Good-paying jobs like those in construction are the foundation of a healthy middle class and growing economy, and a skilled construction workforce builds the high-quality physical infrastructure necessary for growth. According to a new research report, Kentucky’s prevailing wage law strengthens this important industry, and its repeal would have negative repercussions for job quality, workforce development and local economies in the Commonwealth.

Repeal Would Reduce Job Quality for Construction Workers

Kentucky’s prevailing wage law requires construction workers on state and local public projects costing more than $250,000 to be compensated, in terms of both pay and benefits, according to local industry standards measured by the state Labor Cabinet or the U.S. Department of Labor. The law therefore puts a floor on how low a contractor can bid labor on schools, highways and other public jobs, and also helps maintain wage standards for the entire industry in Kentucky.

A repeal or significant weakening of Kentucky’s prevailing wage law (for instance, exempting schools) would lower wages and benefits for workers and increase poverty and reliance on public assistance. The study’s authors estimate:

- Construction worker income would drop by 10 percent.

- 6,100 workers would lose employer-provided health insurance.

- 10,300 would lose employer-provided pensions.

- About 5,700 would become newly eligible for food stamps/SNAP and the Earned Income Tax Credit (EITC) for low-income workers.

Because people who have previously served in the military are more likely to work in construction than non-veterans, a repeal would disproportionately impact this group, draining an estimated $80 million in total wages and salaries from veterans in Kentucky.

Work would also become more dangerous for construction workers under a repeal of prevailing wages. That’s because the law creates an incentive for contractors to train workers in formal apprenticeships. More training leads to less accidents, preventing both injuries and fatalities. Research shows states without strong prevailing wage laws have higher injury and fatality rates.

Repeal Would Weaken Workforce, Local Economies

Prevailing wage laws are designed to support a skilled workforce, in part by not encouraging use of the lowest-paid workers. These laws are also designed to improve skills: contractors can pay apprentices less than senior “journeymen” on prevailing wage jobs, which leads to increased use of apprentices – and as a result, significant investment in worker training – in states with strong prevailing wage laws. Research shows a steep decline in training after states repeal prevailing wages (in the range of 38 to 42 percent less apprenticeship training) and a 6 to 8 percent difference in apprenticeship enrollments between states with and without prevailing wages.

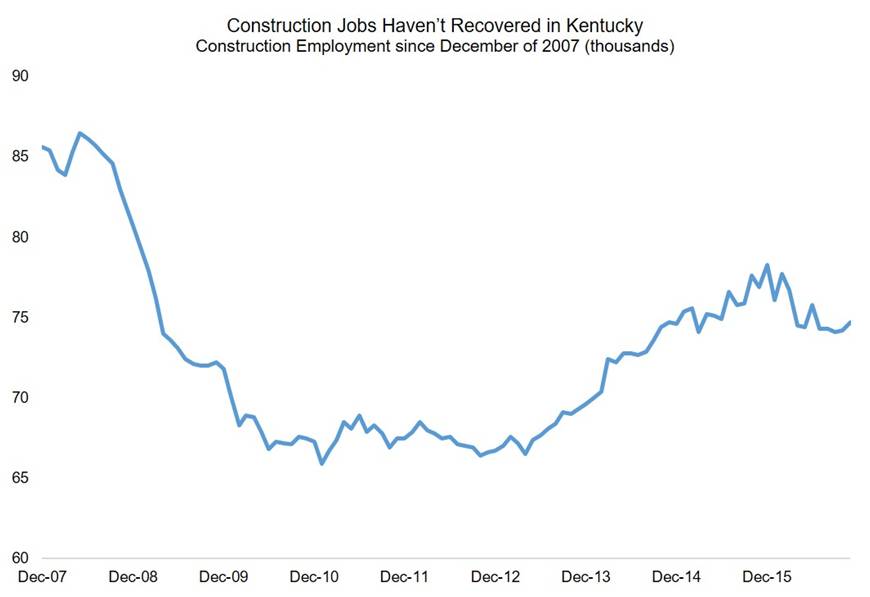

Weakening labor standards will also lead to fewer opportunities for local construction workers and job loss. According to the report, Kentucky would lose a total of 1,800 construction jobs under a repeal of prevailing wages to out-of-state competitors. Kentucky still has 10,900 fewer construction jobs than it did before the Great Recession and a repeal of prevailing wages would make matters worse.

Source: Economic Policy Institute analysis of Current Establishment Survey data.

And when construction workers lose employment due to out-of-state competition, local economies suffer too. That’s because workers spend their paychecks patronizing local businesses, buying groceries and improving the value of their homes, for instance, creating an economic multiplier effect. Kentucky would lose an additional 1,100 jobs in other industries due to the loss of construction worker spending, according to the report, and an associated $12.5 million in state and local tax revenue. These figures do not include the additional economic consequences of a repeal caused by erosion in construction wage standards.

Repeal Not Associated with Savings for State and Local Governments

Despite lowering wages for construction workers, a prevailing wage repeal is unlikely to save governments and school boards money. The report notes that 13 out of 17 (76 percent) peer-reviewed studies since 2000 suggest prevailing wages are not associated with higher public construction costs. The research shows increased wages are offset by other factors such as higher productivity due to a more skilled workforce. Because labor is a small and decreasing share of total construction costs (23 percent, nationally), small increases in productivity or decreases in other costs offset higher wages. In states with prevailing wage laws, contractors spend less on materials, fuel, and equipment, take home smaller profits, and find other efficiencies to remain competitive while still paying good wages.

Research that claims savings to the public sector from repealing prevailing wages typically does not take these factors into account. So-called “wage differential” analyses, such as Kentucky’s Legislative Research Commission (LRC) 2016 fiscal note for SB 9, estimate the difference between prevailing wage and non-prevailing wage labor costs and assume the difference, multiplied by labor’s current share of total construction costs, is passed onto government. These analyses do not look at differences between total construction costs on prevailing and non-prevailing wage jobs, meaning they ignore the offsets described above. SB 9 proposed exempting school construction projects from prevailing wages, a significant weakening of the state’s law.

A summary of the report is available here.