To view this as a PDF, click here.

State legislation enacted in recent decades has limited workers’ compensation benefits in Kentucky. As a result, workers’ compensation insurers have benefited, which has translated into both income for the industry and lower premiums for employers. Strong profitability for the industry and rising fund balances suggest significant financial health for many insurers providing workers’ compensation coverage.

Commercial insurers are earning consistent profit

The commercial workers’ compensation insurance industry makes up about three-fourths of Kentucky’s workers’ compensation market 1. The Kentucky Employers Mutual Insurance Authority (KEMI), the quasi-public workers’ compensation insurance provider, has about 31 percent of the commercial market. Private for-profit insurers make up the balance, and no individual for-profit insurer currently has more than 3.71 percent of the commercial market 2.

As workers’ compensation laws have changed in Kentucky, the direct losses paid for injured workers have declined. Losses in the commercial market decreased 22 percent in Kentucky between 2005 and 2010, from $510 million to $400 million. The amount of direct premiums earned also declined by 22 percent over that period as competition forced insurers to share some of the benefits with employers 3.

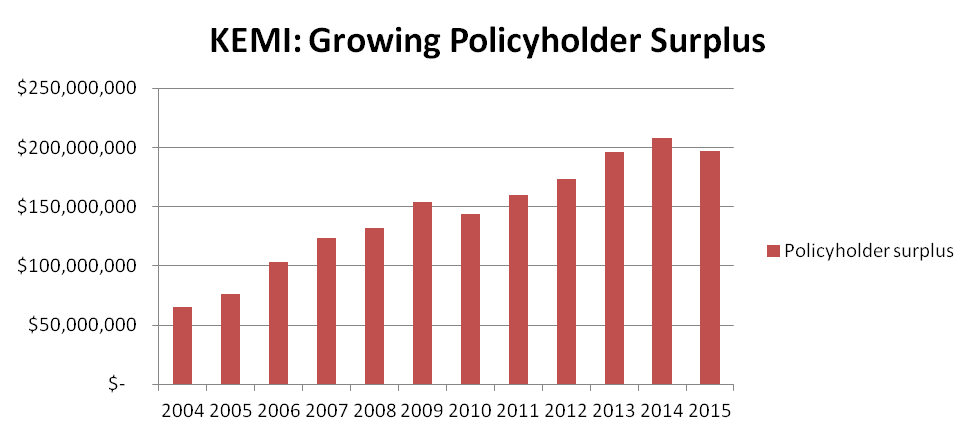

A favorable environment for workers’ compensation insurers in recent years has translated into growing net assets for the biggest insurer, KEMI. KEMI’s net income averaged $11.2 million a year between 2004 and 2015. KEMI in turn built up a policyholder surplus that totaled $196 million in 2015, an amount more than its total underwriting expenses of $171 million that year and an increase in its surplus of 159 percent since 2005 (see Figure 1).

Figure 1

Source: Analysis of KEMI annual audited financial statements

In part because of public pressure in response to its large fund balance, KEMI paid a $30.8 million dividend to policyholders in 2010, and paid additional dividends of $4.7 million in 2012, $6.4 million in 2013 and $3.4 million in 2014. Still, its surplus has continued to rise most years 4.

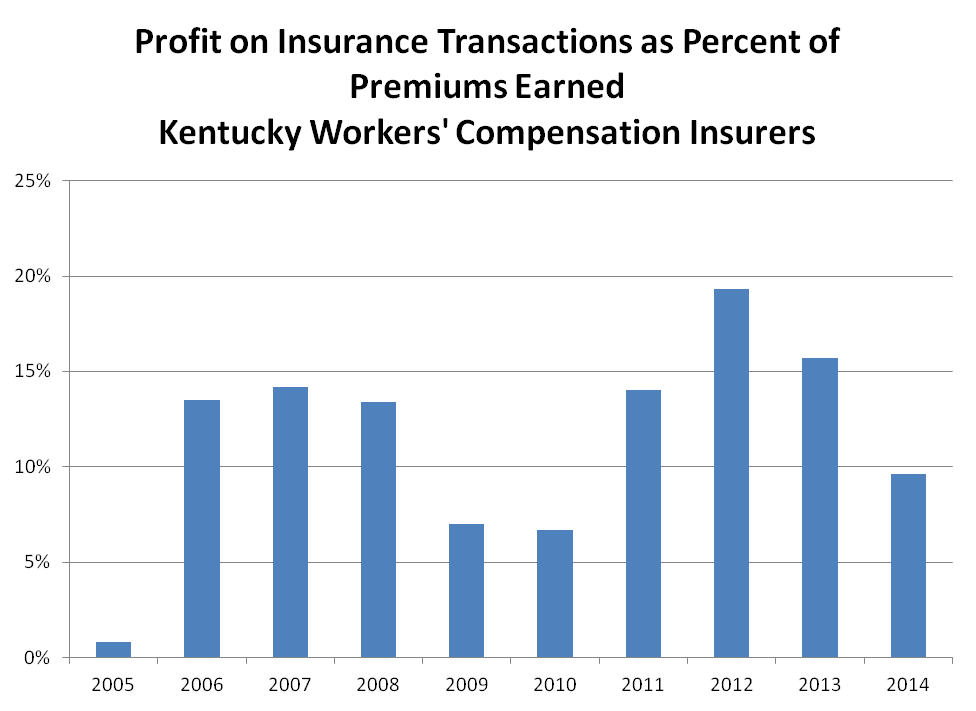

Overall, the commercial market has demonstrated consistent profitability in recent years. The National Association of Insurance Commissioners’ profitability report indicates profits as a percent of premiums earned of between 13 and 14 percent for 2006-2008 and between 6 and 7 percent in 2009 and 2010 (NAIC reports a profitability rate of 0.2 percent for 2010, but that number is artificially reduced because of KEMI’s policyholder dividend, which was equal to 6.5 percent of premiums earned that year. Taking out the policyholder dividend, profits were 6.7 percent of premiums earned in 2010). In 2011, profitability rose to 14 percent and it was 19 percent in 2012, 16 percent in 2013 and 10 percent in 2014 (See Figure 2) 5.

Figure 2

Source: Analysis of National Association of Insurance Commissioners Report on Profitability by Line by State. Graph subtracts the impact of KEMI’s policyholder dividend for 2010.

The growing net assets of the industry as a whole can be seen also in the premiums earned as a percent of net worth. In 2014, premiums were only 26.2 percent of the net worth of Kentucky workers compensation insurers, a lower ratio than all but three other states — indicating that net worth is substantial 6.

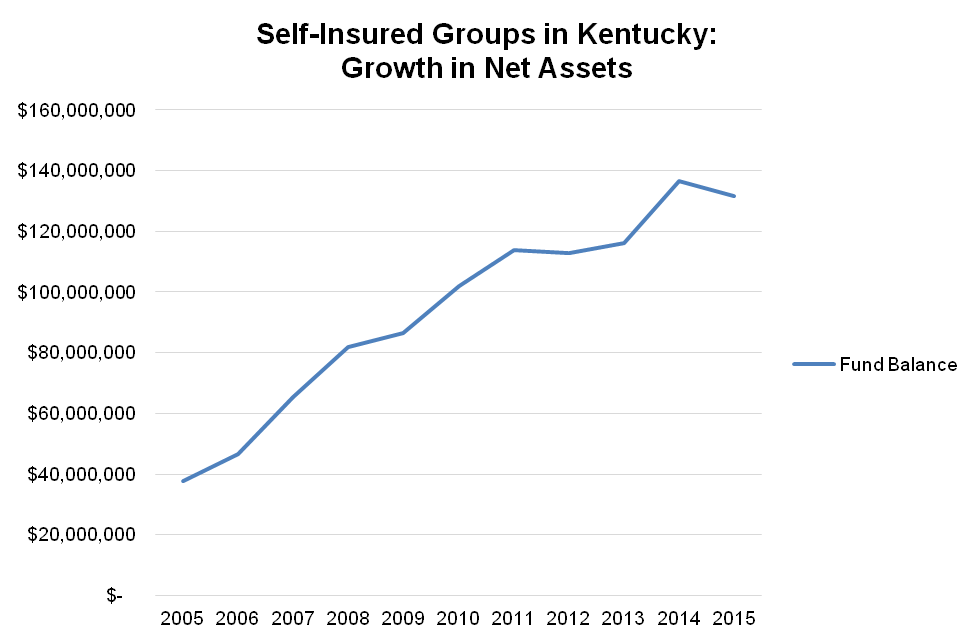

Self-insurance groups also have substantial net assets

The financial condition of the self-insured groups provides another window into industry trends. The six self-insured groups make up one-fourth of the Kentucky workers’ compensation market (excluding individual self-insureds, as above) 7. As with KEMI, the improved workers’ compensation environment for insurers has translated into growth in net assets for these funds. The aggregate fund balance of the six groups has grown from $38 million in 2005 to $132 million in 2015 (see Figure 3) 8.

Figure 3

Source: Analysis of Department of Insurance reports

Conclusion

An improved underwriting environment for the workers’ compensation insurance industry has led to consistent profitability for the industry, reductions in premiums for employers and evidence of the accumulation of net assets for the workers’ compensation insurance industry.

- This estimate does not include workers’ compensation written on a surplus lines basis or through individual self-insureds, amounts for which are not readily available. Department of Insurance, Status Report on Workers’ Compensation Self-Insured Groups, December 15, 2015. ↩

- Market share within the commercial segment is indicated in the National Association of Insurance Commissioners market share report as excerpted in the annual status reports on workers’ compensation self-insured groups. The market shares reported in the most recent report are as follows:

KEMI 30.78% Zurich American 3.71% American Zurich 3.16% Bridgefield Casualty 3.05% LMS 3.00% BrickStreet Mutual 2.61% Praetorian 1.98% Continental 1.72% New Hampshire 1.67% Travelers 1.50% All Others 46.82% . ↩

- National Association of Insurance Commissioners market share report. ↩

- Annual audited financial statements of the Kentucky Employers’ Mutual Insurance Authority, 1995-2015. ↩

- National Association of Insurance Commissioners, “Report on Profitability by Line by State.” ↩

- National Association of Insurance Commissioners, “Report on Profitability by Line by State.” ↩

- The current self-insured groups are KESA, Kentucky Association of Counties, Kentucky Associated General Contractors, Kentucky League of Cities, Kentucky Retail Federation, and Forest Industry of Kentucky. ↩

- Department of Insurance, Status Reports on Workers’ Compensation Self-Insured Groups. ↩