House Bill 256 would help Kentucky workers as well as the state’s budget by cracking down on the growing problem of misclassification of workers as independent contractors, with a focus on Kentucky’s construction industry.

Misclassification occurs when an employer incorrectly classifies a worker as an independent contractor rather than an employee. While an employee’s work is directed by an employer, independent contractors are legally considered to be in business for themselves and are not supposed to be subject to the full-time direction of an employer. According to the Internal Revenue Service, “the general rule is that an individual is an independent contractor if you, the person for whom the services are performed, have the right to control or direct only the result of the work and not the means and methods of accomplishing the result.” Employers increasingly misclassify their employees as independent contractors in order to reduce labor costs, so that they do not have to pay their unemployment insurance and workers’ compensation premiums (which are higher in construction than other sectors).

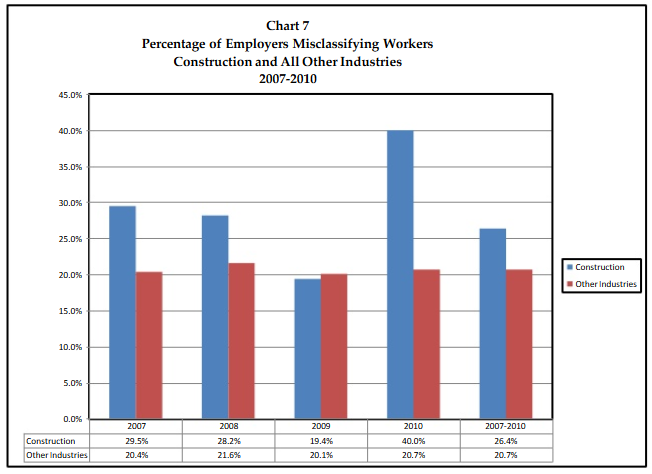

A recent survey of research indicates that 10 to 30 percent of employers—possibly more—misclassify their employees as independent contractors. Some employment sectors are more likely than others to misclassify—for instance, the construction industry has a high rate of misclassification. According to a 2011 study of Kentucky’s unemployment insurance audits for 2007-2010, on average 26.4 percent of construction employers misclassified workers as independent contractors.

Source: Michael Kelsay and James Sturgeon, “The Economic Costs of Employee Misclassification in the Construction Sector in the Commonwealth of Kentucky,” September 14, 2011.

The audit also showed that 41.5 percent of construction firms in Kentucky found to be misclassifying workers had three or more misclassified employees. Twenty-five percent of the firms found to be misclassifying had five or more misclassified workers.

Being misclassified as an independent contractor is harmful to Kentucky’s workers who lose protections designed to help employees—including minimum wage provisions, overtime pay, worker health and safety laws, medical and family leave requirements, workers’ compensation insurance for injuries suffered on the job and unemployment benefits if laid off. Independent contractors also pay more in taxes as they are required to pay both the employee and employer share of Medicare and Social Security taxes—double what regular employees pay.

The misclassification of workers is also harmful to the state. According to the 2011 study of Kentucky’s construction sector the total revenue loss from that industry alone was approximately $11.28 million a year:

- The state lost $6.13 million a year of state income tax revenues from the construction sector due to an estimated 30 percent of the income of misclassified workers in Kentucky not being reported.

- Kentucky’s unemployment insurance system—which has had an exhausted trust fund since 2009 and had to borrow money from the federal government to help make benefit payments—lost an estimated $1.75 million each year in the construction sector from 2007 to 2010 due to unemployment insurance taxes not being levied.

- The state’s worker’s compensation fund lost $3.4 million a year in premiums.

The total amount of state revenue lost from worker misclassification across all industries is potentially much larger. A study of Indiana put the annual income tax revenue loss at $147.5 million, and an Ohio study estimated a range from $21 million to $248 million.

In addition, the misclassification of workers damages the fairness and legitimacy of the bidding process by putting employers who play by the rules at a competitive disadvantage. Those who misclassify employees as independent contractors can reduce their payroll costs by approximately 30 percent.

House Bill 256 would address the problem of the misclassification of workers in the construction industry in Kentucky by:

- Assessing a civil penalty for misclassification of up to $1,000 for the first violation and up to $5,000 for each subsequent determination within a five year period.

- Disqualifying construction firms found to have misclassified workers twice or more within a five year period from being awarded a state contract for two years.

- Establishing a clear, in-depth definition of independent contractor.

- Outlining a process by which a worker can file a complaint about misclassification and a course of action if the employer is found to have misclassified a worker.

- Putting in place protections for workers who file misclassification complaints.

- Requiring construction worksites to post a statement describing the responsibility of independent contractors to pay taxes, the rights of employees to federal and state workplace protections, the penalties for misclassifying workers and information about how to file a complaint or inquire about employment classification status.

House Bill 256’s proposed efforts to decrease misclassification would make life better for Kentucky’s construction workers, level the playing field for employers who treat their workers fairly and generate revenue to help with the state’s many needs.