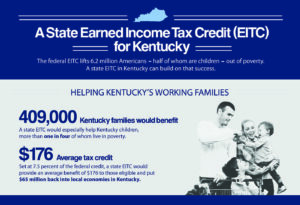

House Bill 374 would close several corporate tax loopholes that allow some profitable corporations to avoid paying their fair share of taxes, and use the resources to fund a tax credit for Kentucky’s working families. The bill targets strategies that major corporations use to artificially shift profits to subsidiaries in no- or low-tax states or foreign tax havens. It would generate $66 million to fund a state Earned Income Tax Credit (EITC), a proven tool to help lift working families out of poverty. HB 374 is a step toward the kind of tax reform Kentucky needs.

House Bill 374 would close several corporate tax loopholes that allow some profitable corporations to avoid paying their fair share of taxes, and use the resources to fund a tax credit for Kentucky’s working families. The bill targets strategies that major corporations use to artificially shift profits to subsidiaries in no- or low-tax states or foreign tax havens. It would generate $66 million to fund a state Earned Income Tax Credit (EITC), a proven tool to help lift working families out of poverty. HB 374 is a step toward the kind of tax reform Kentucky needs.