House Bill (HB) 775 in the Kentucky General Assembly would move the goalposts yet again on the state’s income tax cut trigger formula. As the costs for these cuts grow, the bill lowers the bar so the legislature can continue reducing the tax even if revenues barely exceed spending in a single year. Random events often result in revenues somewhat above or below what is expected, and for the first time HB 775 would recommend permanent tax cuts because of what could easily be a one-time anomaly. These changes will make recommended tax cuts more frequent and force greater harm to critical public services Kentuckians rely upon.

Bill introduces smaller triggers that are easier to meet

HB 8 in the 2022 legislative session established two requirements that must both be met in a fiscal year to trigger income tax cuts the following year. HB 775 does not change the requirement that mandates an amount equal to at least 10% of revenues is in the Budget Reserve Trust Fund for the year in question. But it lowers the threshold for hitting the second requirement, which currently says revenues must exceed expenditures in that year by an amount equal to at least the revenue from a 1% income tax. If both thresholds are surpassed under current law, the formula recommends a permanent 0.5% cut in the income tax rate.

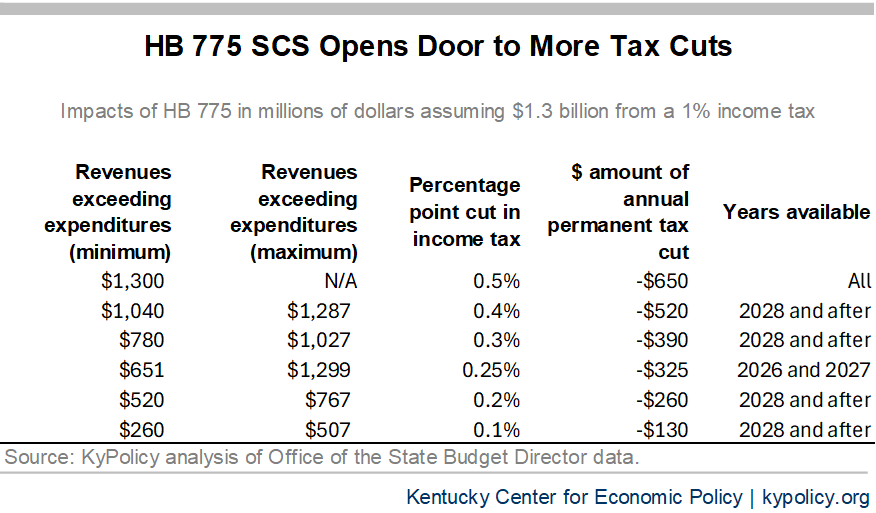

The first lowering of the threshold under HB 775 happens in 2026 and 2027, where the additional option of a 0.25% cut is introduced if revenues exceed spending by a smaller amount. Then in 2028 and after, HB 775 makes possible reductions in the income tax rate of 0.1%, 0.2%, 0.3%, 0.4% or 0.5%.

Let’s look at an example of how HB 775 would work. Assume that a 1% income tax would generate $1.3 billion in 2028, the year the full changes to the formula are implemented. Under current law, if revenues exceed expenditures (as defined under the law) by $1.3 billion, the legislature has “permission” under the trigger to reduce the income tax by 0.5%, which would result in $650 million in permanently lost revenue each year in the future. If revenues exceed expenditures by less than $1.3 billion, the law does not recommend cuts.

Under HB 775, incremental levels are established that allow tax cuts to be triggered if revenues exceed the amount appropriated by the General Assembly by much smaller thresholds. Using the example given above, if revenues exceed spending by between $260 million and $507 million in 2028, the trigger mechanism would recommend permanently cutting the income tax by $130 million per year going forward, or 0.1%. If revenues exceed expenditures by between $520 million and $767 million, the mechanism recommends cutting the income tax by $260 million annually, or 0.2%. Other scenarios are shown in the table below (there is a drafting error so that there are some zones where no tax cut is recommended at all).

HB 775 would recommend more tax cuts at the expense of public services

These thresholds can be surpassed for unsustainable reasons. Because the formula uses only one year of revenue results, it does not take into account anomalies that can make revenues temporarily exceed what is expected. One-time events could include payment of a particularly large past-due tax bill from a wealthy individual or corporation, an unusual spike in a market or industry, a tax avoidance technique that shifts taxes from one year to another, or other causes. Using current data, the formula could recommend tax cuts if revenues exceed spending by only 1.6% in one year.

These tax cuts go overwhelmingly to the wealthiest residents of the state, and no proponent of continuing to cut the individual income tax has identified how the enormous lost revenue from a major state revenue source will be replaced. The full impact of the tax cuts doesn’t appear until two fiscal years after the formula determines them to be “affordable,” pushing the pain forward to future budget cycles. HB 775 will put additional pressure on the General Assembly to pass tax cuts at the expense of investment in education, Medicaid, infrastructure and other services Kentucky needs to thrive.

Updated March 17, 2025 to reflect version that passed both chambers.