The Affordable Care Act (ACA) provides Kentuckians with a greater opportunity to gain health coverage. One way it does this is by offering financial help with purchasing insurance through the marketplaces that the law forms. In 2017, 81,155 Kentuckians purchased plans through Healthcare.gov, and nearly 4 out of 5 of them received financial help to buy those plans.

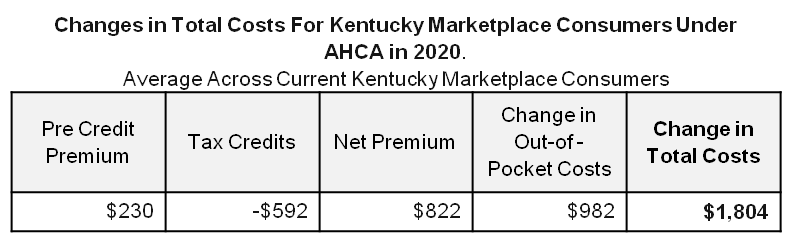

But the American Health Care Act (AHCA), designed to repeal and replace the 2010 healthcare reforms, would drive up the cost for people buying insurance through the marketplace by reducing tax credits for many people and raising out of pocket costs. Total costs would rise an average of $1,804 in Kentucky, according to an analysis by the Center on Budget and Policy Priorities.

AHCA cuts assistance that makes coverage affordable

The ACA reduced healthcare costs for Kentuckians buying through the marketplace in three ways: by subsidizing premium costs, giving financial help for out-of-pocket costs to low-income consumers and requiring insurers to cover a large share of healthcare expenses. All three of these mechanisms are in jeopardy with the AHCA.

- Assistance for paying premiums would be reduced for older and low-income people.

According to Healthcare.gov, the plans people chose in Kentucky in 2017 had premiums that averaged $406 per month before taking into account the tax credits that the law created. But 78 percent of Kentuckians who purchased insurance from the marketplace received tax credits, which lowered monthly premiums to $144 per month.

Older and low-income Kentuckians stand to lose the most from the restructured financial assistance in the AHCA. Whereas the ACA provided an income-based tax credit that adjusts with the cost of premiums, the AHCA provides a flat credit that only adjusts somewhat with age. For a variety of reasons explained here, the credits would be less generous for older people, and the AHCA does less to help lower-income people because it ignores people’s income level or ability to afford insurance.

That is a big problem in Kentucky because according to recent enrollment data, nearly a third of enrollees in Kentucky are between the ages of 55 and 64, and more than half are over the age of 45. In addition, just over 60 percent earn at or below 250 percent of the federal poverty level ($30,150 for an individual) and 40 percent below 200 percent of the federal poverty level. ($24,120 for an individual).

- Help covering out-of-pocket costs would be repealed.

Just over half of all marketplace enrollees receive additional help paying for out-of-pocket costs like deductibles, co-insurance, and co-pays called Cost Sharing Reductions. This financial assistance is specifically targeted for enrollees with a household income at or below 250 percent of the federal poverty level. These Cost Sharing Reductions would be repealed under the AHCA.

- Requiring insurers to cover a high portion of medical costs would be repealed.

At the same time as assistance for premium payments and out-of-pocket costs would be scaled back, the AHCA also cuts the percent of medical costs an insurer would have to cover. Currently a “silver” plan on the marketplace has to cover at least 70% of medical costs. According to the Congressional Budget Office, under the AHCA insurers would likely cover 65% of medical costs. This means that the plans that insurance companies offer would likely have higher deductibles, co-insurance and co-payments.

In addition to these changes, for a variety of reasons premiums would be approximately 4 percent higher under the AHCA for people of similar age.

Cost estimates show big increases in total healthcare costs

In total, the Center on Budget and Policy Priorities (CBPP) estimates that in 2020 (the first year of implementation), the combination of slightly higher premiums, a less generous tax credit for many and higher out of pocket costs mean the AHCA will raise healthcare costs for individuals in Kentucky by an average of $1,804 a year.

Source: Center on Budget and Policy Priorities

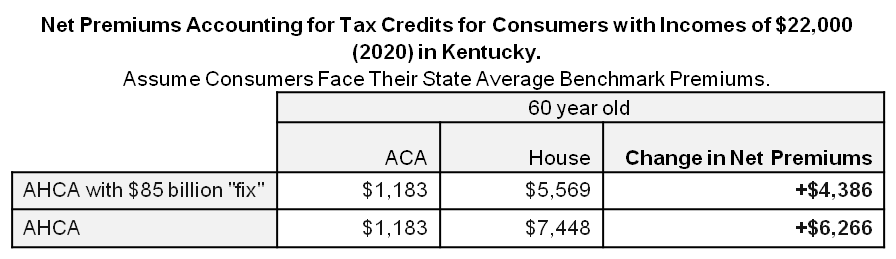

The increase in costs is even bigger for older Kentuckians. While the average increase in net premiums (premiums after tax credits) is $822 for the state as a whole (see above), it is $6,266 for 60 year olds, as shown in the table below. These costs are not reduced much if the final bill includes the rumored $85 billion “fix” the House is considering to help offset costs for older Americans. In Kentucky, the net premium increase for a 60 year old would still be $4,386.

Source: Center on Budget and Policy Priorities

Lawmakers in Washington have consistently promised more affordable insurance, but the current proposal moves us backward and leaves people purchasing insurance on the marketplace in a lurch. Reducing help paying for premiums and out-of-pocket costs while simultaneously reducing what insurers would pay toward medical costs all add up to unaffordable insurance for many Kentuckians.