Senate Health Care Repeal Bill a Drastic Step Backward for Kentucky’s Health

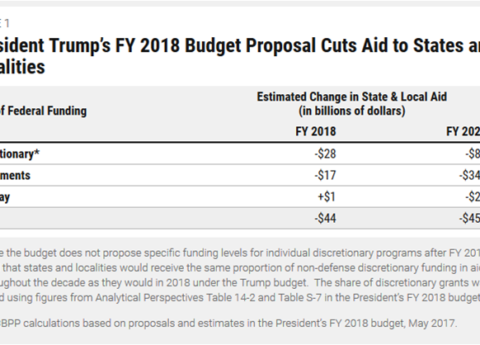

The Senate released the discussion draft of their bill yesterday to repeal the Affordable Care Act (ACA). If passed, the...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap