Kentuckians Are Concerned About Proposed Changes to Medicaid

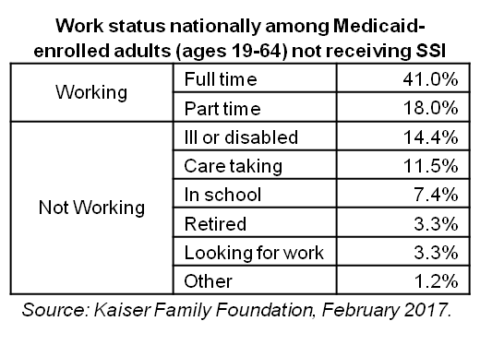

Kentucky officials recently asked the Centers for Medicare and Medicaid Services (CMS) to change certain parts of their original request...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap