Job Growth Claims from Right to Work Not Backed by Evidence

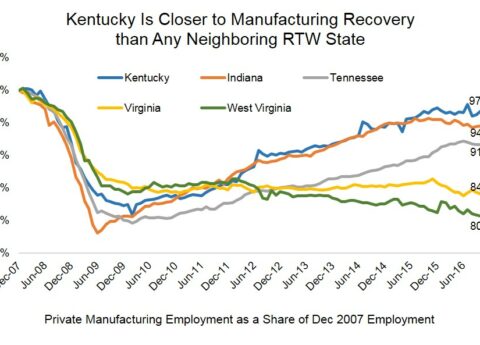

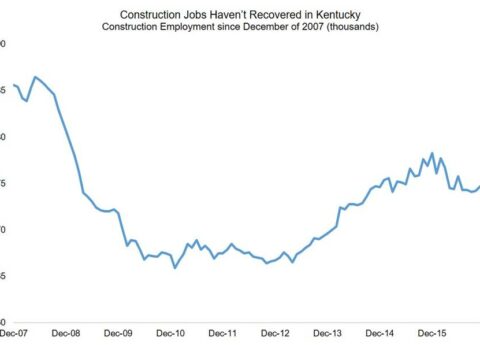

Proponents of Right-to-Work (RTW) argue that Kentucky would attract more jobs if such a law was in place, especially in manufacturing....

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap