Congress is considering huge cuts to vital federal programs like Medicaid and the Supplemental Nutrition Assistance Program (SNAP) in part to make room for more tax cuts for the wealthy. There are growing concerns that the scale of cuts under consideration will not only hurt Americans’ health, well-being and economic security, but blow a major hole in state budgets that could also harm funding for education, infrastructure, human services and other vital investments as well.

Kentucky is already facing growing fiscal challenges due to revenue losses from reductions in the state income tax. Passing the buck from Washington to Frankfort for Medicaid and SNAP would make that problem much worse while taking life-saving food and healthcare from children, seniors, veterans and working Kentuckians.

Federal cuts to Medicaid could cost Kentucky over $1 billion per year

The largest single cut the House of Representatives has identified is $880 million over 10 years to programs overseen by the Energy and Commerce Committee, chaired by Kentucky Representative Brett Guthrie. It would not be possible to make such deep cuts to the committee’s budget without severely harming the Medicaid program.

There are a variety of methods Congress is considering to make those cuts, and all would be very costly. Two possible methods involve shifting costs to the states by reducing federal spending on Medicaid expansion under the Affordable Care Act (ACA) and putting in place what is known as a “per-capita cap.”

The first of these possible methods involves changing the way the state and federal government share the cost of Medicaid. There are two different percentages the federal government uses when paying for Medicaid, which is often called the FMAP:

- The first is a variable rate based on how prosperous each state is, and it changes every year. This rate applies to the people covered by Medicaid under pre-2014 “traditional” categories of eligibility such as being pregnant, having a disability, or being an indigent senior in need of long-term-care. The federal government covers around 72% of costs for this population in Kentucky.

- The second is the post-2014 “expansion” category for eligibility created by the ACA, which includes any adult with earnings up to 138% of the federal poverty level, or a little over $20,000 a year for an individual. The federal government pays 90% of costs for this group.

