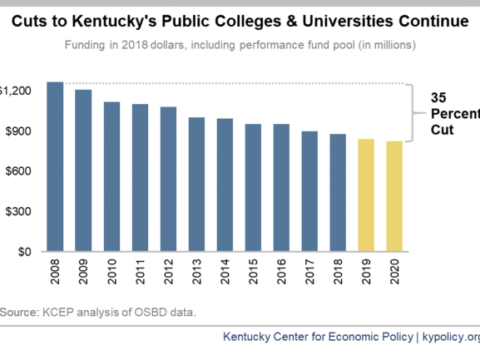

Kentucky Classrooms Cannot Afford to Have Resources Siphoned Away by Most Expensive Neo-Voucher Proposal Yet

All Kentucky children – living in poor and wealthy districts, black, brown and white, whose parents didn’t finish high school...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap