The state’s basic cash assistance program, the Kentucky Transitional Assistance Program (KTAP), provides critical support for families with young children to meet basic needs like rent, utilities, toiletries and school supplies. Because KTAP payments are very modest, it would be especially beneficial for families to receive them in conjunction with owed child support payments. However, in Kentucky, most child support payments for kids receiving KTAP made by a non-custodial parent are intercepted by the state, a policy known as “cost recovery” that dates to the 1970s. Most of that intercepted money is then sent to Washington D.C. where it fails to benefit any Kentucky child.

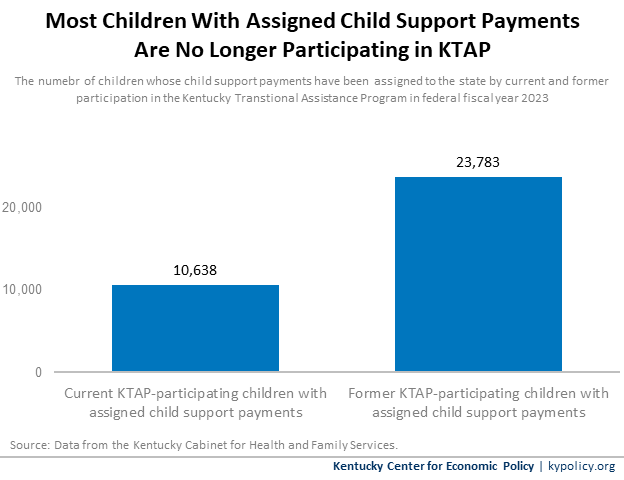

In 2023 alone, more than 34,000 Kentucky kids did not receive all of their child support payments due to this policy. But Kentucky could change that by allowing some or all of these child support payments to flow into the homes of very low-income children, which can have long-lasting positive effects on their lives.

How “cost recovery” works

In Kentucky, when families with children who are owed child support payments complete their KTAP application paperwork, they are required to “assign” those payments to the state, not to exceed the amount of their basic cash assistance. The state receives these child support payments until the value of KTAP benefits are fully reimbursed, or when the total amount of the child support has been turned over to the state if it is less than the KTAP benefits. These payments can continue to be intercepted by the state even after the family is no longer receiving KTAP in some cases.

KTAP is funded by the federal government through the Temporary Assistance for Needy Families (TANF) grant and a smaller, state-funded contribution known as a “maintenance of effort.” The cost recovery policy requires the state to send 72% of non-custodial child support payment money to the federal government to reimburse it for the cost of the KTAP payments (72% is a larger share than most states because of the formula it is based on). In other words, for every $100 check a non-custodial parent writes for their child who is receiving KTAP, $72 of it is sent to the federal government and the Kentucky state government keeps the remaining $28.

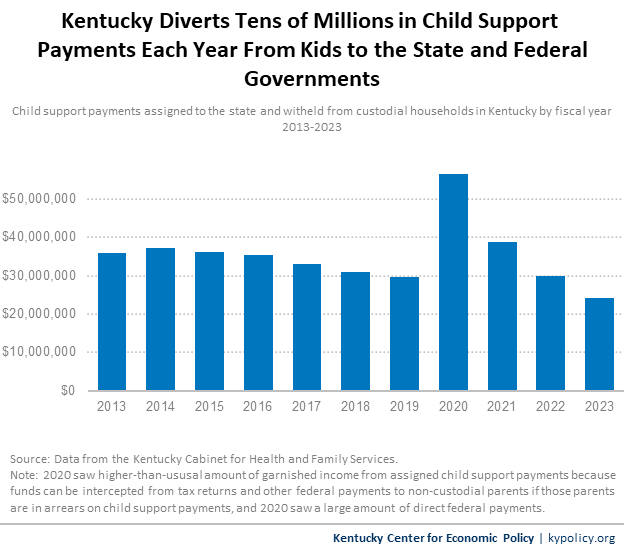

In 2023 alone, a total of $24.3 million in child support payments were withheld from Kentucky kids through the cost recovery policy, which amounted to an average of $1,047 per household. The state’s share of this total was just $4.9 million, which was then added to the state’s Division of Child Support’s budget, with the remaining $19.4 million being sent to the federal government. That year, KTAP-participating children received only $1.6 million in child support payments.

Over the past 10 years, both the number of children and the value of their benefits assigned to the state fell as KTAP caseloads steadily decreased until changes improving benefits were implemented in 2023.

Benefits withheld from children in 2020 were higher than usual because “cost recovery” applies to non-custodial parents who are behind on their child support as well. The state is able to intercept federal payments made to non-custodial parents who are behind on their child support payments, or in arrears. In 2020, when the federal government was sending large amounts of direct aid through stimulus checks, larger tax returns, and boosted unemployment benefits to Kentuckians during the economic downturn, those who were in arrears on their child support payments had some of that money intercepted so the state could pay itself back for the “unreimbursed assistance” paid to their children through KTAP.

Because of this policy, many non-custodial parents who were in arrears on their child support payments ended up making child support payments to the state after their children were no longer receiving KTAP. In 2023, for example, 70% of Kentucky kids whose child support was assigned to the state and withheld from them were not even receiving KTAP any longer but still had “unreimbursed assistance” for which the state was owed.

Similar to the option to pass through some child support payments from non-custodial parents who are not behind on those payments, the state has two options available to determine the order of the “distribution” of payments. Specifically, it can choose to pay the family first for the child support it is owed, or it can pay itself back first for the unreimbursed assistance it is owed. The option that helps children the most is obviously one that distributes funds to them first.

What Kentucky can do instead

States have the option of passing-through some or all of the child support payments to these kids that their non-custodial parent are duly paying, which twenty-eight states and Washington D.C. — four of which border Kentucky — have elected to do. Most recently West Virginia elected to pass through $100 per child and up to $200 in cases with two or more children, and implement a disregard of this income for the purposes of determining TANF eligibility.

Kentucky can join these states in sending more child support to kids and less to the federal government, but only if it changes how it treats those children whose custodial parents need help through KTAP, and whose non-custodial parents are making their child support payments. These are statutory policies and would require legislative action to change. Specifically, Kentucky should opt to:

- Pass $100 of child support payments per child (up to $200 per family) to the kids to whom it is owed,

- Disregard that income for the purposes of determining eligibility for KTAP and benefits calculation,

- Adopt “family first” distribution for child support payments deducted from non-custodial parents’ tax refunds.

The only cost to the state would be the 28% of those funds that were passed-through. While a negligible cost to the state’s ability to operate, this would make an enormous difference to the children it would support. A $100 or $200 pass-through policy would likely still be less than the total child support owed each month – one estimate from 2019 showed the average child support payment in Kentucky is $767 per month. Therefore, it is very likely that the state would still withhold some of the child support payments – and not forgo all of the $4.9 million it is currently receiving as its share of the total withheld – while also sending much less to the federal government.

A combination of KTAP and child support payments is best for Kentucky’s kids

Child support payments are critical to families’ well-being. Households receiving basic cash assistance are generally headed by women with low-incomes, who are disproportionately Black and Hispanic. Ensuring these kids can receive the child support payments they are owed, in addition to a modest amount of basic cash assistance, is critical to alleviating the kind of poverty that has lasting effects on their wellbeing. KTAP benefits in Kentucky average just $200 per month, per person, and have a 60-month lifetime limit, as well as work participation requirements for the parents receiving it.

There is strong evidence that passing child support payments through to KTAP-participating kids does a lot of good for those kids and their families. For example, several studies have shown that allowing the pass-through of child support payments to TANF-participating families increases the likelihood of the establishment of paternity in child support cases, of non-custodial parents making their required child support payments, and of higher payments. Additionally, one study found that allowing even a modest pass-through of child support payments can reduce the likelihood of involvement in the child welfare system by 10%.