A Decade of Erosion in Employer-Sponsored Health Insurance in Kentucky

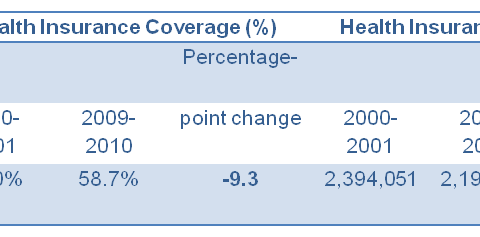

According to a new report from the Economic Policy Institute (EPI), 200,000 fewer non-elderly Kentuckians had health insurance through an...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap