On Thursday, May 22nd, the House of Representatives passed its major tax and spending legislation, which included last-minute revisions that made it even more favorable for the wealthy. The tax provisions discussed in our analysis of a prior version of the bill remain, but it now includes an additional increase in the deduction for State and Local Taxes (SALT), which will mostly benefit high-income, wealthy households. When combined with record-setting cuts to safety net programs and increased household costs due to tariffs, this bill ensures that those struggling to make ends meet will continue to do so.

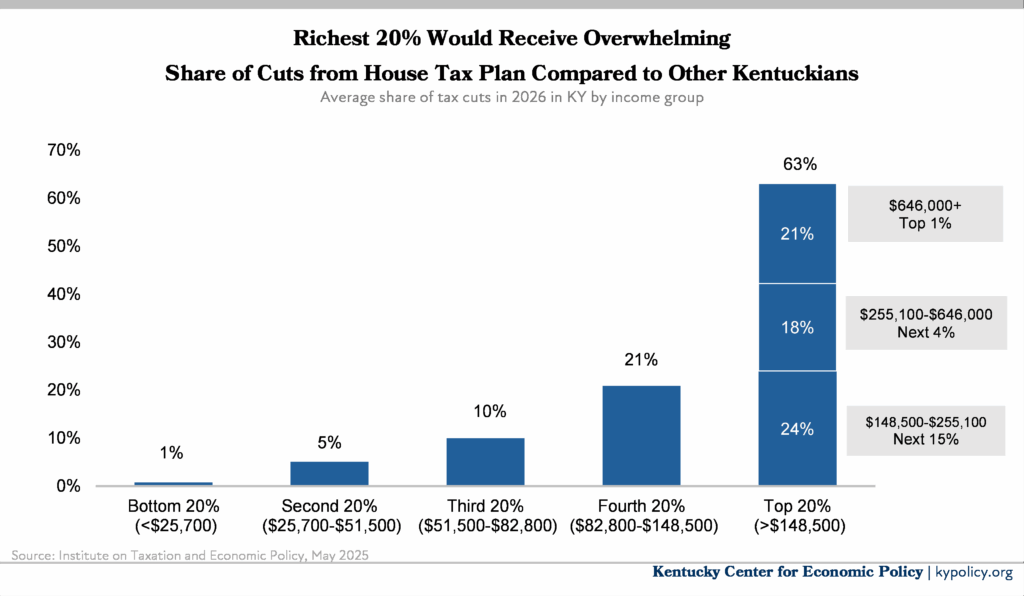

The final version of the House budget significantly widens the gap between the wealthy and everyone else by providing 63% of the benefit from tax cuts to the top 20% of earners, as shown in the graph below.

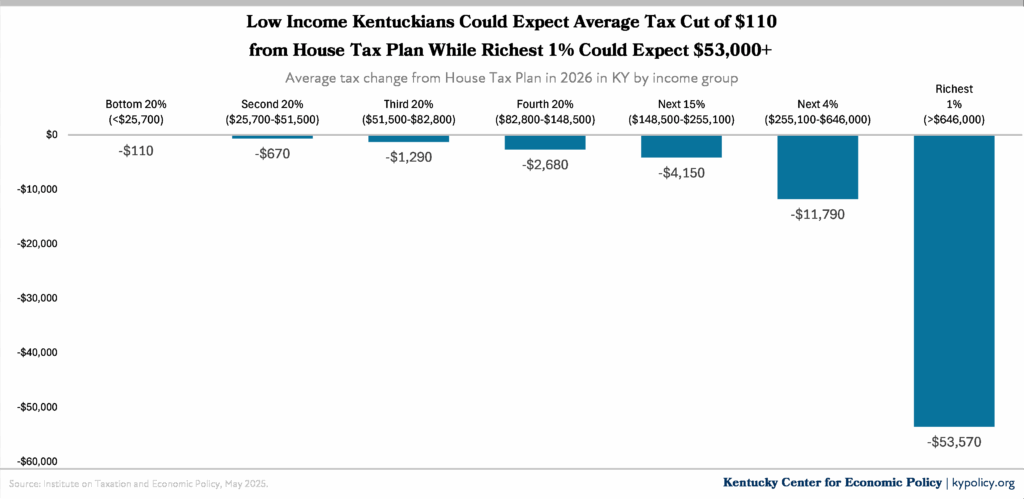

The wealthiest 1% of Kentuckians would receive an average net tax cut of close to $54,000, which equates to around $1,000 per week. That’s compared to just $110, or $2 per week, for the bottom 20%.

For the bottom 40% of households, these modest average savings are likely to be canceled out, or even exceeded, by price increases due to new tariff policies, according to analysis by the Institute on Taxation and Economic Policy. This analysis does not even factor in the widespread harm that will come to Kentucky families as a result of deep cuts to programs like Medicaid and SNAP included in the bill.

Overall, when considered alongside the administration’s new tariffs and cuts to vital programs providing health care and food assistance, this bill is anything but beautiful for all but the wealthiest Kentuckians.