Pension Legislation Should Solve Real Problems and Avoid Harmful Consequences

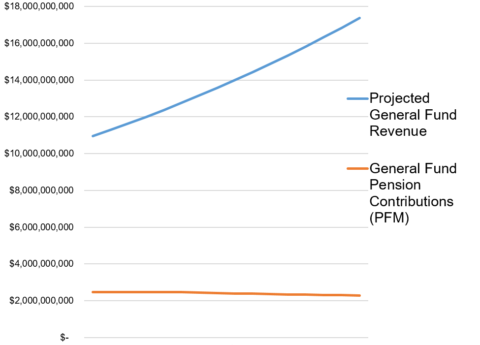

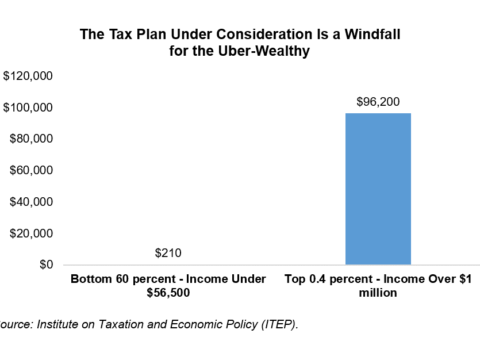

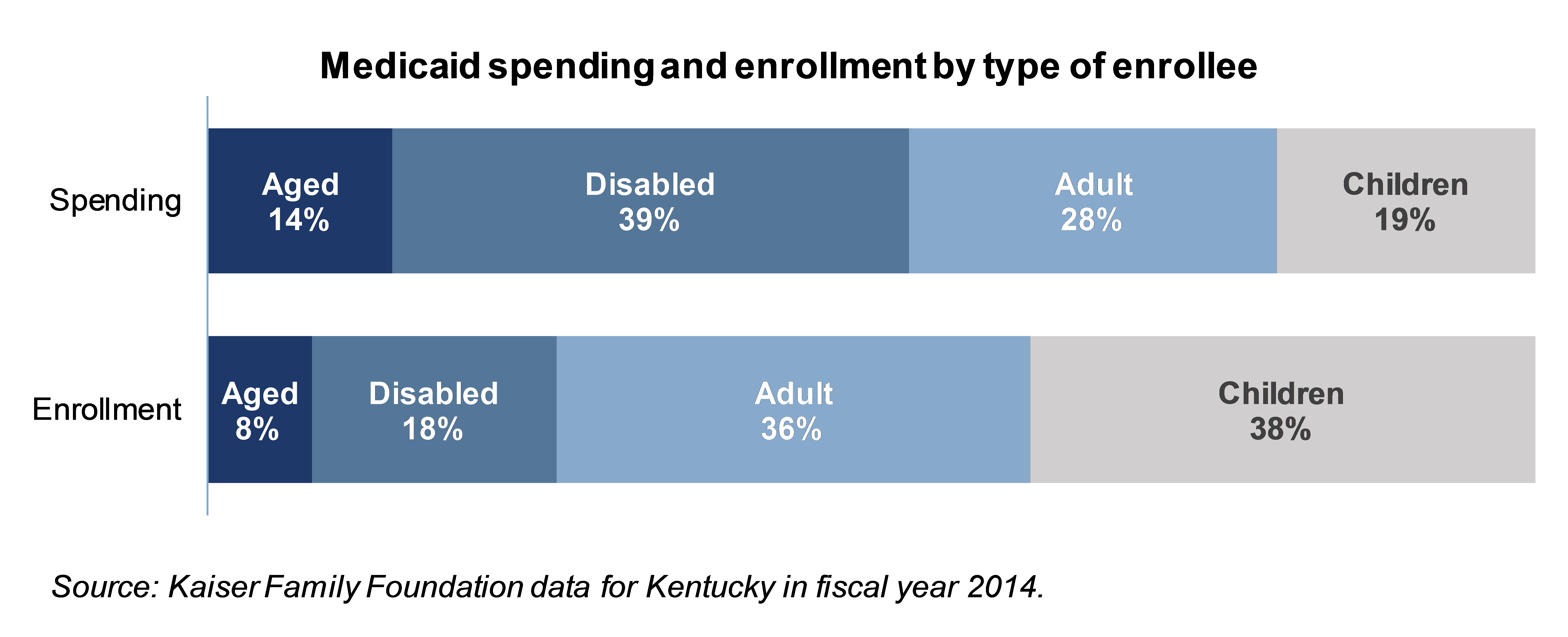

Legislative leaders say they will soon share a framework for potential pension legislation the General Assembly will consider in a...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap