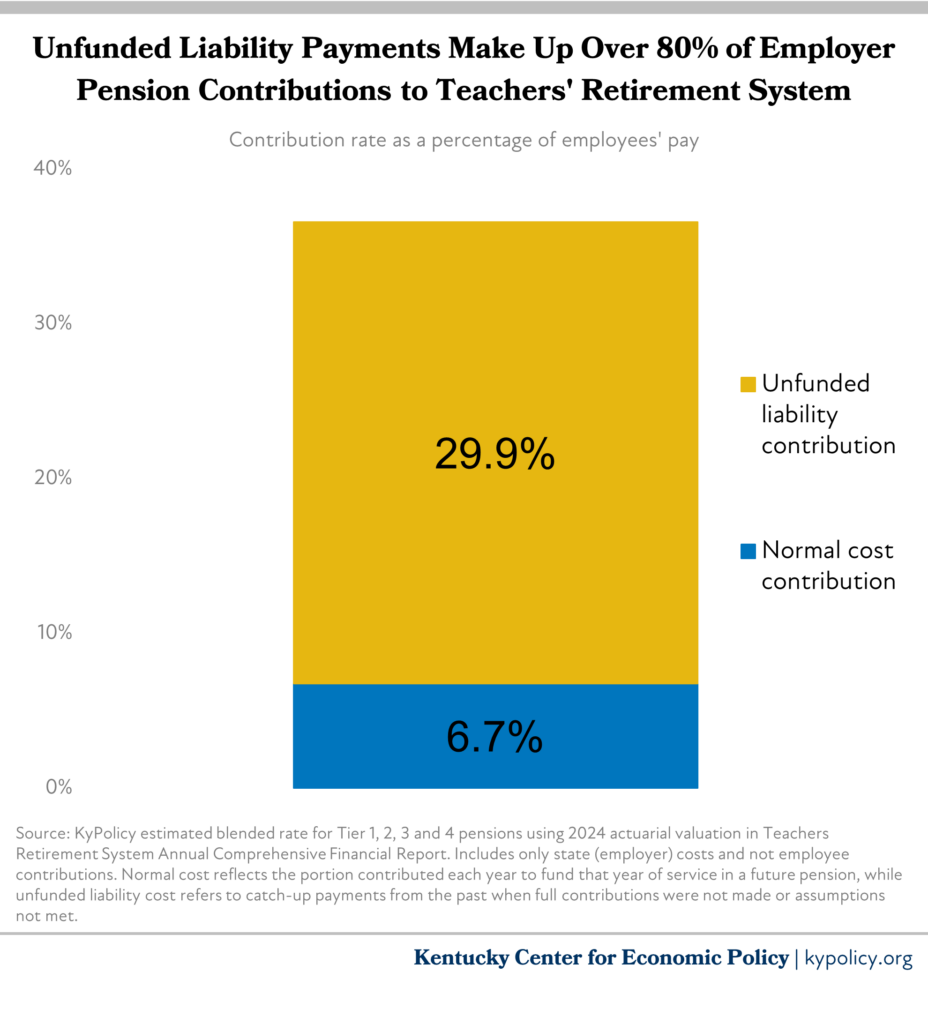

In 2017 the legislature resumed paying the full actuarially determined pension costs. The plan has slowly improved its health since then but will not be fully funded until 2047. Unfunded liability contributions, or catch-up payments, make up approximately 82% of what the state is now contributing to the Teachers Retirement System pension plan, as shown in the graph below. Normal costs — or the contributions needed annually to pay for each current teacher’s future pension benefits — are barely more than what nearly every other employer contributes for Social Security, which Kentucky teachers do not receive and the state therefore does not have to pay.

Resuming the payment of full costs in 2017 met a legal obligation of the state and was the right and responsible thing to do. But those extra dollars in catch-up payments should not be counted as “education spending” because they do not go to current school districts, teachers, classrooms and kids. According to the actuary’s estimates, TRS has $25.7 billion in assets and will receive $5.6 billion in contributions that active teachers and their employers will contribute for their service in the future. That exceeds the $21.8 billion the state will owe for active teachers’ pension benefits. But the state also owes another $26.8 billion to retired and disabled members and beneficiaries of deceased members. In other words, TRS has the resources to fund the pension benefits of active teachers but additional contributions are being made as catch-up payments for a large portion of the benefits for teachers who are no longer in the classroom.

The purpose of the SEEK formula, when adequately funded, is to help ensure that the “efficient system of common schools” promised in the constitution is possible. It is not to pay back contractual obligations that the General Assembly did not meet at the time they were incurred.

Fulfilling the constitutional obligation to properly fund education requires reinvestment in schools

Meanwhile, actual state funding for schools has been eroding since the Great Recession hit in 2008:

- Total SEEK funding (as defined prior to SB 6) is 26% less now than in 2008 in inflation-adjusted dollars, and average teacher pay across districts is 20% less.

- The funding gap between wealthy and poor school districts exceeds the levels declared unconstitutional in the 1980s.

- The General Assembly has provided $0 for textbooks and professional development every year since 2018, and has not increased funding for preschool or extended school services since 2019.

- The legislature has not fully funded school transportation as required by law since 2004.

- Budget cuts have caused fewer school days, higher student fees, cancelled art and music programs, fewer student supports, less health services and other reductions.

- The state faces a growing shortage of school personnel, and fewer potential teachers are entering the teacher education pipeline.

Kentucky students need the General Assembly to meaningfully reinvest in the state’s public schools while also meeting its other important obligations, including paying past debts for teacher pensions not funded in the first place. SB 6 is an accounting change that does not help deliver what kids need today.