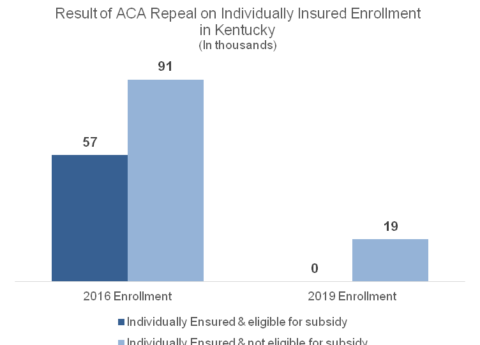

ACA Repeal Would Be Devastating in Ky.

Communities thrive when they have a strong foundation made up of things like good schools and quality healthcare. The Affordable...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap