All Kentucky children should receive a high-quality education that helps them thrive. Because such an education requires skilled teachers, up-to-date instructional materials, non-academic supports, safe learning environments, strong administrators and more in each Kentucky community, providing it takes abundant dedicated resources. We are all better off when we make it happen.

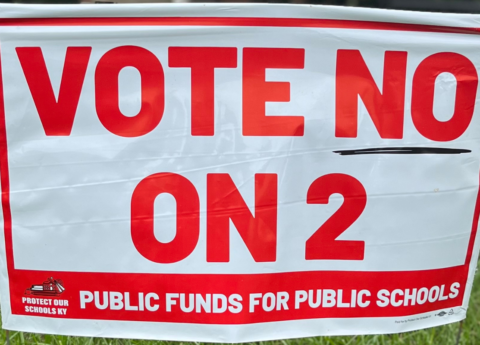

The constitutionally mandated means for providing that education – and the best way to ensure equity in learning as demonstrated by research – is through a healthy public school system that we all support with taxes. In fact, so strong is Kentucky’s commitment to public education that our constitution specifically prohibits spending public resources on private schools without a vote of the citizenry. This does not mean there is no place for private education in Kentucky, but it should be funded privately.

Despite these values and commitments, state lawmakers have been eroding funding for public schools for over a decade through budget cuts, and in 2021 passed House Bill 563 (HB 563) to take millions out of the General Fund to fund private education. The funding mechanism, a new tax break, was meant to get around the constitutional prohibition of public funding for private schools. After passage, HB 563 was immediately challenged in court, and in October of 2021, the Franklin Circuit Court found it unconstitutional.

Now, HB 563 is before the Kentucky Supreme Court, and we at the Kentucky Center for Economic Policy filed a friend of the court brief explaining the program’s unconstitutionality. All tax breaks compromise our ability to provide a good public education, but HB 563 goes much farther. The attempt to hide this appropriation in the tax code fails to pass constitutional muster for two main, interrelated reasons.

The first is its size, which far outpaces all other tax breaks in the state’s code. HB 563 provides a tax credit for contributions made to private school intermediaries (Account Granting Organizations or AGOs) ranging from 95% to 97% of the amount contributed. Thus, a taxpayer who “contributes” $1,000 will reduce their tax liability by a minimum of $950. And there’s more: because of other state and federal tax benefits also available, “donors” can offset the remaining $50 and even make money off the transaction. In effect, the program creates a profit motive out of the diversion of public resources to private schools.

As a point of comparison, Kentuckians who give to veterans’ organizations, animal shelters and other nonprofit institutions get a tax reduction worth at most just 5% of the amount contributed if they itemize deductions on their taxes. HB 563 is the only tax credit in Kentucky in which virtually the entire cost of the program is covered through the tax system, requiring no real donor commitment or investment. As the trial court noted in its opinion: “The funding for this program is 100% raised from the state levying of an income tax. The funding is completely dependent on the coercive power of the state to collect tax … These taxpayers are not donating their own money to AGOs; they are taking the money they owe the state in income taxes and redirecting it to AGOs.”

The second significant factor that makes HB 563 unconstitutional is its prescriptive design. Typically, tax credits subsidize and provide general support to activities that are chosen by taxpayers. HB 563, on the other hand, is very specific. It adds more than a dozen new statutes establishing a previously non-existent system of governmentally approved organizations (AGOs) that perform a new set of legislatively-defined activities. HB 563 thus creates a new government program that differs from other government programs only in its funding source – a tax expenditure as opposed to an appropriation. But if it walks like a duck and quacks like a duck, then that’s exactly what it is.

The Kentucky constitution requires that public resources be used for public education. The teacher pay cuts, large class sizes, slashed programming, inadequate interventions and spotty classroom supports that have happened in recent years due to insufficient funding will only get worse if this program is allowed to stand.

Pam Thomas, who worked for the Legislative Research Commission as staff for the Appropriations and Revenue Committee for 22 years, is Senior Fellow at the Kentucky Center for Economic Policy (KyPolicy).

This column appeared in the Herald-Leader on June 22, 2022.