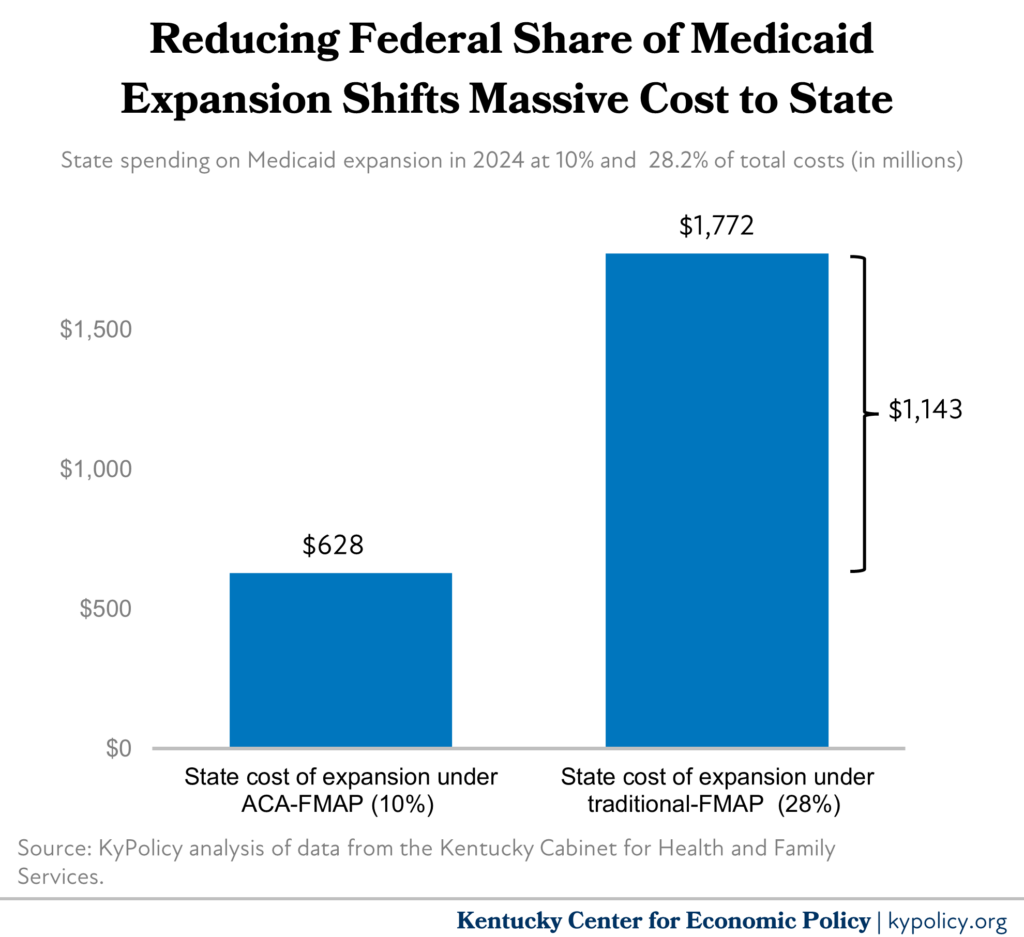

The current proposal affecting the FMAP would reduce the federal government’s 90% contribution of the expansion population to the traditional Medicaid share of 72%. If this policy were in effect in 2024, Kentucky would have needed to spend $1.1 billion more on Medicaid to achieve the same level of coverage.

The other method of shifting costs to states would be to implement a “per-capita cap.” This policy would set a limit on what the federal government would spend on a per-person basis, and only adjust that spending each year by the regular inflation rate, rather than inflation for medical costs which tends to rise more rapidly.

As medical costs continued to outpace inflation, states would be responsible for paying the difference. While estimating the increase in medical costs is difficult, one estimate puts the increase in Kentucky’s spending on Medicaid at anywhere between $14 and $22 billion over 10 years – or a 29%-48% jump in state spending. This increase would apply to all Medicaid enrollees, not just expansion enrollees, and so would put particular fiscal pressure on older, sicker and more disabled Kentuckians who have more healthcare expenses to cover, and whose cost of care rises faster.

One additional change proposed in Congress that could impact the state budget is a limit in the use of provider taxes. Currently, Kentucky taxes various health care providers (most notably hospitals) to help contribute toward the state’s share of Medicaid spending. If Congress were to limit the use of those taxes, the state would need to make up the difference. The fiscal impact of this change would depend greatly on how and to what extent those limitations were designed. According to one analysis, eliminating provider taxes would shift $939.9 million in cost from restricted agency funs to the state General Fund in 2026.

State Medicaid costs grow dramatically when the economy falls into a recession and people lose their jobs, which happens at the same time state tax revenues fall. Each of the above scenarios would therefore put Kentucky in an even deeper bind during hard economic periods due to the increased and swelling financial responsibility, making recessions deeper and longer and increasing hardship on more people.

SNAP cuts could create fiscal hole of hundreds of millions annually

The resolution that outlines the cuts that are supposed to be made also requires the Agriculture Committee, which has oversight of SNAP food assistance, to cut $230 billion. While SNAP may not bear the entirety of that cut, it is the largest program under the committee’s jurisdiction. Reports indicate several methods under consideration to cut SNAP, including a significant cost shift to states. A recent version of this cost shift would require a phased-in shift in funding responsibility that would reach 22.5% by 2034 – which would leave Kentucky with an additional bill of $290 million.

Currently, states partially pay for the cost of administering SNAP, but the cost of the benefits have been entirely federally funded for nearly 50 years, meaning Kentucky would need to find $290 million in offsets elsewhere in the state budget or else raise $290 million in new revenue. Kentucky would find it very difficult to locate or raise enough money to fill that hole, increasing the chance that state appropriators would need to take away some of the food assistance that over 580,000 Kentuckians receive and the over $1.3 million in revenue SNAP brings to Kentucky retailers and farmers. As with the Medicaid cut, the hole will get bigger when recessions hit and more people qualify for SNAP even as state tax revenues fall.

Budget hole will also strain funding for education and other vital needs

The state legislature has been cutting the income tax in Kentucky since 2018, resulting in over $2 billion less in revenue per year starting in 2027 once the latest income tax cut is fully in effect. While the state budget has been able to sustain this loss of revenue due to a large Budget Reserve Trust Fund (BRTF) built up during a period of large federal fiscal relief and high inflation, forecasts suggest those surpluses will not continue, and state appropriators will need the BRTF to avoid budget cuts. This leaves virtually no room to absorb such large cost shifts for vital programs to the state budget.

In the event of an increase in costs well in excess of $1 billion per year, the state would have three main options: cut programs like Medicaid and SNAP needing additional state funding, cut spending elsewhere in the state budget, or raise new revenue. In any scenario under these options, other large appropriations in the budget would be at risk – particularly K-12 education and higher education, which collectively represent just under 50% of all state spending. Funding shifts from the federal to state government of the magnitude being considered would put extreme fiscal pressures on all state investments that haven’t been encountered since the Great Recession 17 years ago, which resulted in program cuts from which Kentucky has yet to recover.