Year End Revenues Below Original Projections and Concerns Going Forward

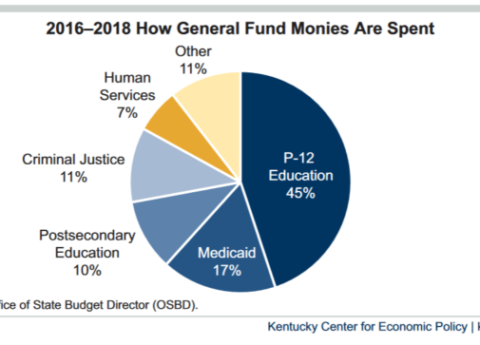

Kentucky ended the 2018 fiscal year with $119.1 million more in the General Fund than was predicted by the official...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap