Because of recent legislative changes, Kentucky’s tax system is rapidly becoming much more inequitable, according to a new report by the Institute on Taxation and Economic Policy (ITEP). Kentucky has the 17th most regressive tax code among all states, down from 30th, in ITEP’s new analysis. If the goal of some lawmakers to completely eliminate the individual income tax is successful, Kentucky would have the eighth-most regressive tax system in the nation, the report says.

The study shows that far from making Kentucky a low-tax state, changes since 2018 have raised taxes for the poorest 20% of Kentuckians on average while deeply reducing them for the wealthiest residents and jeopardizing future budgets through diminished revenue. Kentucky is actually now a comparatively high tax state for residents who are poor or middle class, the report shows, even while the state is on the path of dramatically reducing taxes for the richest 1%.

Report tells a tale of two states

The report, the seventh edition of ITEP’s “Who Pays: A Distributional Analysis of the Tax Systems in All 50 States,” includes a specific look at the diverging trend in Kentucky as compared to Minnesota, which ranks as having the most equitable tax system among all states (behind only District of Columbia).

As the report notes:

Starting in 2018, Kentucky converted its graduated income tax into a flat tax and repeatedly reduced the tax rate. It also lowered corporate taxes. These sizeable tax cuts have delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides. The net result of this tax swap has been to raise taxes on low-income families while cutting them for upper-income families.

