Cutting Back Medicaid Expansion No Solution to Budget Pressures

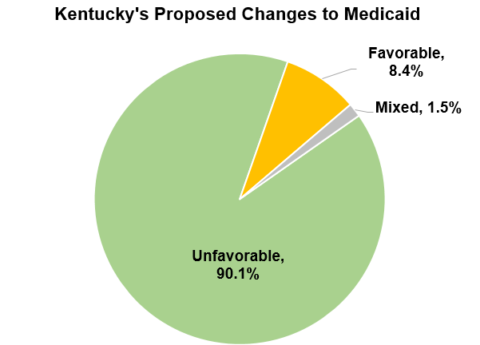

Governor Bevin has sent his proposed Medicaid changes to the federal government and now negotiations begin between his administration and...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap