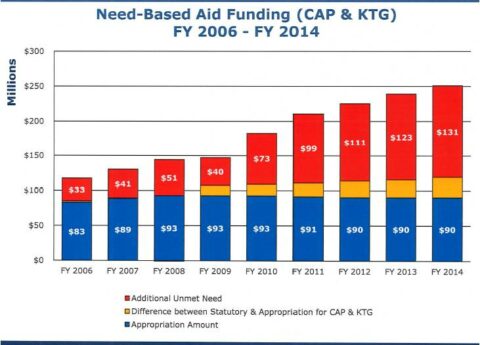

Lottery Funds Not Adequately Supporting State Financial Aid Programs

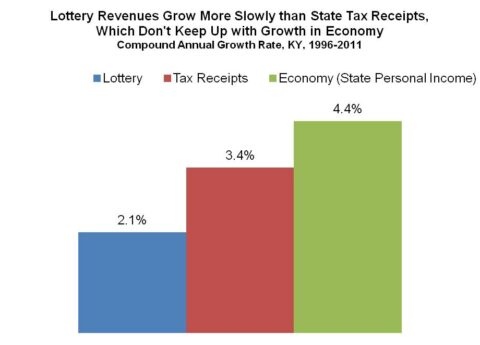

The House has recently identified new lottery funds as a potential source of revenue to help pay down Kentucky’s pension...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap