Since declining in 2009 and 2010 because of the recession, Kentucky’s General Fund revenues have grown for four straight years. But the state’s different sources of revenue have grown or declined at much different rates. That variation tells a lot about the kind of lopsided recovery Kentuckians are experiencing, and the kind of tax system we need when income growth is concentrated at the top.

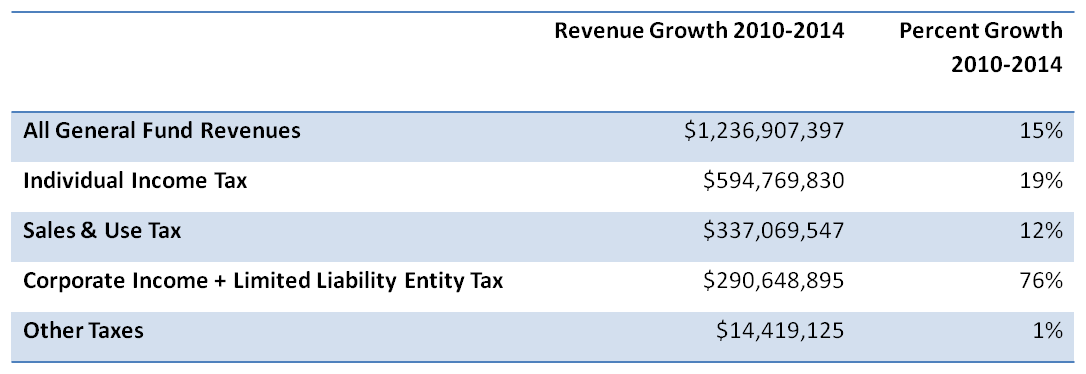

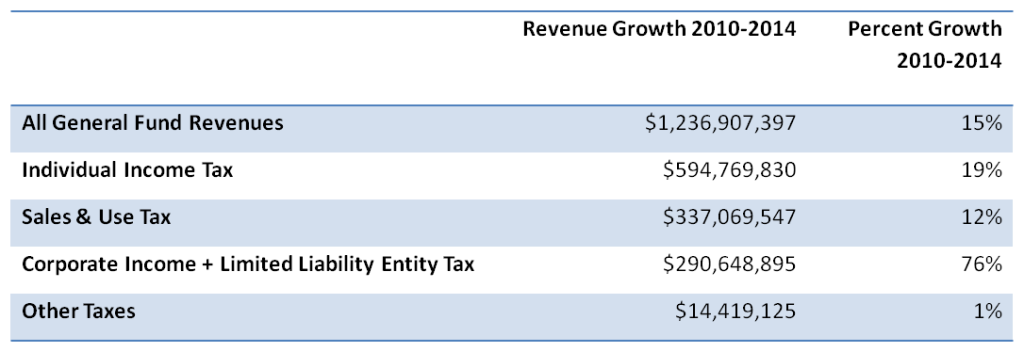

Among the major sources, the individual and corporate income taxes have had the strongest growth rates in the recovery. The individual income tax has been responsible for 48 percent of the new revenue Kentucky generated between 2010 and 2014, or $594 million. It’s grown 19 percent over that time period compared to 15 percent growth for the General Fund as a whole.

Source: KCEP analysis of Office of the State Budget Director data.

Revenue growth from business taxes has also been strong. Receipts from the corporate income tax and limited liability entity tax (an alternative tax for businesses not organized as corporations) have increased 76 percent since 2010, and are responsible for 23 percent of revenue growth. That’s in line with other states around the country, where high corporate profits since the recovery began have meant strong growth in corporate tax revenues.

In contrast, the sales tax—Kentucky’s second-largest revenue source—has been more sluggish. It grew only 12 percent between 2010 and 2014 compared to 15 percent for the General Fund as a whole. There are two main reasons for the weaker performance of the sales tax. As a tax that is paid more by low- and moderate-income people, it’s been impacted by the scarcity of jobs and weak wage growth. Also, since Kentucky taxes very few services even as they are an increasing share of what people and businesses purchase, the sales tax doesn’t keep up with the overall economy.

Like the sales tax, the individual income tax is also harmed by too few jobs and stagnant wages. But it has fared better than the sales tax because a relatively bigger share of the income tax is paid by wealthier people. And those individuals are doing well. The top 1 percent of Kentuckians took in 49 percent of state income growth in the first two years of the recovery, further widening already growing income inequality.

Together, the individual income tax, sales tax and corporate taxes account for 80 percent of Kentucky’s revenues. The state’s remaining revenue sources have been weak, growing only 0.8 percent over the last four years compared to the 15 percent growth for all General Fund revenues mentioned previously.

Especially problematic are the cigarette tax, which has declined 18 percent; the coal severance tax, which has fallen 27 percent, and property taxes on real estate which have grown only 4 percent. The latter two are hit by the decline in the coal industry and the weakness in the housing market, respectively, while the cigarette tax decline is due to decreasing smoking rates. Lottery revenue has also grown more slowly than General Fund revenues as a whole, reflecting the lack of purchasing power of those who buy lottery tickets.

The weak and lopsided recovery—strong income growth for the wealthy and big corporations, continuing economic challenges for everyone else—has played a big role in shaping the revenue story in Kentucky the last few years. Moving forward, the growth we’ve experienced in the corporate income tax may not be sustained. Businesses must at some point in a recovery begin reinvesting in technology and capital improvements, which will mean tighter profit margins and weaker corporate income tax receipts. Indeed, the official forecast for the next two years predicts that corporate income tax and limited liability entity tax revenues will grow only 0.7 percent in 2015 and decline 1.4 percent in 2016.

The bottom line is that Kentucky’s individual and corporate income tax revenues have kept a very difficult budget situation from becoming much worse by generating faster revenue growth to help make up for slower growth elsewhere in the tax system. As income inequality continues to rise, income taxes become even more important to generating the revenue needed for investments in schools and other areas and doing so in a way that is fair.