Kentuckians Who Lose Coverage from Medicaid Cuts Won’t Have Other Options

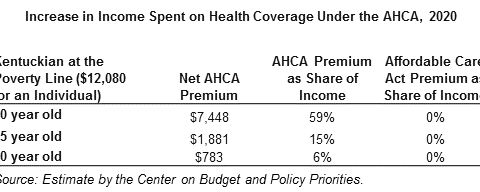

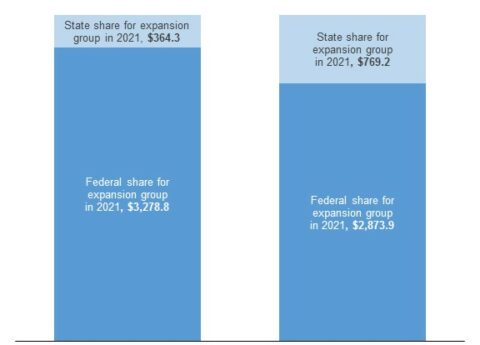

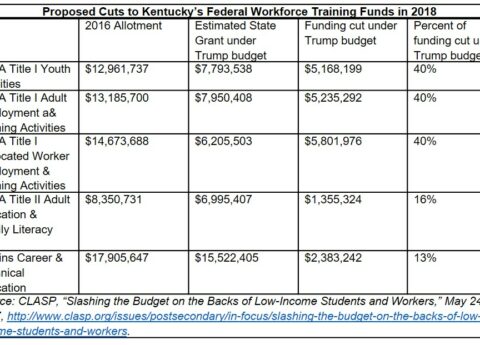

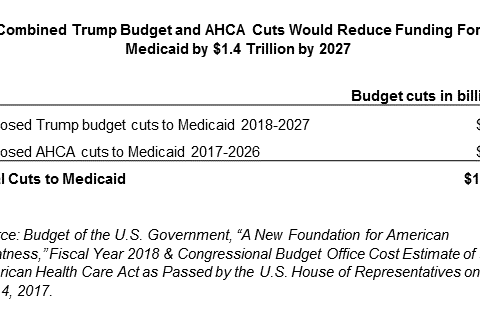

Many of Kentucky’s 1.4 million Medicaid enrollees would lose coverage from the radical cuts proposed in the American Health Care...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap