The final budget agreement spends significant dollars out of the Budget Reserve Trust Fund (BRTF) primarily on infrastructure and very specific local projects. However, it remains largely austere when it comes to meeting other needs, lacking adequate funds for education, child care, housing, state and school employee raises, a retiree cost of living adjustment, and other areas, despite additional ongoing funds being available.

The budget particularly restrains spending in 2025 in an attempt to hit the triggers for an income tax reduction that year, holding down spending by more than $1 billion compared to anticipated revenues. To make that tax cut possible, the budget suspends the tax cut law so that $2.9 billion in spending from the BRTF does not count toward the trigger.

Budget makes possible but not certain a cut to a 3% income tax

Based on the funding levels in the budget passed two years ago, it is likely that the state will hit its income tax trigger for fiscal year 2024. If the legislature approves a cut in the 2025 legislative session that will result in a reduction of the income tax rate from 4% to 3.5% on Jan. 1, 2026. Language in the new budget already anticipates a reduction in revenues of $359 million in 2026 as a result.

Based on the appropriations included in the budget bills and suspension of the law described below, it is possible though not certain that the triggers will be hit in fiscal year 2025. If the triggers are hit and the cut is approved by the legislature, the income tax rate would drop from 3.5% to 3% on Jan. 1, 2027.

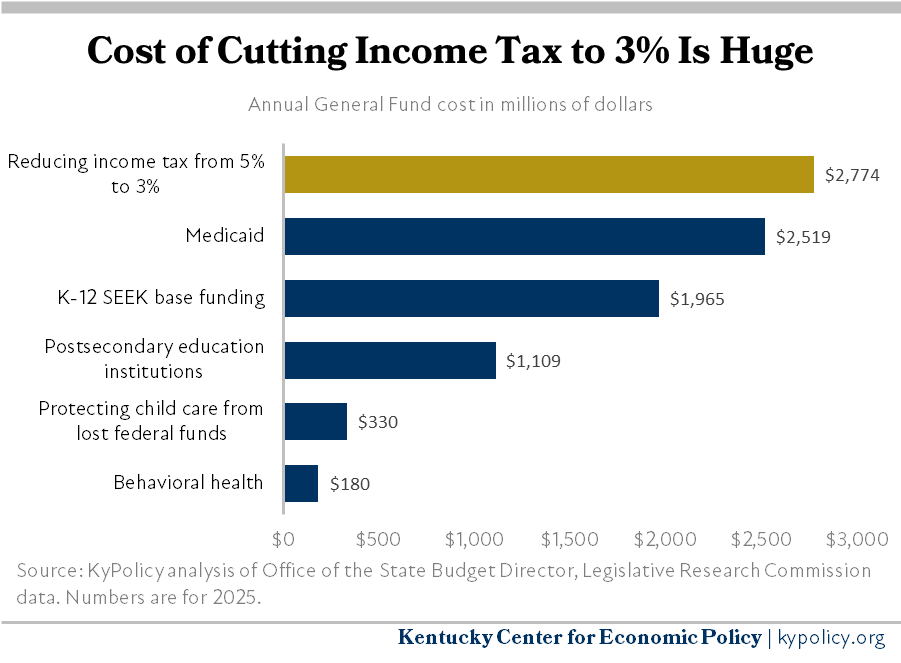

If that happens, nearly one in six total state General Fund dollars will have been eliminated through recent income tax reductions, exceeding the 11% cuts that Kansas made (and then was forced to reverse) in the early 2010s. A cumulative cut in the income tax rate from 5% in 2022 to 3% would cost more General Fund dollars than Kentucky spends on the entire Medicaid program, which provides health insurance for 1.5 million people.

The budget makes triggered tax cuts possible by “notwithstanding” or suspending the trigger law to ignore $2.9 billion in new spending primarily on infrastructure and local projects. The insertion of that word in the budget bill allows this spending to not count toward whether the trigger is met.

Almost all of that spending is contained in House Bill (HB) 1 while SB 91 contains $370 million in additional spending and HB 6 contains $17.9 million for crime victim funding that is also designated not to count toward tax cut triggers. HB 1 in the final agreement also includes $230 million in extra pension contributions, though those already do not count toward income tax triggers (significantly reduced from $950 million of extra pension contributions in prior versions of HB 1).

HB 1 and SB 91 include hundreds of specific local items funded with General Fund dollars from the BRTF. Here’s a partial list of the largest ones:

- Highway construction projects: $750 million

- Kentucky Infrastructure Authority water and sewer projects: $334 million

- GRANT program to provide matching funds: $200 million

- Commonwealth Center for Biomedical Excellence in Covington: $125 million

- Kentucky Employees Retirement Non-hazardous Pension Fund: $100 million

- Economic Development Cabinet mega-projects: $100 million

- Teachers Retirement System: $80 million

- Kentucky Product Development Initiative: $70 million

- Medicaid base funding to replace amount missing in HB 6: $62 million

- RGL Regional Industrial Development Authority for purchase of real property: $62 million

- Murray State University veterinary tech program facility: $60 million

- Various Louisville Metro projects: $50 million

- State Police Retirement System: $50 million

- Economic Development Cabinet loan pool for infrastructure in Hardin and Warren counties: $50 million

- University of Kentucky energy endowment: $40 million

- Home of the Innocents expansion: $30 million

- Commercial airport improvements: $35 million

- Energy development project in Shelby County: $25 million

- Ashland conference center: $25 million

- University of Louisville cancer research: $25 million

- Eastern Kentucky University aviation program: $25 million

- Livestock Innovation Center at University of Kentucky: $22 million

- Kentuckiana Works workforce development: $20 million

- Barren River substance use disorder pilot: $20 million

- Kentucky Horse Park upgrades: $18 million

- Appalachian Regional Healthcare psychiatric residency: $16 million

- Riverport improvements: $15 million

- Life Learning Center treatment/rehabilitation project: $12 million

- Wilkinson Farm Mega Site in Mercer County: $11.5 million

- Frankfort convention center: $11.25 million

- Kentucky Rural Housing Trust Fund: $10 million

Despite monies allocated to these projects, the restrained spending in HB 6 results in a very large ending balance in the BRTF. The balance only falls slightly from $3.7 billion today to $3.5 billion by the end of the biennium. While an amount equal to 15% of an annual budget is considered a strong rainy day fund, Kentucky’s balance would be approximately 22% at the end of 2026.

The final budget also includes $3.3 billion in bonded debt, more than the $3.1 billion in the Senate budget and $2.7 billion in the House budget. That includes $168 million for a Capitol Annex renovation that was not in the previous versions of the budget. Borrowing can be used as a tool to help get around the tax cut triggers rather than using the ample cash available in the BRTF.

Total spending in the budget that counts toward the income tax trigger is approximately $1.3 billion less than projected revenues in 2025. As mentioned previously, that makes triggering a tax cut possible that year but not assured.

SEEK funding doesn’t gain ground with inflation, no dedicated teacher raise, does not fully fund student transportation

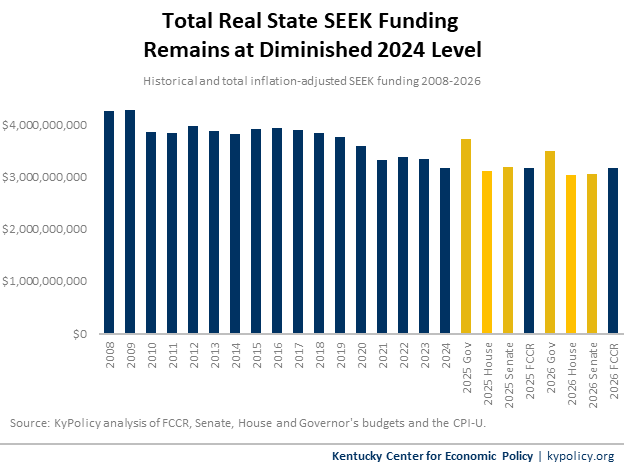

By not including dedicated teacher and school employee raises, and by increasing core K-12 school per-pupil funding (SEEK) by only modest amounts, state SEEK funding is only treading water once inflation is considered. Total state SEEK funding goes up 2.1% in 2025 and 3.2% in 2026 before taking inflation into account. That results in real total state SEEK funding remaining 26% below 2008 levels by the end of 2026, just as it was in 2024, as shown in the graph below.

This flattening happens even though the base per-pupil guarantee increases by 3% in the first year of the budget and 6% in the second year. That’s because the guarantee is a combination of state and local funding. Total state SEEK funding includes an increase in the amount of Tier 1 funding being equalized from 15% of base funding to 17.5%, a change that provides some additional monies to most districts though it provides little or no funds for those with higher property assessments, like Jefferson and Fayette counties.

The final budget increases funding for transportation compared to the prior budget, but still funds school transportation at only 74% of the statutorily required amount in 2025 and 82% in 2026. It was reported that the agreement funds transportation at 90% the first year of the budget and 100% the second, but those percentages are calculated based on 2023 costs rather than 2024. The annual SEEK transportation numbers are released March 1, and the new estimate is $85 million higher than in 2023 due to increased expenses from the bus driver shortage, insurance and other costs. The new funding level continues the practice of the legislature suspending the law mandating 100% funding, which has happened every year since 2005.

The budget does not include additional funds for preschool, which is still funded at its 2019 level ($84.5 million). Extended school services (afterschool programs) are also at the same level as in 2019. The budget includes $31.5 million for school resource officers and related safety expenses in 2025, and $33 million in 2026. It adds $4 million each fiscal year to support the operations of additional Family Resource and Youth Services Centers (FRYSCs), though decreases the amount that could be spent by FRYSCs on administrative expenses.

There are no funds for teacher professional development, which has not been specifically funded since 2018, or for textbooks. The final budget includes funding for a pilot program of teacher student loan forgiveness at the House’s proposed level of $4.8 million in 2025 and $10 million in 2026. It includes $750,000 for an audit of Jefferson County Public Schools, and $5 million for a pilot program of “five Star Academy charter schools within existing public schools throughout the state.”

Budget includes increase for higher education, full funding of need-based college aid

The budget increases base funding for public higher education institutions by 4% the first year (compared to 2024) and 6% the second (compared to 2025) and puts $105 million the first year and $115 million the second in the performance funding pool. In total, even with those increases universities and community colleges will be funded at an amount 31% below 2008 levels once inflation is taken into account.

The budget contains significant bonded capital projects at universities, including an asset preservation pool at each institution. Other large projects include $260 million for a health sciences center at the University of Louisville, $200 million for an agricultural research facility at the University of Kentucky and $160 million for an academic complex at Western Kentucky University. It includes money to design but not build a health sciences center requested by Kentucky State University. As in the last budget, the budget does include full funding of the lottery-supported need-based college scholarship programs.

Plan includes no help for state retirees, modest raises for current employees, significant pension liability contributions

The budget does not include any payment for state retirees to help address the fact they haven’t received a cost-of-living adjustment in their pensions since 2012.

The final budget includes a 3% raise the first year of the budget for state employees and another 3% raise the second year. It does not include funds to address wage compression, a situation in which many long-term employees do not make much more than newer employees due to years without raises. The governor had proposed additional raises of 1% to 7% to deal with that issue. The budget instead mandates another study of the issue (the third such report), this time by an independent consultant, to be completed by December 2024.

On top of the appropriations to unfunded pension liabilities in HB 1 mentioned above, HB 6 includes $500 million in additional funds to the Kentucky Employees Retirement System non-hazardous pension fund, for a total of $730 million on top of the actuarially determined contribution to the state’s retirement systems.

Plan includes too little child care funds, increases slots for Medicaid waiver services

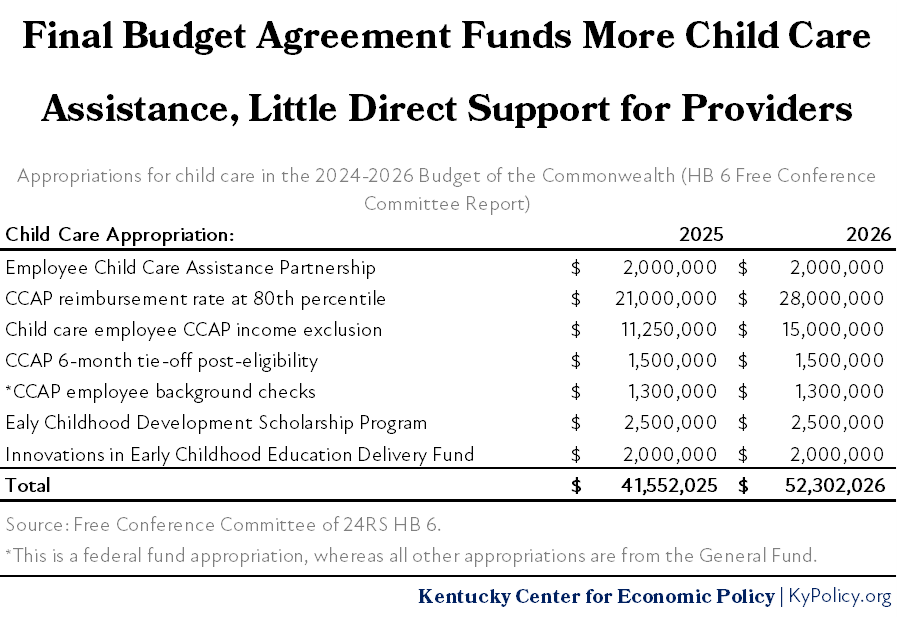

The budget includes $42 million in new spending on child care in 2025 and $50 million in 2026. These monies hold the child care provider reimbursement rate at the 80th percentile of market rate, support a successful program that allows child care workers to take advantage of subsidies, continue a six-month tie-off for parents no longer eligible for Child Care Assistance Program (CCAP), and provide for several other child care improvements. However, the budget does not include funds to maintain the stabilization payments or the higher income eligibility threshold for CCAP that were part of federal pandemic funding.

While all of the policies the budget funds are necessary to support child care providers and the parents they serve, more is needed in light of the coming fiscal cliff, particularly with the loss of quarterly stipends to child care providers previously funded with federal dollars. An estimated $330 million per year would be needed if the state were to fully replace those lost funds, and SB 203 had proposed $150 million annually for this purpose.

HB 6 and HB 1 together fully provide for base Medicaid funding. The budget includes funds to rebase nursing home rates and increase reimbursements for waiver service providers. The budget also includes $25 million in 2026 to provide for rebasing Medicaid rates following a study to be approved by the General Assembly in 2025.

The budget includes funds for 1,925 new Medicaid slots for people with disabilities, significant progress on a waiting list that includes more than 12,000 Kentuckians. The budget also includes an increase in both the foster care and relative caregiver payment rates at amounts similar to what the governor had proposed, and $10 million each year for senior meals to prevent a waiting list. It includes $1.5 million in restricted funds each year for the required administrative match to implement Kentucky’s federally-funded Summer EBT program, which provides food assistance to students in the summer who qualify for free and reduced meals during the school year.

The final budget cut $3 million in each year of the budget for 23 staff positions in the Office of Unemployment Insurance. That cut will make it somewhat harder to handle unemployment claims in an accurate and timely manner, especially when economic downturns hit.

Agreement contains small amount for housing, caps money for disaster relief

The budget includes $10 million for affordable housing in Lexington and $5 million in each fiscal year for the Kentucky Rural Housing Trust Fund. It does not include the $75 million the governor had included for additional disaster relief in eastern Kentucky following the 2022 floods. The budget also caps what can be spent on necessary emergency disaster aid this year at $75 million, and at $50 million each of the next two years, rather than allowing the needed funds to be spent. A separate resolution releases $71 million previously appropriated but held for state parks renovation.

Budget provides significant funds for prosecutors but not public defenders

In the final budget, prosecutors receive additional funding in both years of the biennium. That includes $5 million in each year for additional personnel and $6.2 million over the biennium for salary compensation standardization for Commonwealth’s Attorneys, along with $3.5 million in each year for additional personnel and $17.5 million over the biennium for salary compensation standardization for county attorneys. There are no new appropriations in the budget for comparable increases for public defenders, other than some additional dollars for the Louisville office.

The budget provides $3.8 million in 2025 and $3.9 million in 2026 to the Department for Juvenile Justice for increased alternatives to detention programming. And $6.8 million is provided across the biennium in both proposals for other programs including social service specialists.

The budget also approves bond funding to support retrofitting three existing juvenile detention centers, but does not include two new female facilities or a new high acuity psychiatric detention facility considered earlier in the budget process.

The budget continues the $4 increase in the per-diem amount in the previous biennium for county jails for each person serving a felony sentence (up from $31.34 per day to $35.34 per day).