What the Cuts Would Mean: A Look at How Kentucky Is Hurt By Proposed Disinvestments

In a new video describing the importance of Family Resource and Youth Services Centers (FRYSCs) and Extended School Services (ESS)...

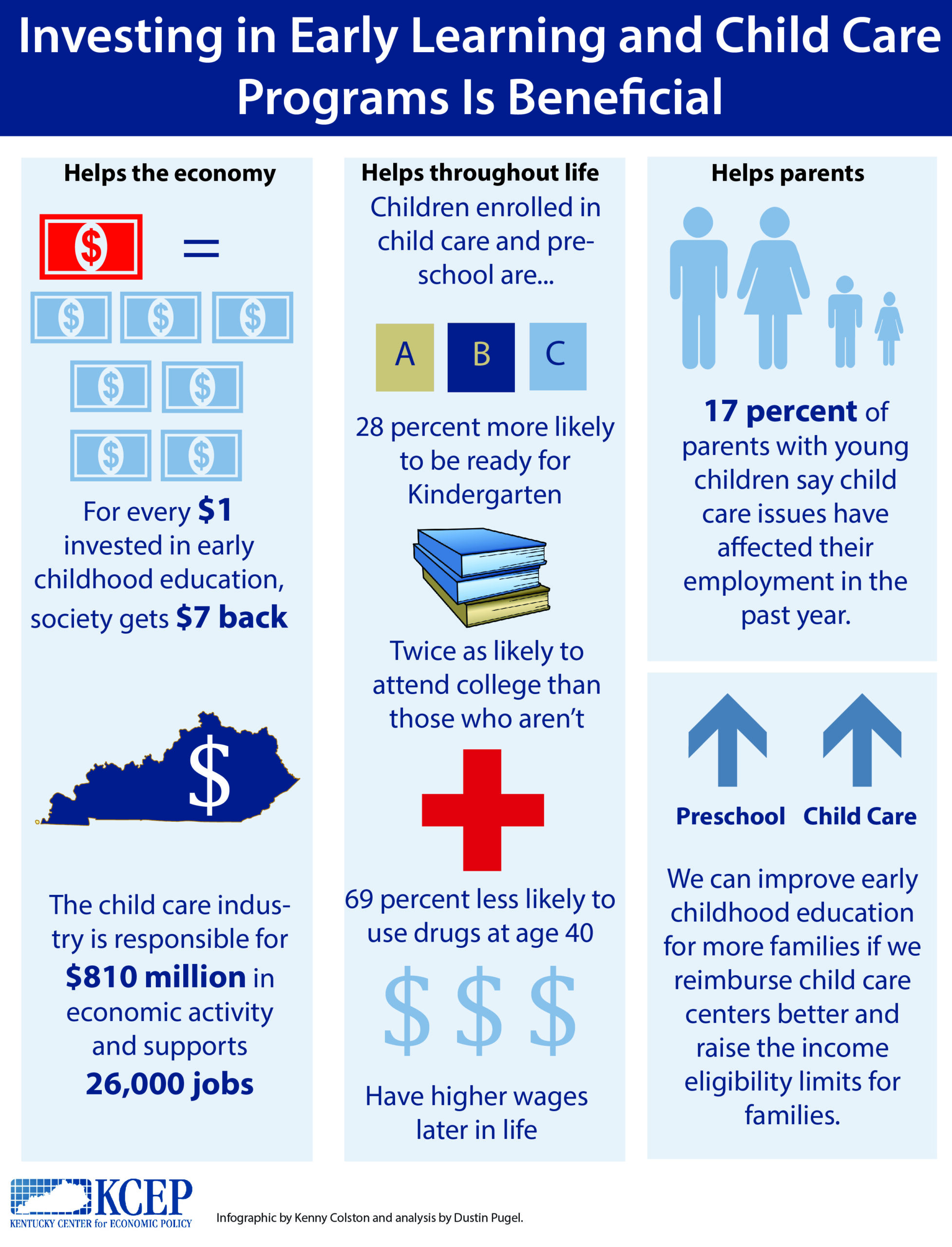

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap