House Budget Does Not Restore Many Crucial Services for Vulnerable Kentuckians

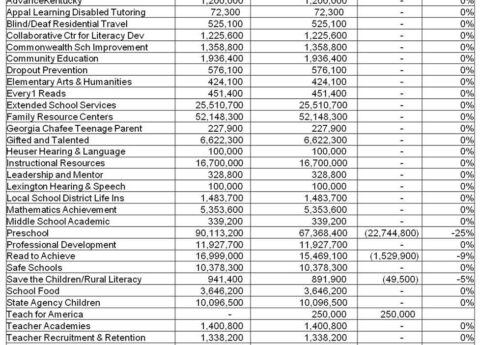

The House budget bill builds on Governor Bevin’s proposed funding for KTRS and KERS and rightly restores his cuts to...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap