The recently released Senate budget proposal includes $39 million in new spending on child care in 2025 and $50 million in 2026. This amount is more new state spending for child care than the House-proposed version of the budget. That makes it a better starting point for final budget negotiations, but it can be improved further by adding funding for several crucial child care investments that are going away.

Kentucky’s child care sector is approaching a $330 million annual fiscal cliff when pandemic-era federal spending on child care finally expires in September 2024, leaving centers with difficult choices like tuition hikes, layoffs or closure without new state investments. In the 2024-2026 budget the legislature should do more to maintain the improvements made in recent years, or watch the sector continue its pre-pandemic decline at the expense of families, kids and our economy as a whole.

With expiration of federal COVID funds, the Senate and House budgets propose which critical recent child care improvements to continue and which to end

Since 2020, a large influx of federal funds has enabled the state to stabilize the child care sector and implement several significant improvements to child care quality and the state’s Child Care Assistance Program (CCAP). Approximately two-thirds of the final round of funding was designed to send direct stipends known as “stabilization payments” to child care centers, and the remaining third funded many improvements to child care quality and assistance. Prior to this influx of federal funds, the Division of Child Care was only receiving $26 million per year from the state through the General Fund.

What was and wasn’t included in the Senate budget for child care

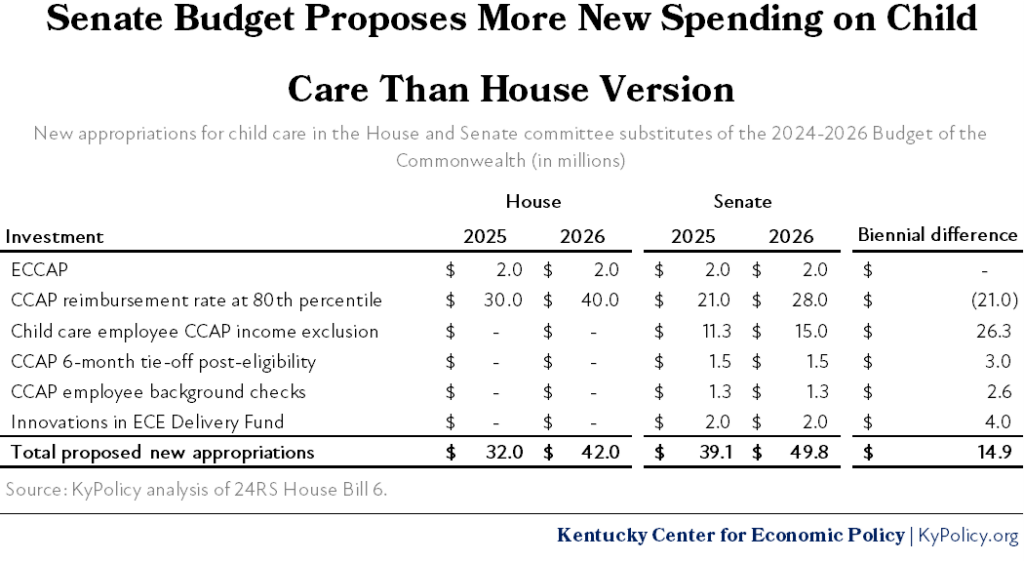

Lawmakers in the House and Senate acknowledged there is a need for more state investment in child care, but there are differences between the two chambers’ budget proposals, and neither adequately replace the coming expiration of federal funds.

The House version of the budget includes $2 million each fiscal year for a state-subsidized employer child care benefit and provides $30 million in 2025 and $40 million in 2026 for CCAP reimbursements to providers at the 80th percentile of market private-pay tuition rates, which is one of the soon-to-expire improvements to CCAP made possible with federal COVID funds.

The Senate budget takes a different course when it comes to new state investments in child care. It proposes to spend $14.9 million more in total than the House to continue recent improvements to child care quality and assistance made with federal dollars, all of which would be lost without state spending:

- $21 million in 2025 and $28 million in 2026 for keeping CCAP reimbursements to providers at the 80th percentile of market rates ($21 million less than the House version).

- $11.3 million in 2025 and $15 million in 2026 to allow child care employees to qualify for CCAP, a nationally-renowned policy that has benefitted 2,100 employees and nearly 3,700 children as of last summer.

- $1.5 million each fiscal year for a six-month tie off that provides half the assistance amount of CCAP for families who are no longer eligible for CCAP due to higher earnings.

- $1.3 million each fiscal year to pay for the mandatory background checks child care providers must perform on prospective employees.

- $2 million each fiscal year to fund an “Innovations in Early Childhood Education Delivery Fund” as envisioned in Senate Bill 203, the “Horizons Act,” and is aimed at expanding the types of services and times of day that child care providers offer.

At least three crucial policies still left unfunded in the Senate version of the budget

The Senate version of the budget includes several badly-needed state investments that the House version did not include, making it a better starting point for final budget negotiations. However, there are a few crucial policies that still require funding to stave off the worst impacts of the federal fiscal cliff. Specifically, those are:

- Keeping the income eligibility limit for CCAP at 85% of State Median Income (SMI). This policy has led to nearly 7,800 children from 5,300 families receiving assistance with child care costs, and reverting back to the previous eligibility threshold of 160% FPL would lead to all of these families losing that assistance.

- Continuing to reimburse providers who care for children in CCAP based on the enrollment of CCAP children, rather than their attendance. Not only is this important to ensure financial stability and predictability for child care providers who must pay for staff and facilities regardless of whether a child on CCAP is present or not, but it is also now required by federal law.

- Providing start-up grants to state-regulated, family-based child care providers. These start-up grants have been very helpful in attempting to reduce the child care deserts in the state. While there are fewer barriers to entry for prospective child care providers in a home-based setting than a traditional center-based setting, start up costs can still be prohibitive. The $5,000 grants have helped overcome those start-up costs for 62 providers as of last summer.

Should the General Assembly fund these three policies in addition to what the Senate proposed, Kentucky would be in a much better position to weather the coming reduction in federal funds starting in September. Neither the Senate nor House version of the budget provides for the largest reduction in those funds, however, which were direct stipends to child care centers, at roughly $200 million per year. Even still, new state investments that include the above policies would be an important start to better supporting Kentucky’s youngest children, their working parents and the commonwealth as a whole.