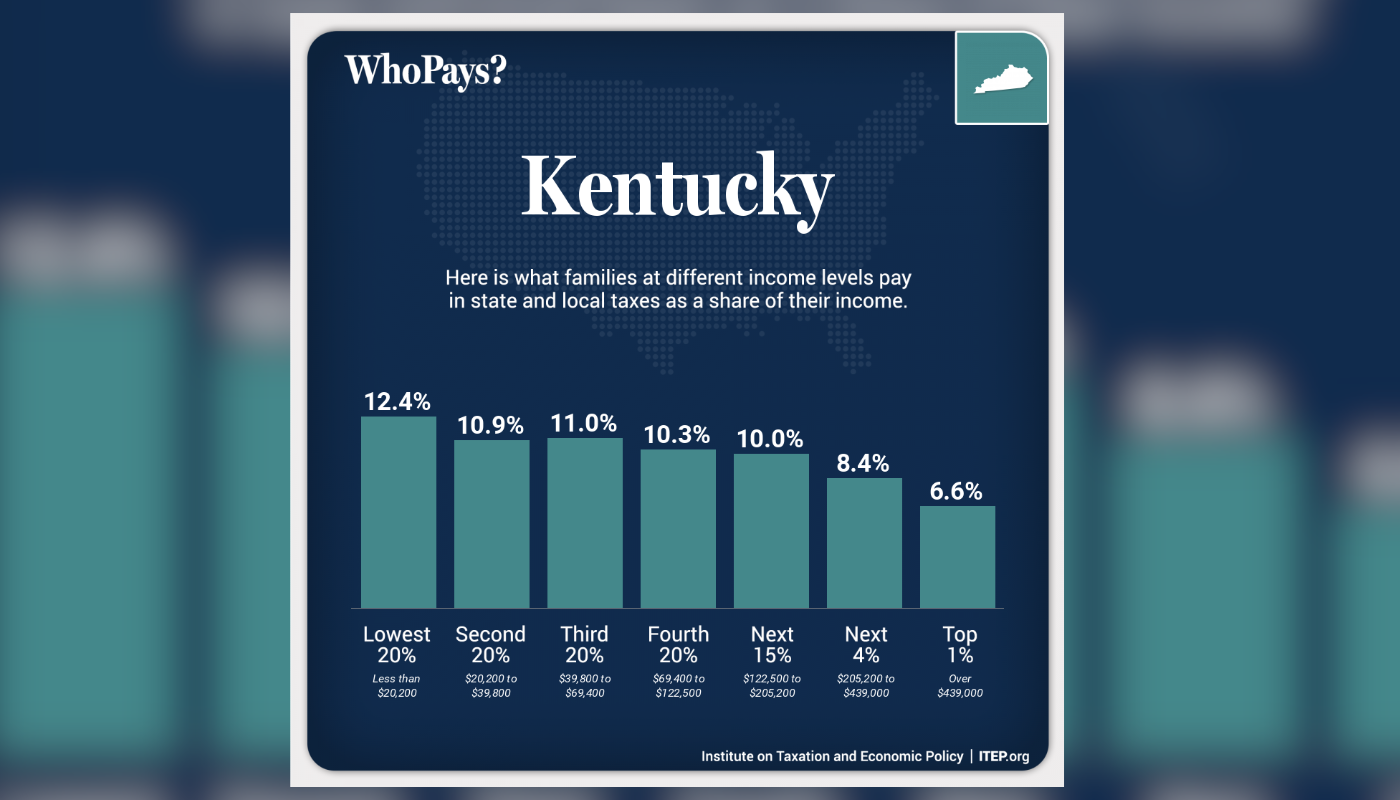

These changes have increased taxes on average for the poorest 20% of Kentuckians, and given the largest breaks to the wealthiest 1% of residents, as shown below.

The report continues:

Minnesota, by contrast, embarked on a sharply different course over this period by enacting tax increases on corporate profits and high-income families, including those with large amounts of investment income. It paired those tax increases with larger tax credits for low-income workers and families with children.

These changes had the exact opposite effect from Kentucky – Minnesota cut taxes for the poorest 40% of Minnesotans on average, and increased them only for those who are better off.

For low- and middle-income residents, taxes are now higher in Kentucky than they are in Minnesota. The report notes, “effective tax rates across the bottom 60 percent of the income distribution in Minnesota range from 6.2 and 10.0 percent, while effective rates for the same groups in Kentucky vary from 10.9 to 12.4 percent of income.” Kentucky has become a comparatively high tax state for the majority of workers, even while Minnesota better funds public services like education, health care and infrastructure through greater revenues generated by higher taxes on the wealthy and corporations.

The richest 1% win big from eliminating Kentucky’s income tax

Kentucky already had a regressive tax system before the recent tax changes that started in 2018, with lower-income people paying more of their income in state and local taxes than the wealthy. But the problem is getting much worse, and the richest 1% will continue to be the big winners if continued income tax reductions go into effect under the state’s tax cut formula.

As shown below, the poorest 20% of Kentuckians pay 12.4% of their income in state and local taxes under current law, while the richest 1% of residents pay only 6.6% (down from 8% in 2017). If the legislature reaches the goal now in law of completely eliminating the individual income tax, the poorest 20% of Kentuckians will only see their taxes fall by 0.1% of income on average, while the richest 1% of Kentuckians will see their taxes fall by another 3.1% of their income. Thus, the wealthiest 1% will see 30 times the benefit compared to the poorest 20%, even though their incomes are already 77 times higher on average.

Of course, eliminating the income tax will also force a massive budget crisis, since before recent cuts began that tax paid for 41% of the state budget. That jeopardizes schools, health care, infrastructure and community services most Kentuckians depend upon.

As the report describes, the features making Kentucky’s state and local tax system regressive overall include its reliance on a 6% sales tax; a flat rather than graduated individual income tax rate; the lack of including investment income in local income (occupational) taxes; the lack of refundable income tax credits to offset regressive sales, excise and property taxes; the lack of a graduated rate on higher value real estate sales in its real estate transfer tax; and the itemized deductions it still allows on individual income taxes. Progressive measures Kentucky does have in place consist of excluding groceries from the sales tax base; requiring combined reporting for the corporate income tax; including some profits booked in tax havens; and levying an inheritance tax.

See the full report here: https://itep.org/whopays-7th-edition/.