As introduced, the House budget (HB 500) severely cuts or freezes many parts of the state budget and underfunds essential public services, with the apparent goal of triggering more income tax cuts under the legislature’s formula. The filing of the budget is only the first step in the process. It will now move to committee where the Appropriations and Revenue Chair has indicated there will be opportunities for input before it passes the chamber.

But as filed, the budget shorts funding for school transportation by $129 million a year and freezes the SEEK base and other parts of K-12 school funding, continuing a 20-year pattern of allowing school funding to fall further behind the cost of living. It cuts higher education institutions by $339 million over the biennium compared to the last budget’s appropriations, or a remarkable 15%. The plan also leaves an unexplained shortfall of over $800 million in Medicaid funding over the two-year period, does not explain how new costs from the federal government’s H. R. 1 for SNAP and other public benefits will be covered and cuts state and school employee health care in a way that will cost a massive cost shift to employees.

Plan cuts funding for school buses, freezes SEEK base funding and provides no educator raise or preschool increase

The House proposal freezes the SEEK base per-pupil guarantee at its 2026 level of $4,586 per-student for both 2027 and 2028. SEEK transportation costs are cut by $40 million from their 2026 levels for both 2027 and 2028 in this budget. That means school buses are funded at only 74% of what is required by law, a shortfall of $129 million per year based on the most recent data available. The Tier 1 level funding under SEEK is matched at the slightly higher 17.5% level used in the last budget.

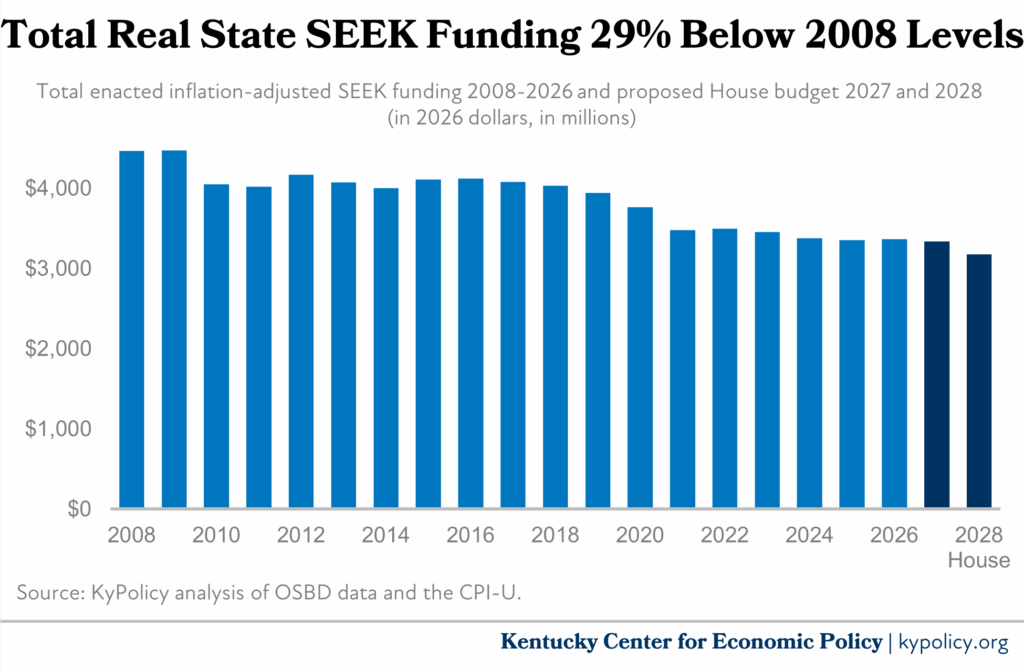

Already, total SEEK funding was 25% below 2008 levels after adjusting for inflation. The House budget will bring that number down to 29% by 2028.

No additional funds are provided for teacher and school employee raises, and the budget does not allow teachers to keep 3.75% of their salary that had been going to pay down a liability in their medical insurance plan. The governor had proposed returning the funds to teachers as the liability is paid off, as had been the original agreement back in 2010.

The budget does not increase funding for preschool, which remains at its 2019 level through 2028. The same is true for extended school services (afterschool programs). Family Resource and Youth Service Centers are cut by $3 million in 2027 and $5.2 million in 2028 compared to 2026 levels. There is still no dedicated money for textbooks and teacher professional development.

Budget includes deep cuts to higher education institutions, less in financial aid

The total funding for postsecondary education is cut by 15% over the biennium compared to last budget’s enacted appropriations. Base funding for higher education institutions is cut even more than that, while the plan includes $115 million in the performance-based funding that requires postsecondary institutions to compete for resources. In total, funding for postsecondary institutions will be 43% below 2008 levels by 2028 once inflation is taken into account.

Although the House budget appropriates lottery-funded student financial aid according to statute, it provides slightly less than in the governor’s plan. Because there will not be enough money to meet all the demand, the governor stated that his proposal is expected to result in first-come, first served funding or cuts in grant levels for need-based financial aid.

Medicaid underfunded by $848 million compared to governor’s budget

The House’s Medicaid budget contains $183 million less for Medicaid in 2027 and $629 million less in 2028 than the governor had recommended. Medicaid benefit costs seem to have been calculated using different assumptions than the executive branch used in its forecast, but those differences are not explained. The budget does not include the $8.1 million in 2027 and $1.5 million in 2028 included in the governor’s budget for technology changes needed to implement new work reporting requirements mandated by H. R. 1. It also does not include new slots in Medicaid waiver programs for people with special care needs, whereas the governor’s plan included 1,250 new slots.

The House cuts the budget for the Department of Community Based Services by $55 million in 2027 and $91 million in 2028 compared to what the governor proposed. The governor’s plan includes an additional $43.5 million in 2027 and $58 million in 2028 to cover the increased administrative costs of the SNAP food assistance program required by H. R. 1, and the House does not include language specifying whether that new expense is being covered. The governor’s plan had also included language allowing the state to draw down monies from the Budget Reserve Trust Fund (BRTF) if it must pay additional program costs for SNAP in 2028 (which could be as much as $180 million), but the House budget does not include that language.

The House budget makes no mention of over $40 million a year that was included in the last budget to help maintain reimbursement rates for childcare centers and keep them in operation. The budget also does not mention funding for Relative and Fictive Care foster care costs, replacing funds that have been diverted from the Temporary Assistance to Needy Families program this year to address a shortfall in out-of-home care services for youth, or funding for senior meals.

Funding is essentially flatlined for the Department of Public Advocacy, which had requested additional funds to deal with turnover and caseloads.

Budget makes huge cut to state and school employee health care, no cost of living adjustment or payment for retirees

The House budget caps the growth of employer contributions to state and school employee health care at 5% per year, creating a shortfall in the program of $77 million in 2027 and $202 million in 2028. The Personnel Cabinet reports that “will have a devastating impact on all Kentucky Employee Health Plan (KEHP) members and their dependents, resulting in a possible 78% increase in employee premiums over two years.” In a letter, the Cabinet estimates, for example, that a school bus driver will lose $535.18 a month in health coverage while a social worker loses $425.92.

The budget provides for a 2% raise for state employees in 2027 and another 2% in 2028. The budget releases $27 million of $67 million that had been appropriated several years ago by the General Assembly to address pay compression for state employees in recognition of many years without raises, which it earmarks for a “pilot program” for Cabinet for Health and Family Services and Transportation Cabinet employees. The remainder of that appropriation goes into the Budget Reserve Trust Fund.

State retirees do not receive a cost-of-living adjustment or one-time payment to address the erosion of their pension benefits in this proposal.

Plan aims for more income tax cuts, doesn’t touch Budget Reserve Trust Fund

Even while these cuts are made, the House budget leaves unappropriated the $3.7 billion in the BRTF. In contrast, the governor proposed using $500 million in that fund for affordability needs in addition to monies for infrastructure. Based on comments from House leaders, spending from the BRTF may be included in a separate bill not yet introduced. Debt service increases by $406 million compared to the last biennium because of a substantial increase in debt issued for capital projects in the ’22-’24 and ’24-’26 budgets.

The budget also states that the executive branch must make cuts of between 20% and 50% to general functions that made up $344 million in operating expenses in 2025 without specifying what programs or services will be impacted.

The House plan’s overall appropriation levels over the two-year period fall $1.1 billion short of revenues, meaning the budget is designed to potentially trigger more reductions in the individual income tax rate under the legislature’s formula.

Updated February 12, 2026.