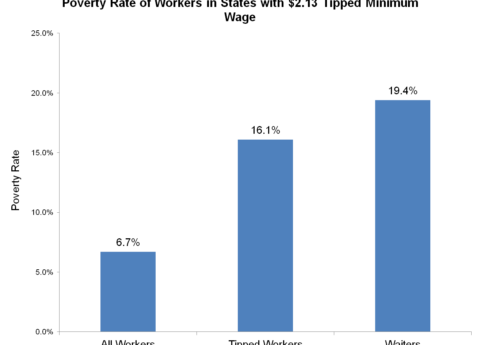

Increase in Tipped Minimum Wage Is Long Overdue

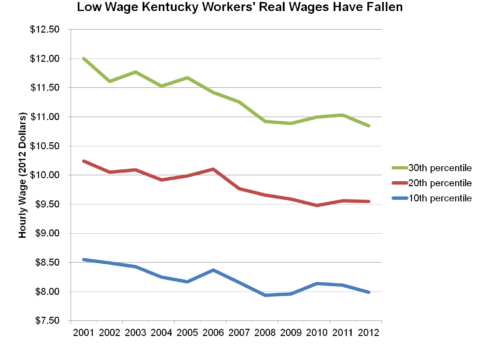

Stagnant or falling real wages for many Kentucky workers threatens their standard of living and is leading to growing income...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap