The conditions have been met for the General Assembly to potentially cut the individual income tax rate from 4% to 3.5% beginning Jan. 1, 2026, the State Budget Director announced during the Appropriations and Revenue Committee meeting on Thursday. But the conditions were met because the General Assembly moved the goalposts on its own formula required to make the cuts and intentionally constrained needed spending for public education and other areas in the last budget despite the ability to appropriate more.

In addition, there were several unique circumstances that resulted in increased General Fund revenues this year that are not expected to continue, according to the state’s own forecast. Following through with more tax cuts in the next legislative session threatens future funding for vital services Kentuckians rely on while primarily giving more money to the wealthy.

The conditions were met to trigger another income tax cut but only because the goalposts were moved

The conditions to reduce the income tax rate were established by the General Assembly in 2022. The formula, which relies on a one-year backward-looking snapshot of the state’s fiscal picture to make permanent tax cuts, includes two parts. The first is that the Budget Reserve Trust Fund (BRTF) balance must be greater than 10% of General Fund receipts during the fiscal year. The second is that revenues must exceed spending by at least the cost of a 1% cut in the income tax, which at current levels is around $1.3 billion. In practical terms, the General Assembly must spend at least $1.3 billion less than it has available in a year they hope to meet the expenditure trigger.

The question then becomes, if spending must be at least $1.3 billion less than the revenues available to hit the trigger, and if the General Assembly is specifically trying to hit the trigger, where does that money that isn’t being spent go? The answer is the BRTF, which has become excessively large.

Kentucky ended the 2024 fiscal year with a revenue surplus of $1.4 billion over the estimates that were used to craft the budget for the 2022-24 biennium. As a result, the balance in the Budget Reserve Trust Fund at the close of the 2024 fiscal year was $5.2 billion – equal to 33.8% of the General Fund monies for that year. That level is far above the 15% recommended by experts to adequately address emergencies, and the 10% required to hit that portion of the trigger. For comparison, the National Association of State Budget Officers last spring estimated the median rainy day fund balance for states in FY 2024 to be 12.3% of General Fund expenditures, putting Kentucky’s balance as the sixth highest as a percentage of General Fund expenditures among all states. As the budget director noted in a recent letter, four of those states with the largest funds are oil-producing states that must have a substantial balance due to the volatility of those industries.

During the 2024 legislative session, the General Assembly seemed to recognize that if it continued to constrain spending to meet that portion of the trigger formula, depositing the over $1 billion it wasn’t spending annually into the BRTF, that the BRTF would continue to grow. But if they spent any money from the BRTF, which by statute is part of the General Fund, it would count against them on the expenditure side of the trigger. They were stuck with a huge and growing pot of money and no way to spend while still hitting the trigger.

Because they did not constrain spending enough, the legislature did not meet the expenditure condition of the formula in fiscal year 2023. Facing the dilemma of a large and growing BRTF and a desire for more tax cuts, the General Assembly chose to move the goalposts by amending the formula to also allow appropriations from the BRTF to not count for purposes of the expenditure trigger. This change, which was effective April 10, 2024, makes the expenditure prong of the formula effectively meaningless. Following this change, all the General Assembly needs to do to spend significant amounts while avoiding the expenditure limitation prong of the formula is to first appropriate the money to the BRTF, and then appropriate it for other purposes from there.

And that’s exactly what they did in 2024. The General Assembly made appropriations from the BRTF of over $3 billion to support over 265 separately identified projects or purposes, some of which are one-time expenditures and others of which are recurring expenditures. The General Assembly also added another $900 million at the close of the 2025 fiscal year to the BRTF, leaving a projected balance of $3.5 billion at the close of the next biennium – an amount equal to 22% of projected General Fund revenues. And after the deposit to the BRTF these monies are available for the General Assembly to expend in the future without impacting their ability to meet the expenditure prong of the formula.

The official letter notifying the General Assembly that conditions had been met to further reduce the income tax rate identifies that the difference between General Fund Appropriations and that amount plus a 1% reduction in the income tax at $151 million. Meanwhile, House Bill 1 and Senate Bill 91 appropriated $504.7 million from the BRTF for fiscal year 2024 that did not count for the trigger calculation. Therefore, absent moving the goalposts on the formula, the conditions to reduce the tax rate would not have been met.

Some have tried to claim that the General Assembly is using these monies from the BRTF for one-time expenditures, so they should not count toward the trigger. But in reality, there are always one-time expenditures in any state budget. Each year there are buildings and infrastructure that need repaired or replaced, and any new capital construction will have to be maintained in the future, which costs money. Also there were some operational expenditures made out of the BRTF that now do not count against the trigger; for example, HB 1 includes $62 million from the BRTF “to the Medicaid Benefits budget unit to support ongoing needs of the Medicaid benefits program,” while SB 91 includes nearly $7 million from the BRTF to support workforce and operations for local health departments.

Revenues are projected to deteriorate during the 2025 fiscal year, increasing the likelihood of a revenue shortfall

A new forecast included in the most recent quarterly report issued by the Office of State Budget director predicts that General Fund receipts will decline by 5.2% over the next three quarters due to significantly reduced individual income tax receipts and a leveling out of sales tax receipts. If revenues follow that path and decline by 5.2% for the entire fiscal year, that would mean a revenue shortfall this year of approximately $788 million below the official projections, forcing action to plug the resulting budget hole. The prospect of a possible shortfall as early as this year is an additional reason for caution about more tax cuts.

A unique anomaly of the 2024 income tax receipts was that $791 million or 13.6% of total receipts in this category were from a passthrough entity tax enacted by the General Assembly in 2023 to mitigate the impact of federal tax changes on such entities. These amounts paid in by the passthrough entities will eventually be paid back out to the partners and members of such entities as a refundable credit. These revenues also obscure the full impact of the income tax rate reductions on revenues that would otherwise be apparent. Over the next three quarters, OSBD estimates that individual income tax receipts will decline by 19.4% or $811 million due to the phasing in of the latest income tax cut from 4.5% to 4%, and a reduction in estimated payments and net returns as partners and members consider the passthrough entity tax credit. And these predictions are already coming to pass, with individual income tax receipts falling by 21% in the month of July.

Strong consumer spending also led to growth in sales tax receipts the last few years that may not be sustained as the economy cools somewhat. Sales tax receipts grew by 4.1% in 2024 following three consecutive years of double-digit growth. OSBD estimates that growth will moderate further over the next three quarters, at 2.7% over the prior year. In the month of July, sales tax receipts were down 0.7% compared to 2023.

One other important factor to note when examining anomalies in 2024 General Fund revenues is the significant increase in interest income due in large part to the size of the BRTF (and increases in interest rates over the last few years). In fiscal year 2022, interest income was just $585,000, but by fiscal year 2024 interest income had grown to over $300 million. That puts this revenue source in par with what the state collects from the lottery and from real estate property taxes. This category will likely continue to be uncharacteristically large so long as the BRTF balance remains high, but it will not continue to be such a robust revenue source if the BRTF must be relied on to plug budget holes caused by income tax reductions.

Income tax cuts overwhelmingly benefit the wealthy

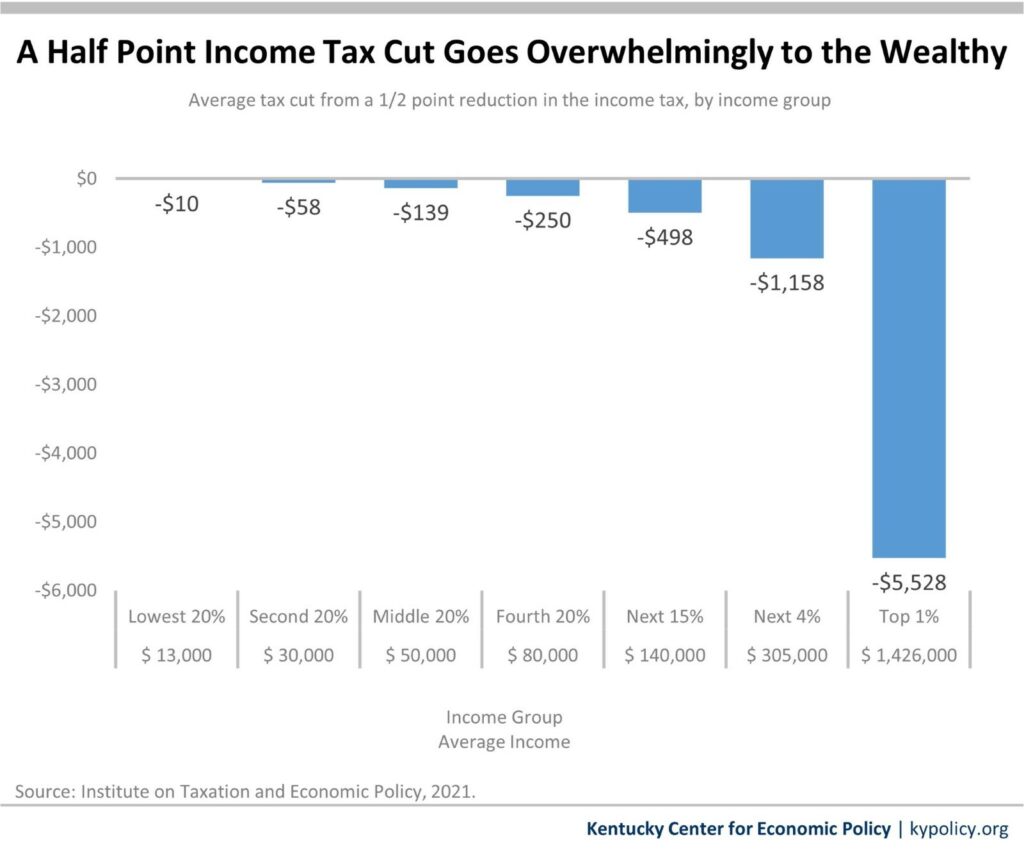

With another possible income tax rate cut coming in 2026 , it is important to recognize that the cuts overwhelmingly benefit the wealthy, as illustrated below. Middle-income families may receive $2-$3 a week from a half point rate reduction, while the top 1% will get over 40 times that amount.

Each half point cut results in the loss of approximately $700 million in revenues and if an additional rate reduction is enacted, the loss from that cut will be on top of the loss of $1.4 billion expected from the 1 point cut already implemented but not fully felt in the state budget until this fiscal year.

Continuing to cut in the face of already declining revenues will result in less money for our underfunded schools, and missed opportunities to build affordable housing, reduce the cost of childcare, and address the many other pressing needs facing Kentuckians. Kentucky, like most other states, has experienced unprecedented revenue growth during the past few years spurred by pandemic stimulus dollars, high inflation, and higher wages leading to increases in sales tax collections and income tax withholding. But those conditions are not permanent. The tax cuts that have already been enacted are just now being fully implemented. Another half point cut in the income tax rate would not be fully implemented until fiscal year 2027, the first year of the next two-year budget. Caution would recommend not continuing down a path that is sure to lead to serious problems.