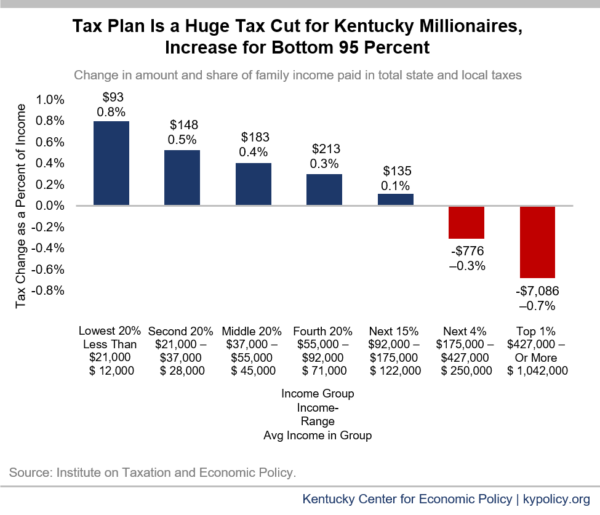

A new analysis from the Institute for Taxation and Economic Policy (ITEP) shows that the General Assembly’s new tax plan, HB 366, is a huge tax cut for the wealthiest Kentuckians and a shift in reliance onto everyone else. As the graph below shows, as a share of their income the richest 1 percent of Kentuckians — who make on average $1,042,000 a year — will will receive an average tax cut of $7,086 while the poorest 95 percent of Kentuckians will receive a tax increase. The biggest tax increase as a share of income will go to Kentuckians making less than $21,000 a year.

“This tax plan doubles down on the deeply flawed Trump-GOP tax law enacted last year,” said Aidan Davis, a Senior Policy Analyst at ITEP. “Average Kentuckians are being asked to pay for a giveaway to wealthy taxpayers, all under the guise of tax reform. A small number of wealthy families and corporations would walk away with significant tax cuts while most Kentuckians would pay higher taxes.”

Another negative consequence of a regressive tax shift is that it reduces revenue growth. Income taxes grow better than sales taxes, including because a disproportionate share of economic growth goes to those at the top who pay a larger share of their income in income taxes as opposed to sales taxes. The plan is not only a huge tax cut for the wealthy and a shift in reliance onto everyone else, but it also means investments in our schools, services for vulnerable populations, infrastructure and more will be undermined over time.

“Sound tax policy requires state lawmakers to ask tough questions about the most sustainable way to raise necessary revenue,” said Pam Thomas, Senior Fellow at the Kentucky Center for Economic Policy. “Instead of looking at what works, Kentucky lawmakers opted for the failed approaches we have seen in Kansas, North Carolina and other states in recent years. In the long-run, state funding for education and other services will be undermined by this effort to move away from taxes on corporations and high-income earners, and toward slower-growing, more regressive cigarette taxes and sales taxes instead. On top of that, this is a tax cut for Kentucky’s richest people paired with a tax increase for the middle class and the poor.”

This analysis was produced by ITEP using their microsimulation tax model. The analysis incorporates personal, corporate, sales and tobacco tax changes under HB 366.

After passing the tax plan, the Kentucky General Assembly sent it to the governor, who has until next Friday to veto the plan. If he does, the General Assembly could override the veto with a majority vote in both chambers when they return for their final legislative days, beginning on April 13.